UK Government: Co-op Bank's Failure and Deficiency Was Embodied by Paul Flowers

The Treasury Committee, an influential panel of politicians headed by Andrew Tyrie, has blamed the "too large, unwieldy and inadequate" governance at the Co-operative Group for its subsidiary bank's failings over the last few years.

In its highly anticipated Project Verde report, the committee said the Co-op Bank's £1.5bn (€1.8bn, $2.4bn) capital black hole and personnel scandals, all stemmed from the group's "inadequate" governance structured and "inexperienced" management.

"Co-op Bank's governance structure up to the middle of 2013 was entirely inadequate for a bank of any size. It is shocking that it was in place in an institution that came so close to becoming a major new challenger bank," said the Treasury Committee in the report.

"Co-op Bank's board was dominated by members from the parent group who lacked financial services experience. Those members with financial services experience were responsible for overseeing a very broad range of business.

"Being small in number, their expertise was spread too thinly, and ran the risk of being over-ruled by possibly well-meaning, but inexperienced, democratic members of the board. Yet, at least from 2009 to 2011, the board was also too large and unwieldy to allow for meaningful discussion and debate."

The Co-op Bank is one of UK's smallest lenders with 6.5 million customers and a 1.5% share of the current account market. However, it is a household name in Britain, as the wider group includes supermarkets, funeral services and pharmacies.

The Co-op posted a £2.5bn annual loss for 2013 in what bosses called the worst year in its history.

However, after selling off farming and pharmaceutical assets, as well as slashing jobs and closing branches at its bank, the Co-op Group has managed to rein in losses.

For the first six months of the year, profits reached £12m, compared with losses of £767m in the same period last year.

However, the group has been dogged with management issues, as former chief executive Euan Sutherland quit after just ten months in the role and two separate reviews into the Co-op Group and its bank revealed management failings.

Management failings at Co-op

On 30 April, Christopher Kelly, the man who led independent review into the embattled Co-op Bank's capital black hole said the state of the firm was a "sorry story of failings in management and governance on many levels".

On 7 May, Lord Myners, the independent reviewer in charge of analysing and helping overhaul the Co-op Group, said the ethical company's board was "manifestly dysfunctional" and called for the dismantlement of the current set up.

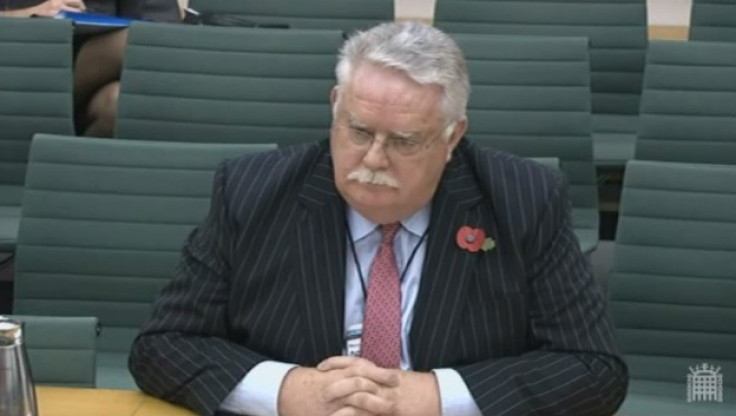

In tandem with the group's troubles, Paul Flowers, a Methodist minister who chaired the bank, was charged with drug offences. He quit the chairmanship after allegations of drug-taking were made by a newspaper.

"The deficient composition of Co-op Bank's governance was embodied in Paul Flowers, who lacked any of the requisite financial services experience to act as Chairman of a bank," said the Treasury Committee.

"In this regard he appointed two experienced Deputy Chairmen to strengthen the advice to him and the board. Flowers was appointed on the basis that he would be able to navigate the 'politics' of Co-op Group and chair the board. We took evidence that he had performed these functions well. But this was an inappropriate basis for his appointment.

"An effective bank Chairman should usually possess a good deal of experience of financial services. He or she should be at least capable of understanding financial issues. Flowers lacked both the desirable experience and the minimum essential skills. He should not have put himself forward for the role. Co-op should not have selected him. The regulator should not have permitted his appointment."

Meanwhile, Stuart Ramsay, a director at Co-op Group, stepped down from his position, after an internal investigation revealed that he was leaking sensitive information about the organisation.

Co-op board member and Labour councillor Munir Malik also left the firm amid the embattled company launching an internal investigation into qualification claims when he sought re-election to the board.

"The structure and composition of Co-op Bank's board was an accident waiting to happen and badly let down Co-op members and customers. Co-op Bank's governance structure was not fit for purpose for any bank, let alone one bidding to become a major challenger in the UK market," said chairman of the Treasury Committee Andrew Tyrie MP.

"The failings of Co-op Bank's board are, among other things, an indictment of the discredited Approved Persons Regime. The new, much more narrowly drawn, Senior Managers Regime, if implemented properly, offers the prospect that the Approved Persons Regime's shortcomings can be rectified. This is a work in progress.

"The Approved Persons Regime remains in place for the majority of financial services firms, despite its manifest failings. This is a mistake, and one which must be addressed soon by the Government and regulators."

© Copyright IBTimes 2024. All rights reserved.