Wall Street tumbles, treasury yields slide as recession fears mount

European stocks lost ground as investors weighed generally upbeat earnings against comments by European Central Bank policymakers regarding the future path of interest rates.

U.S. stocks turned sharply lower and benchmark Treasury yields dropped on Tuesday as disappointing earnings and soft economic data stoked recession fears, sending investors fleeing riskier assets for safe havens.

All three major indexes were deep in negative territory, with tech and tech-adjacent momentum shares dragging the Nasdaq down about 1.7%.

Those losses grew after a report showing a steeper-than-expected decline in consumer confidence.

"The type of environment where both gold and dollar gain, it's very much risk-off high-volatility stuff," said Ross Mayfield, investment strategy analyst at Baird in Louisville, Kentucky.

Earnings from a wide range of companies, including 3M Co, General Motors Co, PepsiCo Inc, United Parcel Service Inc and McDonald's Inc, provided a mixed picture of corporate profit and outlook.

First Republic Bank, under pressure amid regional bank liquidity concerns, reported a plunge in deposits which sent its shares, along with the broader KBW regional banking index sharply lower.

"The more cyclical and economically sensitive companies have missed (earnings estimates) or guided down, while consumer staples have done well," Mayfield added. "And that suggests a weakening economic environment that maybe wasn't priced into the market."

Microsoft Corp and Alphabet Inc are slated to report after the bell.

The Dow Jones Industrial Average fell 335.19 points, or 0.99%, to 33,540.21, the S&P 500 lost 59.56 points, or 1.44%, to 4,077.48 and the Nasdaq Composite dropped 207.27 points, or 1.72%, to 11,829.93.

European stocks lost ground as investors weighed generally upbeat earnings against comments by European Central Bank policymakers regarding the future path of interest rates.

Spanish stocks had their worst day in a month, as Santander led a slide in European bank shares.

The pan-European STOXX 600 index lost 0.40% and MSCI's gauge of stocks across the globe shed 1.24%.

Emerging market stocks lost 1.39%. MSCI's broadest index of Asia-Pacific shares outside Japan closed 1.44% lower, while Japan's Nikkei rose 0.09%.

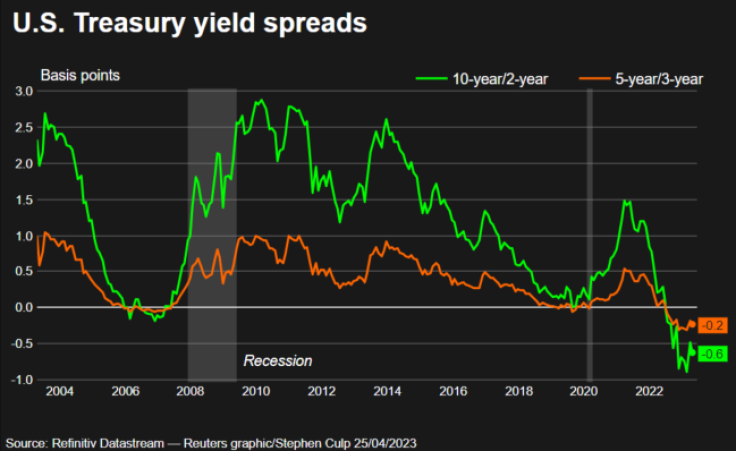

Benchmark Treasury yields posted their steepest drop since March as market participants juggled concerns over the looming debt ceiling deadline and ongoing concerns - exacerbated by First Republic results - of a liquidity crisis in the regional banking sector.

(Graphic: Treasury yield spreads -

)

Benchmark 10-year notes last rose 32/32 in price to yield 3.3958%, from 3.515% late on Monday.

The 30-year bond rose 47/32 in price to yield 3.6472%, from 3.729% late on Monday.

The greenback gained ground against a basket of world currencies and the euro retreated from a near 10-month high as worries over corporate results and the global economic outlook deepened.

The dollar index rose 0.51%, with the euro down 0.69% at $1.0965.

The Japanese yen strengthened 0.51% versus the greenback at 133.57 per dollar, while Sterling was last trading at $1.2401, down 0.65% on the day.

Argentina's peso tumbled to a record low on the popular black market amid uncertainties surrounding the country's upcoming election, prompting its economic minister to pledge "all tools" to counter the currency's dangerous slide.

Crude prices reversed Monday's gain, plunging as economic worries and the strong dollar offset optimism over China demand expectations.

U.S. crude dropped 2.25% to settled at $77.07 per barrel, and Brent settled at $80.77 per barrel, down 2.37% on the day.

Gold prices gained as investors awaited a slew of economic data later in the week that could sway the Federal Reserve's policy decisions.

Spot gold added 0.3% to $1,995.46 an ounce.

Copyright Thomson Reuters. All rights reserved.