EU Lawyers: Financial Transaction Tax is Illegal

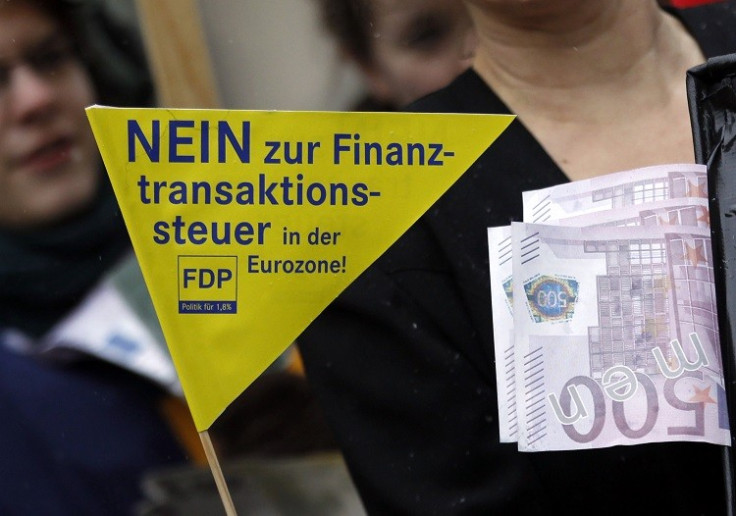

Europe's ambition for a Financial Transactions Tax, dubbed by many as the Robin Hood Tax, has tripped up after the EU Council's lawyers said the rolling out the levy across 11 states could be illegal.

The UK has already said it would not sign up to the EU's FTT plans, which would tax certain financial transactions at a rate of between 0.01% and 0.1%, and has started a legal challenge at the EU Court of Justice over fears it could hit British banks trading with European colleagues.

EU Council lawyers have issued a document that argues the FTT would be in breach of the 28-member state union's treaties and infringe on the sovereignty of national governments, according to Reuters.

They say the FTT "exceeds member states' jurisdiction for taxation under the norms of international customary law", an argument made by the UK government.

"This opinion recognises that the FTT would have damaging implications for growth, jobs and investment beyond the member states involved, so now is the time to draw a line under this flawed proposal," said Leo Ringer, head of financial services and corporate governance at the Confederation of British Industry, the UK's biggest business lobbyist.

"It also makes clear that moves towards further integration between a number of EU countries can't be taken forward if they impact on the rights of all member states, unless all states affected have signed up."

Among the 11 EU states wanting to adopt the FTT were the eurozone's three largest economies, Germany, France and Italy.

Under the FTT proposal, shares and bonds transactions would be taxed at 0.1% and derivatives at 0.01%. The EU estimates this would generate revenues of €30-35bn a year.

"The FTT's opponents would love to present this non-binding legal opinion as a wall that will block progress but it is likely to prove no more than a hurdle on the road to making banks pay their fair share," said Simon Chouffot, spokesperson for the Robin Hood Tax campaign.

"The fact is that some EU countries already have FTTs that are extra-territorial in nature - just look at the UK's own Stamp Duty on shares. Rather than going to court to block European efforts to ensure taxpayers get a fair deal from the banking sector, George Osborne should get on board.

"This is only a non-binding legal opinion but if necessary it should not be beyond the wit of European leaders to tweak their proposed FTT so that it is workable and does not fall foul of European legislation."

A London Economics study, commissioned by the City of London Corporation, revealed that Britain faces paying £4bn (€4.7bn /$6bn) more in borrowing costs as a result of the FTT, even if it does not sign up.

© Copyright IBTimes 2025. All rights reserved.