China Power Skirts EU Solar Panel Import Cap With Enemalta Corporation Stake Purchase

China Power Investments, one of five large energy producers in China, will acquire a minority stake in Malta's Enemalta Corporation, a state-owned electricity supplier, Maltese Prime Minister Joseph Muscat has said.

According to a Times of Malta report, the Chinese firm will invest €200m (£168m , $266m) in Enemalta.

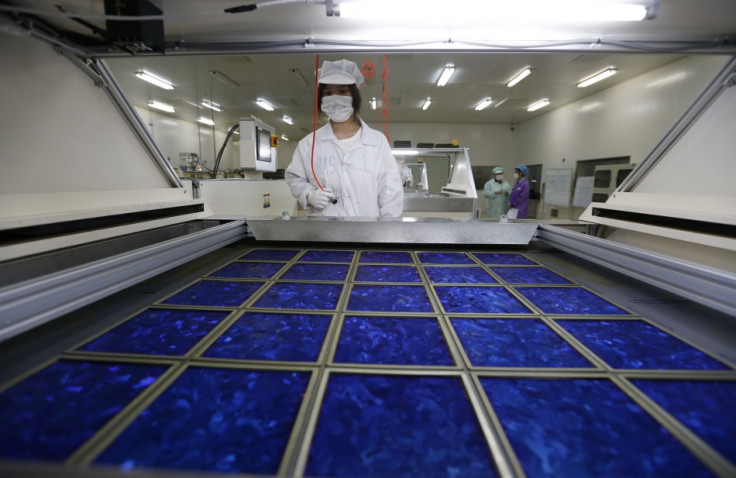

China Power and Enemalta propose to manufacture photo-voltaic units in Malta, for sale in the European Union. Rooftop photo-voltaic units convert solar energy into electricity.

The investment will give China Power a firm footing in the European solar panels business, just as the EU regulated Chinese solar panel imports.

The stake sale will help Enemalta reduce its €800m debt and create employment.

The planned production of solar panels in Malta will also help the country generate more electricity from renewable sources. When Malta joined the European Union in 2004, it committed to a target of generating 10% of its electricity from renewable sources by 2020. The country is way behind schedule, reported Deutsche Welle.

Enemalta has a monopoly in the supply of electricity. The agreement was announced on the sidelines of the World Economic Forum in Dalian, China, after Muscat met with Chinese Premier Li Keqiang.

Trade Dispute

The EU and China had earlier agreed to resolve a dispute over the alleged dumping of solar panels by Chinese companies in Europe, following six weeks of talks.

As per the agreement, shipments from China, the world's dominant solar panel supplier, will be capped at 7GW per year, around half of the EU's 2012 demand of about 15GW. The deal also sets a minimum price for China's solar panel exports to Europe.

Subsequently, the European Union decided against imposing preliminary anti-subsidy tariffs on Chinese solar panels, opting to wait another four months to assess the industry.

The deal was hugely important to China, which feared a trade war would hit demand for Chinese solar products. China's solar production quadrupled between 2009 and 2011 to exceed global demand, and the EU accounts for around half of China's solar exports.

Eurozone regulators had earlier accused Chinese solar panel makers, including Trina Solar, Yingli Green Energy and Suntech Power Holdings, of damaging the European solar industry by selling their products at below cost price, a practice known as dumping.

The spat between China and the EU worsened, after the latter had imposed anti dumping duties on China's solar exports.

In retaliation, China launched an anti-dumping and anti-subsidy probe into various imports from Europe, including chemicals and wine.

© Copyright IBTimes 2025. All rights reserved.