China Wants Banks to Tap Private Funds to Tackle Swelling Bad Debt

Beijing, which is reluctant to bailout Chinese banks in the event of a debt crisis, wants financial institutions to tap private capital, thereby inhibiting the need for any large scale government rescue package.

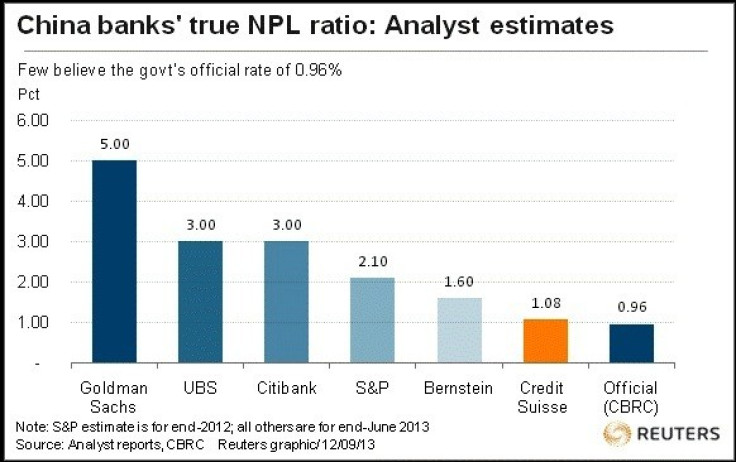

Chinese banks are shouldering a heavy debt burden. Analysts believe that the government projected non-performing loans ratio of less than 1% is significantly understated - they estimate the non-performing loans ratio to be in the 3% to 6% range.

Twelve of China's 17 listed banks have already made public their plans to bring in about 425bn yuan (£43bn ,€52bn, $69bn), mostly through subordinate debt, reported Reuters.

In addition, on 13 September, markets regulator China Securities Regulatory Commission (CSRC) allowed banks to raise funds through non-tradeable preferential stock allotments.

Still, some analysts believe that Beijing is giving too much weight to warnings of an approaching debt crisis.

Nevertheless, they point out that Beijing must regulate the country's shadow banks - a mix of informal lenders, leasing companies, pawnbrokers, insurance firms and trust companies - if it wants to prevent a debt crisis.

Between 2010 and 2012, when traditional banks cut back on lending, shadow lenders doubled their loan disbursements to 36 trillion yuan ($5.8 trillion), or about 69% of China's gross domestic product, estimated JPMorgan Chase.

"We've done some stress test analyses, which find that even under fairly stressed scenarios, the banks - especially the larger banks - will still be making a marginal profit," said Grace Wu, head China bank analyst at Daiwa Capital Markets in Hong Kong.

"So in that sense, they won't even eat into their reserves.

According to a Reuters estimate, Chinese banks' current capital and loan-loss provisions would hold them in good stead even if over 20% of their loans went bad.

"A 1% non-performing loan ratio has little signaling value when 36% of all outstanding credit resides outside Chinese banks' loan portfolios," said Charlene Chu, China bank analyst at Fitch Ratings.

"China must get to a point where it can get back on a healthy growth path that is not dependent on massive amounts of credit every year. Absent this, everything else is secondary, including policies to improve the soundness of shadow finance or financial sector liberalization."

China looks set to hit its full-year growth target of 7.5%.

The country's leaders are more interested in reforming the world's second largest economy, than stimulating it. Beijing wants to guide the economy away from debt-driven investments, in infrastructure and property, and towards a more sustainable path.

However, the government is treading with caution, when it comes to radical reforms. Analysts from top government think-tanks say the room for reform is limited in China as any dramatic shift in policy could exacerbate a growth slowdown and push the government to revert to tightly controlled market conditions.

© Copyright IBTimes 2024. All rights reserved.