Bitcoin price surges past $650 on back of Chinese mining conference

Many believe price is driven by Chinese speculators and investors returning to Bitcoin following the recent yuan devaluation.

The price of Bitcoin has risen 4% in the past 24 hours to over $650, led by Chinese exchanges on the back of a mining conference in Chengdu, which optimistically pointed to the end of the Bitcoin scaling debate.

The closing remarks from Huang shiliang, a famous bitcoin advocate in China, were essentially about galvanising the Chinese Bitcoin mining community, who own the majority of hashing power, to push for larger blocksizes sooner rather than later.

In terms of BTC/USD, it is the first time since the Bitfinex hack that Bitcoin has crossed the $650 mark. Many believe the price is also being driven by Chinese speculators and investors returning to Bitcoin following the recent yuan devaluation.

Bitcoin scaling debate

The Bitcoin scaling debate argue over on which path should be taken (and when) to increase the number of transactions the Bitcoin network can handle.

At present this is limited to 1Mb every 10 minutes, which equates to roughly 3-6 transactions per second. There are various considerations in when and how the limit is increased, whether to hard fork or soft fork and to what degree the block size is increased or with what mechanism.

A hard fork means everyone who wants to use the network has to upgrade the software - this means work on behalf of exchanges, wallet providers, miners etc. A soft fork is an opt-in feature that means network users can choose to adopt the new protocol or not and still remain a part of the network.

Bitcoin Core versus Bitcoin Unlimited

Charles Hayter, CEO, CryptoCompare, said: "The Bitcoin Core team is the heir apparent to Satoshi's initial vision of Bitcoin and is a developer based group who prefer elegant solutions to problems than rough and ready workarounds. This has often led to accusations of inactivity as well as autocratic leadership in the ecosystem. One practical consideration is the space needed to store the blockchain when operating a full node amongst other technical limitations which Bitcoin Core have been urging caution with.

"Bitcoin Unlimited are the challengers to the status quo in what is not only a battle for the next steps, but a battle for power and shaping the industry on philosophical tenets and for vested interests. Although critics of their approach say their mechanisms are not fully thought through in long term effects on network stability," he said.

Bitcoin Core is pushing for an immediate 1.8x increase in the number of transactions that can be included in a block by removing unnecessary signature components and hence freeing up space. Bitcoin Unlimited disagrees with this move saying it changes the fundamental nature of bitcoin and wants to push for an "Emergent Consensus" or voting amongst miners as to what the block size should be.

Another key difference is where both sides see transactions taking place. Bitcoin Core sees transactions taking place "OffChain" and not in blocks - essentially freeing up space in each block and lowering total transaction fee volume.

"The result of these approaches comes down to how much transaction fees are and where they are earned. Offchain transactions mean lower fees for miners and short term restrictions in block size mean higher fees that stifle adoption and increasing the userbase.

"At present miners see 3% of revenue from transaction fees and this gambit under the umbrella of Bitcoin Unlimited is an attempt to secure their future with more power on setting supply and demand whilst keeping transactions 'OnChain'," said Hayter.

Bitcoin Unlimited & ViaBTC - the Chinese connection

ViaBTC is a relatively new mining pool that has rapidly gained market share in the past months. It is said to be supported by Bitmain - the largest Bitcoin mining equipment manufacturer. The pool has over 7% of hashing power - enough to block any proposal of Bitcoin Core that requires a 95% hashing power vote for clearance; essentially a form of deadlock, says Hayter.

ViaBTC has been the most vocal supporter of Bitcoin Unlimited. And perhaps after yesterday's moves there will be further support for Bitcoin Unlimited's point of view and a shift in the balance of power. A majority of hashing power is thought to be concentrated in China.

"Although there is Chinese exhilaration on a nearing solution to the blocksize debate, the end result is not so clear cut as there are more twists to this tale to come. There are divisions of a technological, philosophical and practical nature.

"The strong volume on the Chinese markets at over 5.2 million BTC ($3.5bn) in a 24hr period is unprecedented and shows the underlying optimism with which Bitcoin Unlimited is being greeted.

"This is East meets West with Bitcoin miners versus Bitcoin developers. Sides are being played with vested interests of industry incumbents," said Hayter.

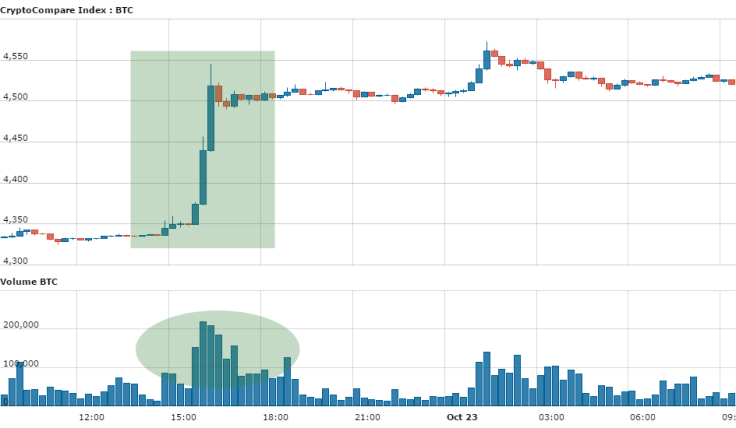

Price movements

Chinese Bitcoin exchange operator, OKcoin led the rally with its price reaching CNY 4572, or in direct dollar terms USD 676 per Bitcoin.

USD Exchanges lagged at $658, with prices still maintaining a discount to the CNY prices of c.$10 although this was as large as $30 between, for example, OKcoin and Coinbase.

Volumes as usual have been dominated by the CNY pairs with 99% of the market for the past 24 hrs. The past 24 hrs is showing a record breaking 5.18 million BTC changing hands on the CNY BTC pairs compared to average to good – 43,000 BTC on the USD-BTC pairs.

© Copyright IBTimes 2024. All rights reserved.