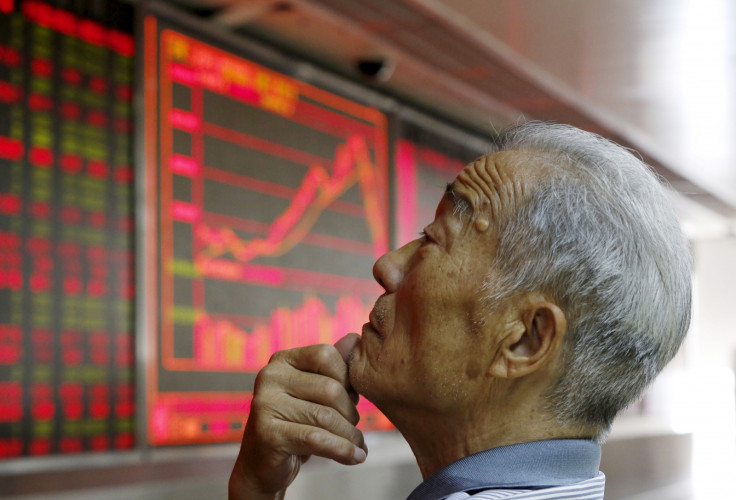

Black Monday: China's plunge is a warning that bubbles are going to pop

Most of us can remember a teacher or headmaster whose mere footsteps were enough to silence a corridor, classroom or a school hall, abruptly ending multiple mischiefs. Global markets are rather like that now.

The creaking footsteps are of Janet Yellen, chair of the US Federal Reserve. China's crashing stock market, the plunge in oil and other global commodities, the relentless retreat of emerging markets, the wobbles in developed ones: all of this is related to the fear that US interest rates will start to go up. Investors will seek refuges. But the uncomfortable reality is that after seven years of extreme monetary policy, it is hard to find a market that is not distorted and therefore dangerous.

China is at the forefront of investors' minds. The 8.5% plunge in Chinese stocks is a big blatant shock. The 2% devaluation of the yuan on 11 August was an insidious and important one. Slow appreciation of the yuan, reflecting China's huge trade surplus, had been expected to continue. The central bank's weakening of the currency has been seen by some as a reaction to weakness in China's exports, and that may be part of the explanation. But profoundly what is troubling in China is that the continuing ability of the authorities to keep growth high and stable is now in doubt.

China's success has been built on unorthodox policies that have worked. The yuan is not free floating, as most major currencies are, but has been managed and kept relatively cheap even though China has been running huge trade surpluses and attracting very high capital flows: forces that would normally drive a currency higher. For years, China avoided that by piling its dollar surpluses into US Treasury bonds.

But a policy of this kind carries risks. The world now looks saturated with Chinese exports, there is overcapacity in export industry and bubbles have formed in Chinese assets. The authorities' willingness to prevent the Chinese stock bubble from popping by empowering a state agency to pour money into the market also looks a mistake.

China's economy needs to rebalance, and as part of that the bubbles must be allowed to burst. But the more fundamental shift to growth led by the domestic economy is not easy. And while it happens, growth may be much lower. As China is the world's second-biggest economy, that has troubling implications for the global economy.

Devaluations and vulnerabilities

In Asia, unease is intense. Further Chinese devaluations are seen as a big threat. If China makes itself cheaper, other economies' exports may suffer. Comparisons are being made with 1994, when China devalued shortly before crisis swept across Asia. Asian economies don't look as vulnerable now. But the adjustment China faces will have an impact across emerging economies, many of which share some of China's vulnerabilities.

Emerging economies became too popular for their own good – as some of them warned at the time. It was Guido Mantega, a Brazilian finance minister, who in 2010 first used the term "currency war" to complain bitterly that a devaluing dollar was driving up Brazil's currency, the Real, as well as equities, bonds and property prices.

What Brazil was arguing was that the US strategy was to some degree deliberate. The reality is that the flow into emerging economies that QE provoked was unlikely to have been intended. It was instead collateral damage of desperate Federal Reserve efforts to revive the US economy. But now as emerging markets reel, the unfortunate and dangerous global side effect of the QE binge can be seen. Emerging economies' assets are beached. From Vietnam to Mexico to Turkey, currencies that were strong are being diluted.

The damage done by the inflow and exit of the global tide is great. While the tide flowed in, the world lined up to praise emerging economies, suppliers of an ever greater share of global growth. In emerging economies themselves, complacency became easy. But when the tide retreats the enduring frailties, injustices and policy-making mistakes of innumerable countries are exposed.

The emerging carnage looks like continuing for some time, until growth revives. But investors in developed economies cannot afford to look on smugly. Here too markets are distorted and vulnerable.

Safe bet on bonds?

Stock markets have soared since 2008 yet weak growth and tumbling commodity prices are bad news for many sectors. Safe haven bonds such as US Treasuries are again rising as equities slide, with the yield on the benchmark 10-year bond dropping again to what would, before the global crisis, have been an unthinkable 2%. Bonds are the safer bet for now but will themselves face a rethink when eventually inflation and interest rates rise. The current yield could easily double or treble, inflicting big losses on bondholders. But when will normality come?

Many will see plunging markets as yet more evidence of global weakness and reason for Yellen to hold off on raising interest rates. Barclays comments that the European Central Bank and Bank of Japan might be to drawn towards "additional steps", which means still more money printing.

And yet the lesson of the tide in and out of emerging economies and commodities is that pumping markets up with QE is liable to create asset bubbles and too expensive commodities, not stable economic growth.

It might also be asked who these bubbles are good for? Hedge funds and other fast-moving investors can profit from the volatility QE has created, surfing the tides up and profiting too from the outward tides by donning shorts: positions that profit from falling markets. Killing off the bubbles, however, will ultimately have benefits for the bulk of the world's citizens: Main Street, rather than Wall Street.

The oil price, which soared during the world's greatest crisis since the 1930s due to QE and the speculation it fanned, has now dropped below $40. This welcome disinflation means global consumers will spend far less at the petrol station – and have more to spend elsewhere. Cheaper commodities means a wave of higher consumption should follow.

The great market deflation triggered merely by Yellen's footsteps and eventually by rate rises are ultimately likely to bring us a healthier global economy. But for now, China's plunge is a warning that in both developed and emerging economies, bubbles are going to pop. Fear of the headmistress's footsteps is going to precede a more orderly world.

Ian Campbell is an economist and commentator. He was director for Latin America at the Economist Intelligence Unit, chief economist emerging markets at ABN AMRO Bank and head of Latin American research at Bank Boston.

© Copyright IBTimes 2024. All rights reserved.