Budget 2016: Experts mixed on George Osborne's policies

Chancellor George Osborne managed to pull some rabbits out of a hat on the dispatch box in what was initially expected to be "the most uneventful Budget ever".

Osborne explained the details of the Budget just three months ahead of the EU referendum and shortly after the OBR downgraded GDP growth in the UK for 2016 from 2.4% to 2%. Few would have been surprised if the Chancellor had sweaty hands.

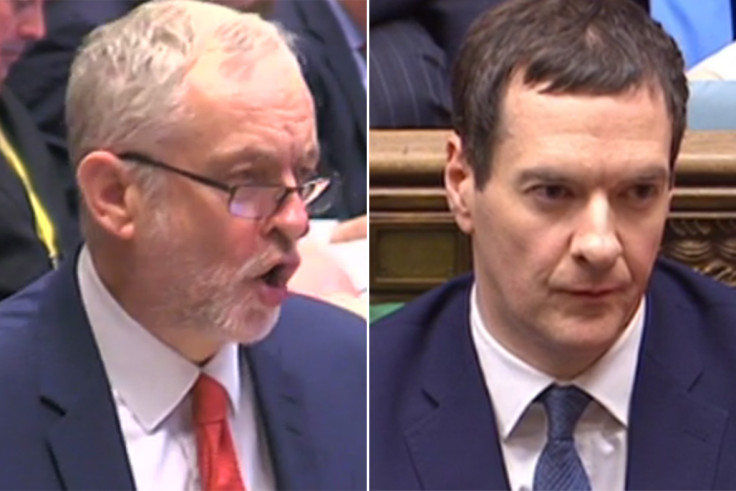

The leader of the Labour party, Jeremy Corbyn, gave his response to the Budget, not afraid to accuse Osborne of being "utterly incapable" of introducing economic policies that would help the UK achieve equality.

But the leader of the opposition was not the only one with strong thoughts on the Chancellor's Budget. IBTimes UK listed some of the responses to the economic policies introduced by Osborne by the finest experts.

Bowman, the executive director of the Adam Smith Institute, on personal tax allowance:

Raising the personal allowance is a good thing, but National Insurance thresholds have been left alone again. The Adam Smith Institute has campaigned for years to take the lowest-paid workers out of tax, and progress in raising the personal allowance is to be welcomed. But there has been no movement in National Insurance contributions, which are an income tax in all but name and kick in at much lower income levels than income tax now does – at just £8,060 per year. The Chancellor should target his income tax cuts on the poor and focus on raising National Insurance thresholds.

James Bloodworth, IBTimes columnist on academies

The fealty shown by Conservative and Labour politicians toward academy schools resembles the romantic attachment in some quarters to grammars. There is no evidence that either perform better than comprehensives, yet there is a stubborn romantic aura around the idea that these schools are better than 'bog standard' comprehensives.

Jamie Oliver on the Sugar Levy

We did it guys, we did it! A sugar levy on sugary sweetened drinks. A profound move that will ripple around the world. Business cannot come between our kids' health! Our kids' health comes first. Bold, brave, logical and supported by all the right people. Now bring on the whole strategy soon to come. Amazing news.

Toby Ryland, corporate tax partner at the chartered accountants HW Fisher & Company, on corporation tax:

Still smarting from accusations that he was soft on Google, the Chancellor sought to walk a tightrope between a voter-pleasing bashing of multinationals and encouraging inward investment.

Few voters will shed a tear for the global companies with complex tax arrangements that now face an additional £9bn tax hit, and the Chancellor offered an ingenious pitch to foreign firms - come to Britain, pay your fair share of taxes and enjoy the lowest rate of Corporation Tax in the G20.

Such a comprehensive assault on loopholes will force companies that aggressively seek to avoid tax to radically rethink their structuring – and such a low Corporation Tax rate will reduce many of the incentives for avoidance too.

At the other end of the spectrum, the removal of business rates for Britain's smallest firms will provide a huge boost for entrepreneurs, but more valuable still is the reassurance that the exemption will be permanent.

Scott Lehmann, VP product management and marketing of solutions provider Petrotechnics on the oil and gas tax relief:

The chancellor said that this Budget was all about putting stability first and the measures announced today will certainly be welcomed by the oil and gas industry. However, even in a more stable environment, operators will continue to face significant pressure to maintain or increase production levels. The industry is already striving to do more with less, but as this focus intensifies it will create new challenges with regards to the emerging safety productivity dynamic.

Simon Walker, director general at the Institute of Directors (IoD), on infrastructure:

The announcements of new infrastructure will be welcomed by IoD members, both in London and across the North. They key with new roads and rail links is getting spades in the ground. Businesses in Northern cities have been waiting a long time for these improvements, and cannot afford to see the protracted delays we have endured on other major infrastructure, such as airports.

The UK faces risks on many fronts, and much heavy lifting will still be required to get rid of the deficit by the end of the Parliament. For a Chancellor who correctly prizes maths education, although he's come up with a good answer, he hasn't yet shown us enough of his working on how he plans to get there.

Lucian Cook, Savills UK head of residential research, on Stamp Duty and CGT:

The failure to give relief from the additional stamp duty levy for large investors could inhibit the development of a much-needed institutional private rented sector. While purchases of 6 or more residential properties can be treated as a non residential transaction, the reform of stamp duty on commercial properties is likely mean greater entry costs for large scale residential investors one way or another. Our recent analysis suggests there will be demand for another 1 million private rented households in the next 5 years despite policies to boost home ownership.

Keeping the old rates of CGT on residential property will make it more difficult for existing buy to let investors (who face a cut in income tax relief on interest payments) to reorganise their portfolios towards better performing property. It will also act as a longer term disincentive to invest in residential property compared to other asset classes which may put further pressure on the supply of private rented homes against the backdrop of rising demand. That may well put upward pressure on rents.

Richard Parkin, head of pensions at Fiedlity International, on Lifetime ISAs:

We welcome any changes that encourages and incentives saving for the longer term – particularly those in the younger age group who are facing real struggles between saving for a pension and saving to get on the property ladder. The Lifetime ISA straddles that idea well and with flexibility on access, it will increase the appeal of longer term saving to younger generations.

Talk of these changes signifying the death of pensions is overdone. For most people, they would still be best advised to use auto-enrolment and benefit from the matching employer contribution. These changes will be good for people who are lucky to have additional funds that they wish to save outside of auto-enrolment or who want to have a boost to their housing fund.

Mark Boleat, policy chairman at the City of London Corporation, on the EU Referendum:

The Chancellor's words from today's Budget about the UK being better off in a reformed EU are backed up by the City of London Corporation.

Our view is that remaining as a member of the EU will benefit the financial and professional services firms based in the City, across the capital and up and down the country. The years of uncertainty that would follow if we were to leave would almost certainly impact on investment, business confidence and job creation.

© Copyright IBTimes 2025. All rights reserved.