China Manufacturing PMIs Rise to New Multi-Month Highs as Yuan Awaits More Dollar Cues

The Chinese yuan traded lower despite manufacturing indices showing faster expansion for the month of July as the market preferred to stay light on the local currency which is holding close to a 4-1/2-month high, ahead of US non-farm payroll data.

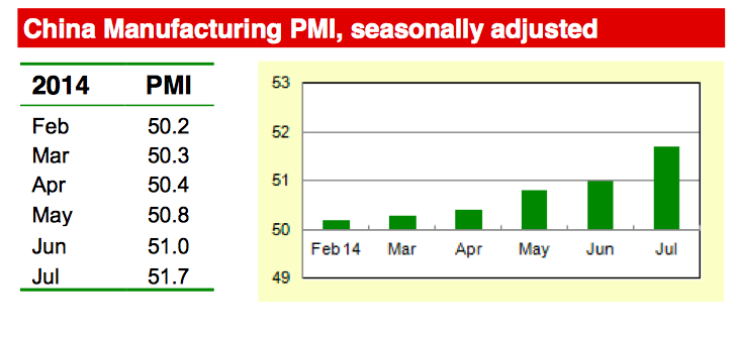

Purchasing managers' indices for manufacturing surveyed by the China Federation of Logistics & Purchasing (CFLP) and HSBC showed faster expansion in July compared to the previous month, with the former rising to a two-year high and the latter to a 17-month high.

The NBS PMI released by CFLP rose to 51.7 in July from 51.0 in June with output, new orders, new export orders and purchases of inputs, expanding and stocks of finished goods, backlogs of orders, imports and stocks of major inputs contracting. Input prices were rising and suppliers' delivery was faster in July.

The HSBC index too rose to 51.7, slightly below the flash estimate of 52.0, but still its highest final print since February 2013, and compared to the June final print of 50.7.

"The economy is improving sequentially and registered across-the-board improvement compared to June," said Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC.

"Policy makers are continuing with targeted easing in recent weeks and we expect the cumulative impact of these measures to filter through in the next few months and help consolidate the recovery."

Chinese shares showed slight gains despite all the major regional stock indices falling on earnings concerns. The Shanghai composite index was 0.09% higher while the MSCI Asia Pacific apex 50 was 0.88% down dragged by the Nikkei 225 and Hang Seng indices, down 0.33% and 0.5% respectively.

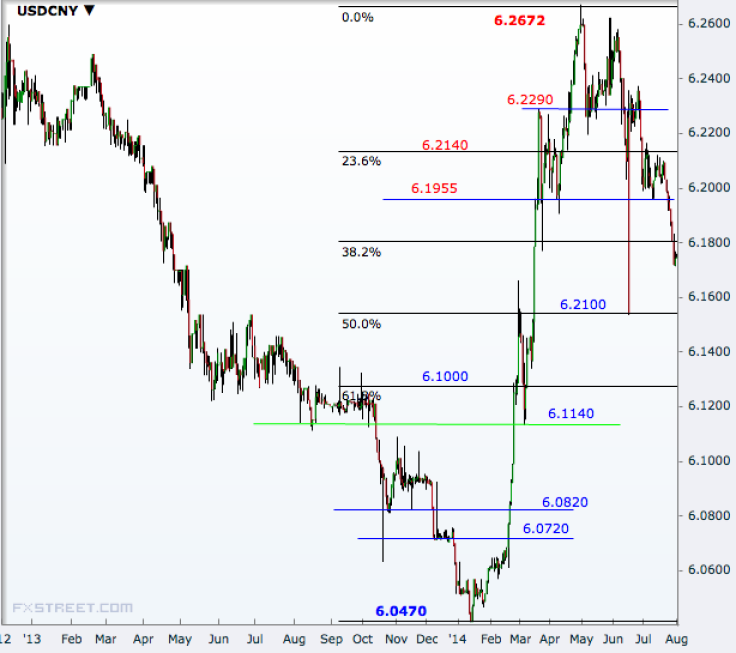

The yuan rose to 6.1758 from Thursday's close of 6.1742, further distancing itself from Wednesday's 6.1717, its lowest since 17 March. After gaining ground in May, the Chinese currency completed its third straight month of gains in July. It has rallied 1.5% from the 17-month low of 6.2672 touched in April.

Global currencies have been under pressure recently also because of the data-driven rally in the US dollar. Faster than expected Q2 GDP growth, as per the data on Wednesday, had pushed the greenback higher, further weighing on other currencies.

The market is now waiting for the July non-farm payroll report from the US, due on Friday. That the Federal Reserve will not be comfortable with hiking rates without stronger labour market signals makes the July jobs report even more important.

Yuan Technical Outlook

With the downward move over the past three months, the USD/CNY has fallen below the 38.2% Fibonacci retracement of the January to April rally and it is now targeting the 50% level at 6.2100.

Next on the downside will be the 61.8% level of 6.1000 and then comes 6.1140. A break of that region will open the doors to 6.0820-6.0720 ahead of a retest of the January low of 6.0470.

On the higher side, one should watch 6.1955 ahead of a break above the 23.6% level of 6.2140. Such a break will take the pair to 6.2290 ahead of a retest of the April high of 6.2672.

© Copyright IBTimes 2024. All rights reserved.