Chinese CPI Inflation Slows, PPI Deflation Eases and AUD/USD Little Changed Ahead of Australian Jobs Data

China's consumer price inflation (CPI) slowed more than expected in June, data on Wednesday (9 July) showed, but its impact was offset by the easing of factory deflation in the same month.

The Australian dollar, the major currency most sensitive to Chinese economic data, traded at 0.9401 against the US dollar at 6:47 GMT, little changed from Tuesday's close of 0.9399.

The June CPI came in at 2.3% year-on-year from 2.5% in the previous month and compared to the consensus estimate of 2.4%.

Food prices rose 3.7%, adding 1.21 percentage points to the headline index, after a 4.1% increase in May. Non-food inflation was unchanged at 1.7%.

The producer-price index declined 1.1% year-on-year, while analysts had been expecting a 1% drop.

A Bloomberg report called the fall the softest in more than two years.

Many analysts believe that the PPI inflation in China will turn positive by the end of this year.

However, some of them also expect the slower-than-expected CPI to prompt the authorities to stay supportive for more stimulus measures.

Upcoming Data

The second-quarter GDP data due on 16 July, is the next important Chinese number.

A Bloomberg poll conducted last month has forecast it at 7.4% y/y, better than the May survey finding of 7.3%, as the Chinese government has come up with more growth-supportive measures.

Chinese Premier Li Keqiang said on 7 July that China's economic performance in the second quarter has improved from the previous period, but the nation can't lower its guard against downward pressures and will increase the strength of targeted measures.

On 10 July, China will release the June trade data followed by the M2 money supply and new loans data for the same month.

The quarterly data on foreign exchange reserves will also be published on Thursday.

China and Australian Dollar

Improved outlook for prices in China, Asia's largest economy, adds to the overall demand outlook, and should help commodity currencies like the Australian dollar.

The Westpac July consumer confidence index came in at 94.9, data showed on Wednesday, from 93.2 for June.

The AUD, however, is waiting for the very important Australian jobs data scheduled for Thursday.

The market expects an addition of 12,300 jobs in June, after registering a payroll loss of 4,800 in May. The unemployment rate, however, is expected to rise to 5.9% from 5.8%.

AUD/USD Technical Outlook

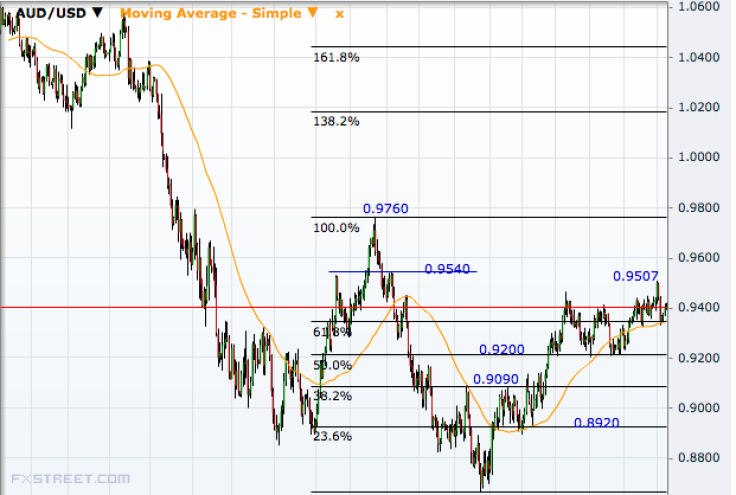

AUD/USD has fallen from the 9-month high of 0.9507 touched on 1 July, but the pair is still holding above the 61.8% retracement of the October 2013-January 2014 selloff.

That comes near 0.9320, making the first support for the pair. Below that it will target 0.9200, the 50% level, which is being held as a support line for the past three months.

Further south, watch out for levels like 0.9090 and 0.8920 ahead of the 24 January low of 0.8659.

On the higher side, 0.9507 is the next level to watch and then comes 0.9540 ahead of 0.9760, the October 2013 peak.

© Copyright IBTimes 2024. All rights reserved.