Commodities round-up: Oil futures fall to two-month low as silver outperforms gold

Economic uncertainty is weighing on oil demand forecasts.

Oil futures continued to lurk near two-month lows on growing concerns that crude market rebalancing might not be in line with previous forecasts.

At 3:16pm BST on Monday (11 July), the Brent September contract was down 0.47% or 22 cents to $46.54 per barrel, while the West Texas Intermediate August contract was down 0.44% or 20 cents to $45.21 per barrel, as both market benchmarks extended the previous week's declines.

Fresh fears were raised about the health of the global economy after China's commerce minister Gao Hucheng told a meeting of G20 ministers in Shanghai that the outlook remains grim despite the world having overcome the impact of the 2008 financial crisis.

Meanwhile, uncertainty posed by the UK's vote to leave the European Union (EU) and the developing Italian Banks crisis is also weighing on market sentiment.

The World Bank cut its forecast for the global economy in 2016 from 2.9% to 2.4% last month, while the International Monetary Fund cut its forecast to 3.2% from 3.4% back in April.

The current oil demand growth projections remain in the 1.2 to 1.4m barrels per day (bpd) range, but analysts at Barclays believe even 1.1m bpd would be hard to achieve under the current conditions.

Michael Cohen, head of energy markets research at Barclays, said: "The deterioration in the global economic outlook, financial market uncertainty and ripple effects on key areas of oil demand growth are likely to exacerbate already-lacklustre industrial demand growth trends."

As fears for demand grow, supply outages, especially in Canada, appear to be on their way towards being resolved. Furthermore, with oil prices staying in the $40 to $50 range, ratings agency Moody's said independent US oil companies with viable hydrocarbon plays are adjusting to the new normal and coping reasonably well.

RJ Cruz, vice president and senior analyst at Moody's, noted: "Amid persistent low oil and natural gas prices, these exploration and production companies have been searching for ways to become more efficient in finding and replacing reserves, reducing costs and avoiding leverage from creeping higher."

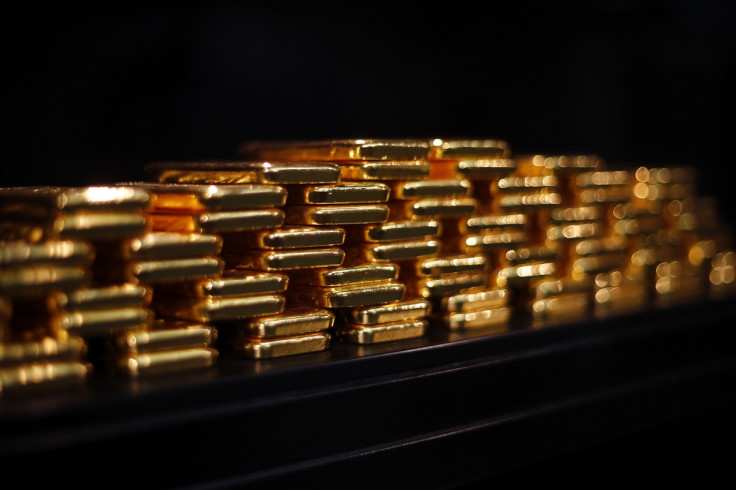

Away from oil markets, in the face of growing global economic uncertainty, precious metals saw yet another positive session spurred on by safe-haven calls, with silver outperforming gold in early US trading.

At 3:34pm BST, Comex silver contract for September delivery was up 1.75% or 35 cents to $20.45 an ounce, bolstered by hedging demand, while the Comex gold contract for August delivery was up a mere 0.05% or 30 cents to $1,358.70 an ounce.

Nonetheless, voracious market appetite for the yellow metal is showing no signs of subsiding. According to the US Commodity Futures Trading Commission data to 5 July, net-long gold futures positions, i.e. bets that the price will go up, hit a record high of 273,100 contracts, a rise of 84% over the past five weeks.

However, in a note to clients, analysts at Commerzbank cautioned: "In our opinion, this gives rise to correction potential if speculative financial investors were to decide to take profits."

© Copyright IBTimes 2024. All rights reserved.