Over 200,000 Equitable Life Victims Could Lose Pensions

Over 200,000 savers could lose their pensions despite insurer, Equitable Life, virtually collapsing over a decade ago, says Public Accounts Committee chair Margaret Hodge.

In a PAC report, only £168m (€195m, $258m) had been paid out to Equitable Life policyholders by March 2012, which is only a third of the £500m expected.

It also warned how the UK Treasury has estimated that up to 236,000 people might not receive any money and that an "arbitrary choice" of enforcing a March 2014 compensation deadline "increased the risk" of these untraced savers losing out again.

Hodge said it was "completely unacceptable". "Hundreds of thousands of conscientious savers are losing out because of the Treasury's failure to get a grip on the payment scheme," she said.

"It focused on an arbitrary target for making the first payments at the expense of proper planning and this has led to unacceptable delays and spiralling costs."

The Near-Collapse of Equitable Life

Equitable was once considered one of Britain's strongest insurers but it collapsed in 2000.

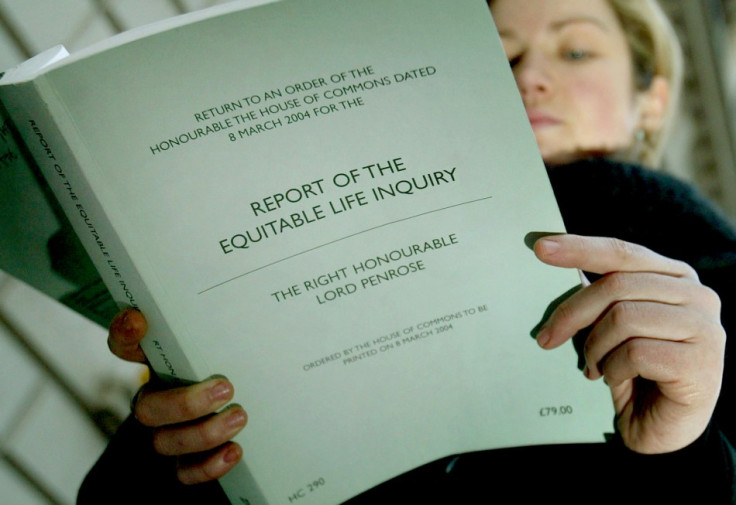

In 2004, the government launched the "Report of the Equitable Life Inquiry" into the near-collapse of the world's oldest life assurer. The report absolved government regulators of negligence but it heaped blame on the firm's management but offered no compensation for policyholders at the time.

Since then it has left 1.5 million policyholders without pay outs, with losses amounting to £5bn.

In 2010, the coalition government agreed to help pension savers to recoup some of their cash, with up to £1.5bn allocated as potential redress.

However, policyholders have since complained of severe delays in payments and badly managed correspondence, despite pay outs commencing in 2011.

Earlier this year, the National Audit Office reported that the process was falling behind and was over budget.

"With less than a year to go before the scheme closes, the Treasury still has 664,200 payments worth £370m left to make. Unless the Treasury and its administrator, National Savings and Investments (NS&I), get their act together there is a real risk that large numbers of policyholders will miss out," said Hodge.

However, a Treasury source hit back and said "we make no apology for starting to get payments out the door a year after the Coalition was formed."

© Copyright IBTimes 2024. All rights reserved.