Ethical investing: Good for your health, and good for your wealth

Sustainable businesses are well worth considering given they are now credible and profitable undertakings.

I have been looking at ethical and sustainability investments for a long time as I am passionate about the welfare of our planet and the people on it. Back in the early 2000s, I was tasked with setting up an ethical fund of funds, although at the time it never took off.

Back then, the companies that were working for the benefit of the planet were often small technology firms run by environmental fanatics who weren't business savvy, but cared greatly for their cause, hence they were hugely risky ventures.

The only funds that invested ethically tended to do this by excluding so-called "bad" companies, for example those involved in arms manufacture or tobacco. These funds had their merits but were limited in their scope.

It was more a case about investing with your heart rather than your head, and the ability of many ethical funds to deliver good performance was reduced by having a smaller number of companies in which to invest.

Today, with the huge advances in technology and with a commitment from the biggest powers in the world to reduce their impact on global warming, we are seeing a plethora of investment opportunities that not only are succeeding at making the world a better place, but are increasing investors' wealth at the same time.

Sustainable businesses now are credible and profitable

Following the Conference of the Parties (COP21), the Paris Climate Change Convention of global leaders which took place in December 2015, sustainable investing has become even more mainstream.

There was a commitment on all sides to limit the rise in global temperatures to 'well below' two degrees Celsius above pre-industrial levels, and the International Energy Agency (IEA) has estimated this will require $16.5trn (£13.5trn) of investment by 2030 in order to drive innovation in the climate change economy.

On the eve of the G20 summit in Hangzhou in September 2016, US President Barack Obama said: "Just as I believe the Paris agreement will ultimately prove to be a turning point for our planet, I believe that history will judge today's efforts as pivotal."

Xi Jinging, President of China, reiterated this message by saying: "Our response to climate change bears on the future of our people and the well-being of mankind." So the commitment is solid and a lot of investment will be required.

Mike Fox, head of sustainable funds at Royal London Asset Management and manager of Royal London Sustainable Leaders, believes investors need to consider how this agreement will change their investment portfolios. "As governments seek to implement the Paris agreement it is likely the penalties for poor environmental practices will only increase and companies will have to adjust to making climate change a core principle in how they set strategy."

Sustainable companies perform better

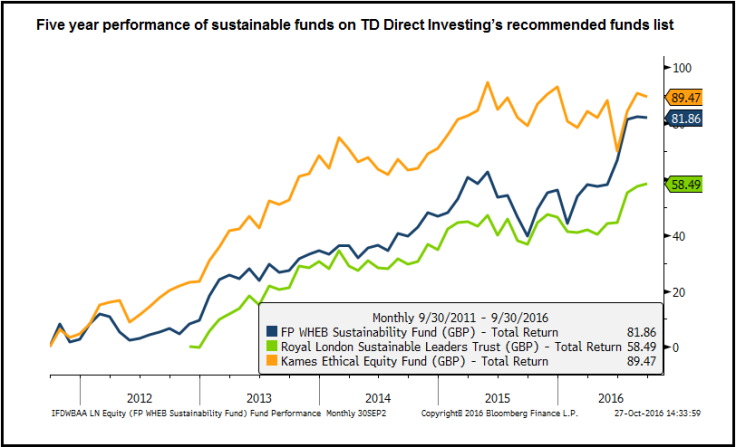

Sustainability is becoming one of the most significant trends in financial markets; the sustainable and ethical funds have seen increasing inflows across the board (see chart above). Evidence also shows those companies which adopt sustainable business practices are likely to do better than those which do not, as can be seen from some of the examples detailed below.

Companies investing this way are embracing new technologies, helping people to be healthier, seeking out alternative fuels and promoting better corporate governance.

Ted Franks, fund manager of WHEB Sustainability fund, says that while every company claims it is integrating environmental, social and governance (ESG) into its process, they are doing it to greater and lesser degrees. "The good thing for us is that those which are doing it are creating a lot of alpha while also mitigating risk."

Sustainability in action

- Solar and wind versus traditional coal companies

According to the International Energy Agency, renewables' (wind and solar) share of power generation should rise 28% by 2021. Renewables are already increasing market share, and by 2021 the agency predicts renewables will supply the equivalent of all the electricity generated today in the US and EU put together.

- Wellbeing

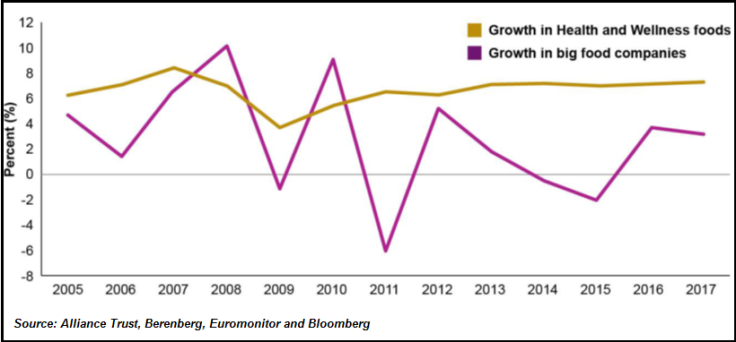

We have seen significant developments in the area of wellbeing, where the growth in healthy foods is outpacing that of big food companies (see below).

Companies such as Kerry Group, an Irish flavours technology specialist, and Wessanen, a Dutch food producer, have benefited and outperformed traditional food companies.

- Corporate Governance takes on a new importance

Companies such as Sports Direct, where the share price has fallen 60% year-on-year to date, which adopt a laissez-faire approach to their business affairs and face allegations of staff exploitation are being punished severely by shareholders and customers alike.

The large Dutch and Scandinavian pension and sovereign wealth funds were early investors. But Individual investors have been slow to commit, although many surveys reveal that individuals are keen to invest sustainably. Morgan Stanley's Institute for Sustainable Investing survey in 2015 found that 71% of individuals are interested in sustainable investing and that 'Millennials' and females were twice as interested in doing so.

Financial paralysis

TD Direct Investing's research into investor behaviour in 2015 found that while these groups have preferences in how they would like to invest, they find it difficult to commit and are under-invested at every level.

The study found that some groups that were more exposed than others – women, Generation Y (those aged 18 – 34) and the over 55s. For those that are in the Generation Y camp, they could be missing out on years of investing that would help give them the financial future they want.

A good first step for these investors is to put their money where their mouth is and to invest in a sustainability fund. In fact, a sustainable / ethical investment should be a value enhancing addition to anyone's portfolio. Investing in helping the world become a better place and improving your long term wealth at the same time has definite win-win appeal.

Michelle McGrade is Chief Investment Officer at TD Direct Investing, the UK brokerage arm of Canada's TD Waterhouse bank. Since the mid-1990s, Michelle has specialised in manager selection and portfolio management, researching managers with different disciplines across the globe. Prior to her role at TD Direct Investing, Michelle worked at both Executive Director and Chief Investment Officer levels at Bank of Bermuda, Coutts, Northern Trust, Investment Solutions and Mediolanum.

© Copyright IBTimes 2024. All rights reserved.