EU referendum: Bank of England chief Mark Carney backs David Cameron's deal

David Cameron's bid to keep the UK inside the EU has been boosted after Mark Carney claimed his renegotiation settlement with Brussels would secure Britain's financial and monetary stability.

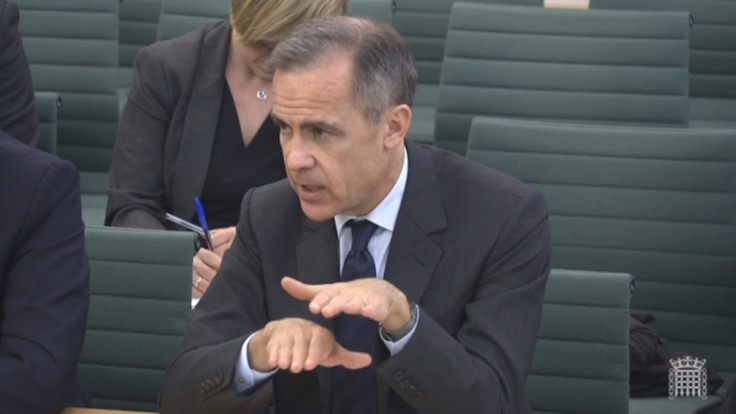

The Bank of England governor made the claims in a letter to the House of Commons' Treasury Committee, published to coincide with the central banker's appearance before the MPs on 8 March.

"[The settlement] makes clear that the UK retains responsibility for supervising its financial stability, financial institutions and markets as well as maintaining responsibility for the resolution of failed financial institutions within its jurisdiction," Carney wrote.

"At the same time, it acknowledges the existing powers of the Union to take action that is necessary to respond to threats to financial stability.

"The settlement recognises that EU financial services legislation may need to be conceived in a more uniform way for Banking Union member states than for member states like the UK that are not participating.

"It recognises that there is more than one currency in the EU and makes a legally binding commitment to ensure non-discrimination in the single market on the basis of currency."

He concluded: "Finally, it makes a series of commitments to improve the competitiveness of the EU economy—commitments, to the extent they are fulfilled, that would reinforce the positive impact of EU membership on the Bank's secondary objectives."

Rees-Mogg takes on Carney

Carney faced a grilling from Conservative Eurosceptic and Brexiteer Jacob Rees-Mogg during the session. The North East Somerset MP accused the Bank of England governor of making "speculative pro-EU statements", which were "beneath the dignity" of the central bank.

But Carney, the former governor of the Bank of Canada dismissed Rees-Mogg's criticism arguing that the Bank of England had made a "careful" assessment of economic implications of the UK's membership of the EU.

The economist also faced a grilling from John Mann. The Labour MP asked Carney if he had an estimate on the number of jobs that could be lost if the UK broke away from the EU after the 23 June referendum.

But the Bank of England chief revealed he had yet to analyse the scenario and could therefore not provide any figures. Carney also said the central bank would not launch an investigation into the wage and inflation implications of a Brexit ahead of the historic vote.

However, the Bank of England boss did suggest that some financial firms could leave the UK in the event of a leave vote. "Certain firms would take a view in terms of relocation," he told the committee.

Contingency plan

Carney's appearance before the Treasury Committee comes after the Bank of England announced it would offer extra liquidity to the banking sector around the EU referendum in a bid to avoid a run on the institutions.

Threadneedle Street will hold three additional Indexed Long-Term Repo (ILTR) operations in the weeks before the historic vote. "These operations are additional to the regular ILTR operations which will continue to take place once a month," the Bank said.

"As usual, the Bank will continue to offer liquidity insurance via its other facilities, including running its regular weekly US Dollar repo operations, throughout this period. The Bank will continue to monitor market conditions carefully and keep its operations under review."

© Copyright IBTimes 2024. All rights reserved.