Halloween Should Bring Better Times to Stock Markets and Not Scare Off Investors

"Be greedy when others are fearful." This quote from one of the most famous investors of our age, Warren Buffett, is one to remember when confronted by a sharp sell-off of the sort that we have witnessed over the last four weeks.

In early September, the FTSE 100 index stood a fraction below the 7000 level, finally a hair's breadth away from setting a new all-time high (the current all-time high is 6950, set back in late 2000).

Now here we are in early October, braving the onset of Autumn and cooler temperatures, with stock markets globally also seemingly affected by a similar cooling.

The FTSE 100 is now sitting around 6340, roughly 8% lower than a month ago.

This sharp reversal, triggered by fears over weakening global growth and with the prospect of the US Federal Reserve raising interest rates on the other side of the pond, has investors scurrying for the relative safety of bonds.

According to the Investment Company Institute, US retail investors have taken a net $4.5bn (£2.8bn, €3.6bn) out of stock funds over the five weeks to 1 October, instead seeking the safety of money market funds despite the lack of any yield.

Don't Follow the Herd and Stampede Out of Shares

Rather than follow this herd, which has typically been late to invest in stock market uptrends and also late to exit stock markets one they have already fallen far, my contrarian instincts tell me to buy into the stock market now, on the basis that one should always be aiming to "buy low and sell high".

Several stock market sectors such as Oil & Gas and Food Retail have already suffered heavy falls and are now beginning to rebound. Valuation is relatively attractive too, with the FTSE 100 trading at a P/E of just over 12x and paying out a generous 4% dividend yield.

That's not far off twice the paltry return that you will get for buying the UK government's 10-year IOUs (I mean government bonds) right now.

And even if the International Monetary Fund was relatively downbeat about global economic growth prospects, it was at least positive about the UK.

The Halloween Effect Could Strike (Again)

Let's not forget about seasonal effects too. The Halloween effect, describing the traditional outperformance of stock markets globally from November through to April, is close to starting.

In fact, my own research indicates that a better starting seasonal date for being invested in stocks in developed markets like the UK and US is actually midway through October.

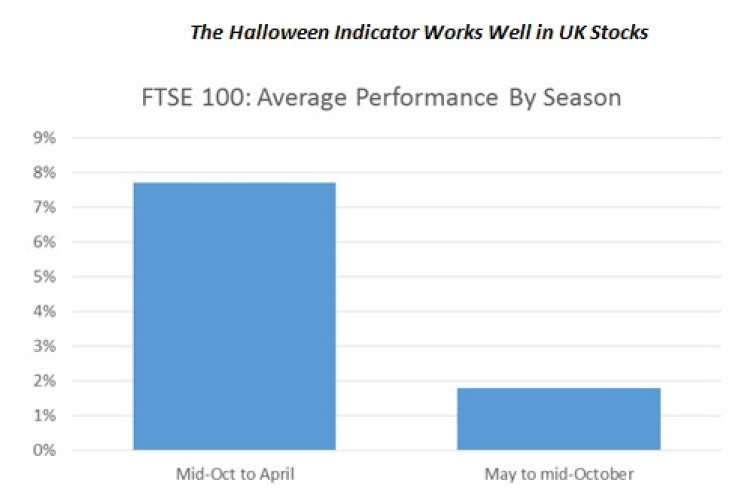

From mid-October through to the end of April, the FTSE 100 has gained an average of nearly 8% per period since 1986 (when the FTSE 100 began). This is the vast bulk of the average 9.5% yearly gain in the FTSE 100 (dividends included), and beats the average May-mid-October period performance of only 1.8% hands down [Figure 1].

Follow the Value and Seasonal Trend in the FTSE

The current relative value (comparing the FTSE 100 dividend yield to bond yields) and the positive seasonal effect both argue that we should not overreact to the doom and gloom that surrounds investors at the moment, but rather that we should add exposure to the FTSE 100 in preparation for the strongest stock market half-year.

In fact you could argue that this September sell-off could in fact be Christmas come early for the contrarian investor.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2024. All rights reserved.