Leveson Inquiry: Media Stocks To Watch in Wake of Report into Phone Hacking [VIDEO]

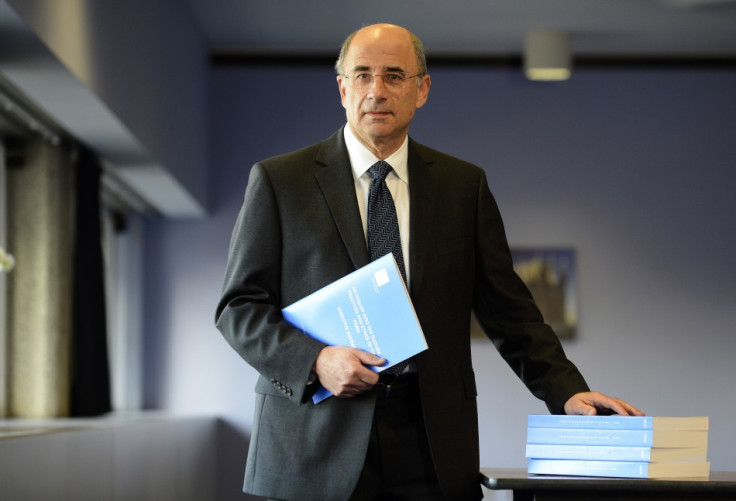

The long-awaited inquiry into the ethics and culture of the British press following a phone hacking scandal that ultimately led to the closure of the UK's biggest Sunday newspaper has been revealed in London today.

Lord Justice Brian Leveson's recommendations for a new model of press regulation, which will be considered by Prime Minister David Cameron, have the power to impact a range of media stocks over the coming weeks and months.

Rupert Murdoch's media enterprise has been the beating heart of the Leveson Inquiry and provided the bulk of the drama of its televised testimony.

News Corp has paid around $315m in civil settlements, legal fees and costs linked to the broader investigation into phone hacking and breaches of privacy, angering shareholders who felt the excesses of the News International unit - which include the Sun tabloid and the now-defunct News of the World - were causing reputational and economic damage to other parts of the business.

Former News International CEO Rebekah Brooks, who today faced charges of conspiracy to commit misconduct in public office in relation to the phone hacking scandal, was said to have received nearly £7m in compensation from the company when she stood down last year.

A side-bar to the phone hacking investigations - which included the interception of messages on the mobile phone of a murdered schoolgirl - was the failure of a bid by BSkyB for 61 percent of the company that News Corp doesn't already own. News Corp pulled the deal just days after shuttering News of the World in July 2011.

Leveson's detailing of the failures of News Corp and BSkyB management could cause further embarrassment for the Murdochs, who have insisted the wrongdoing was isolated to a few News International titles.

Any indication of more robust regulation could also be seen as driver for share price performance in that it may accelerate the company's plans to split into publishing and entertainment units with the latter - which includes BskyB and Fox - being far more valuable.

NWSA: +1.8 percent (Wednesday) / +36 percent year-to-date

BSY: -0.6 percent / +6 percent

ITV

Britain's biggest public television broadcaster has had no direct implication in the Leveson Inquiry, but it was subsequently linked to the broader discussion of media culture during the scandal surrounding alleged sexual abuse cover-ups at the BBC. Earlier this month, ITV presenter Philip Schofield was disciplined for handing Prime Minister David Cameron a list of suspected paedophiles within his party during a live broadcast of a morning chat show.

The company, which was once seen as a potential takeover target of BSkyB, has shown a steady improvement in advertising revenues and financial performance over the past year and it sees better advertising revenue into the Christmas period due to the strength of its schedule and flagship hits such as Downton Abbey and X-Factor.

A long-shot reaction to the Inquiry's findings and conclusions could put the broadcaster "in-play" once again. BSkyB has a 7.5 percent stake in ITV after it was forced to sell around 10 percent at 48.5 pence in 2010 for a £350m loss. BskyB bought the stake in 2006 as part of a presumptive attempt to block a bid for ITV at the time by cable group NTL, which is now part of Virgin Media.

ITV: +.92 percent / +44 percent

Virgin Media

Like ITV, the cable group was not directly implicated in the Leveson Inquiry but has been tainted to a degree but what some saw as an unusual relationship with the police. Virgin Media paid the overtime bill of Scotland Yard officers investigating a fraud allegation that Virgin said was costing it £144m each year. The payments, while legal, did again remind many of the close relationship between the media and Britain's police services.

VMED: +1.7 percent / +54 percent

Trinity Mirror

Trinity Mirror newspapers have barely been grazed by the phone hacking scandal, though there have been rumblings about Piers Morgan's time as editor at the Daily Mirror with accusations - strongly denied by the parent group and the man himself - that it happened under his watch.

However some of the over-zealous antics of Trinity Mirror journalists in pursuing stories were cast under the Leveson Inquiry's spotlight, causing embarrassment.

The company's publications, which span local and national level, have suffered budget cuts and redundancies in recent years because of poor financial performance.

Its share price has lost almost 80 percent of its value over the past decade.

If the government does choose tough regulation, with tabloids at the heart of its business, then Trinity Mirror's journalism is likely to be affected.

TNI -3.05 percent / +65 percent

Associated Newspapers Limited / Daily Mail & General Trust

Daily Mail owner Associated Newspapers has taken a lot of criticism during the Leveson Inquiry for its salacious reporting and it has been one of the probe's most vociferous critics.

It recently ran an 11-page diatribe railing against pro-regulation campaigners and Leveson ahead of the inquiry's report.

Much of the Mail Online's success - which has seen it grow to be one of the most popular newspaper websites in the world and profitable, a rarity in itself - is down to its so-called "Sidebar of Shame", with all the usual prurient, gossipy, celebrity puff that the mass market craves.

Like Trinity Mirror, Associated Newspapers' journalism will be hit by tough regulations cracking down on the behaviour and reporting of the tabloids.

DMGT: +1.3 percent / +31 percent

Pearson

As owner of the Financial Times and the Economist, Pearson is certainly not at the tabloid end of the media market, but it will still be impacted by a new regulatory regime, depending on how strict any new rules are and how far they impinge on the day-to-day working of journalists.

There have been rumours recently about the possible sale by Pearson of the Financial Times Group, and tougher conditions for the newspaper industry under a new regulatory regime could give them the excuse to shift its own holdings in the dead tree press.

PSON: -0.8 percent / -2.7 percent

© Copyright IBTimes 2025. All rights reserved.