Persimmon gets ‘Overweight’ rating from JP Morgan ahead of FY Earnings

Persimmon FY Earnings Preview

With a keen focus on first-time buyers and a robust platform for its future growth, Persimmon, the house building Group, is scheduled to report its preliminary earnings on Tuesday, February 28, 2012.

Ahead of full-year earnings, JP Morgan has assigned "Overweight" rating to the operator of Persimmon Homes, Charles Church, Westbury Partnerships and Space4 as the Group expects to perform in a challenging environment due to the overall economic situation, while the UK housing market remains stable.

According to company reports, the Group continues to explore opportunities to improve the availability of mortgage finance with its key mortgage lending partners. It is particularly keen to assist a greater number of first-time buyers fulfil their desire to acquire a home of their own. It has been successful in securing c.£35m of funding from the HCA under the First Buy shared equity scheme which specifically focuses on assisting first-time buyers to acquire a new build home. This funding represents c.20% of the total funds allocated and will help it deliver c.2,100 new homes across c.290 developments nationwide during the period to March 2013.

The Group expects the overall growth in new home sales volumes to reflect the developments in the wider economy. It anticipates legally completing a similar number of new homes as it did in 2011. Its new site opening programme will continue to support sales and its consented land bank will assist in the delivery of new outlets over the long term. This high quality asset base provides an excellent platform for the future profitable growth of the Group.

The house building Group remains committed to its strategic objectives of margin improvement and cash generation. As a consequence, its teams across the country will remain focused on the basics of house building in their local markets which it is confident will deliver future success for the Group.

Brokers' Views:

- JP Morgan raises to "Overweight" from "Neutral"

- Panmure Gordon cuts to "Hold" from "Buy"

- Peel Hunt gives "Sell" rating on the stock

- Shore Capital Stockbroker recommends "Hold" rating on the stock

- Liberum Capital recommends "Sell" rating on the stock.

Earnings Outlook:

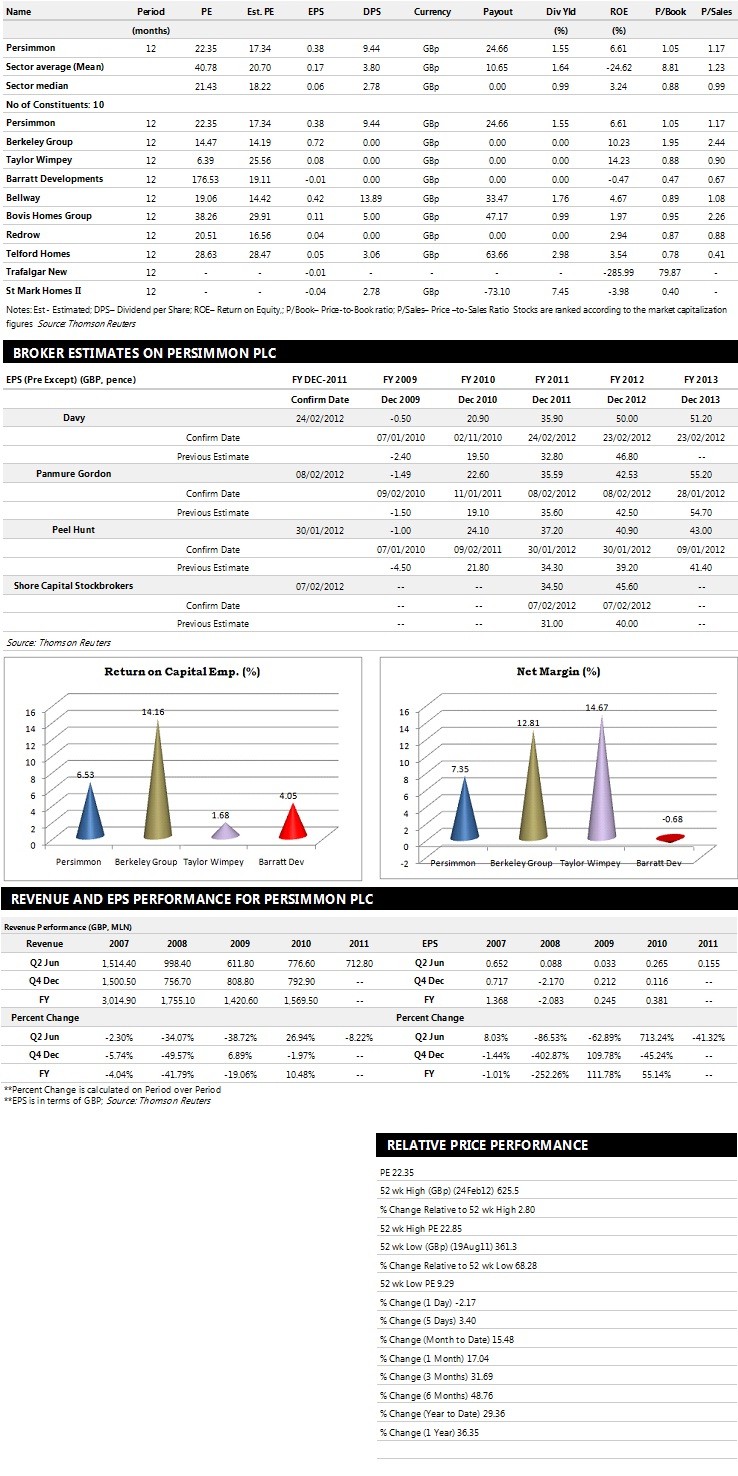

- Davy estimates the company to report revenues of £1,645.80 million and £1,752.90 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £140.20 million and £197.80 million. Profit per share is projected at 35.90 pence for FY 2011 and 50.00 pence for FY 2012.

- Panmure Gordon estimates the company to post revenues of £1,538 million and £1,646 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £145.30 million and £171.30 million. EPS is estimated at 35.59 pence for FY 2011 and 42.53 pence for FY 2012.

- Shore Capital Stockbroker expects the company to earn revenues of £1,535 million for the FY 2011 and £1,696.50 million for the FY 2012 respectively with pre-tax profits of £143.00 million and £185.50 million. Profit earnings per share are projected at 34.50 pence for the FY 2011 and 45.60 pence for the FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2024. All rights reserved.