UK Feb Borrowing Smashes Expectations

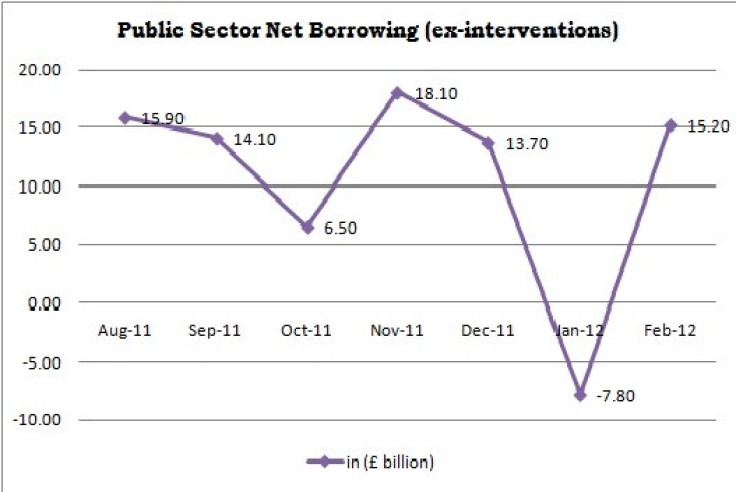

The U.K.'s public sector net borrowing increased more than anticipated in February 2012, while striking a record value for the month of February, according to the latest data released from Office for National Statistics (ONS).

Public sector net borrowing (ex-interventions) was £15.2 billion, an increase of £6.3 billion from February 2011, when net borrowing was £8.9 billion. Public sector net debt at the end of February 2012 was £995.0 billion (63.1 per cent of GDP) compared to £877.3 billion (58.8 per cent of GDP) at the end of February 2011. The central government net cash requirement was £5.9 billion, a £2.0 billion higher net cash requirement than in February 2011, when there was a net cash requirement of £3.9 billion.

Economists estimated the borrowings of £7.9 billion in February. But today's data smashed those expectations. March is typically a large deficit month, with borrowing stood at £18 billion in March 2011. If that figure is repeated this year, the finance minister Mr. George Osborne will overshoot the borrowing target by £1 billion.

Public sector net borrowing (including interventions) was £12.9 billion, up £6.8 billion from February 2011, when net borrowing was £6.1 billion. Public sector net debt at the end of February 2012 was £2172.8 billion (137.9 per cent of GDP) compared to £2233.3 billion (149.6 per cent of GDP) at the end of February 2011.

With UK's AAA rating now under warning from credit ratings agencies, the government must convince markets that it will stick to its ambitious deficit-reduction plan and stand up to calls to ease back on the pace of cuts. Finance minister has already warned that there won't be any giveaways in his budget statement at 1230 GMT today. Help for low-income families is likely to be offset by revenue-raising measures elsewhere, such as a new property sales tax on high value homes.

The U.K. public sector current budget (ex-interventions) was in deficit by £11.1 billion in February 2012, a rise of £6.7 billion from February 2011, when there was a deficit of £4.3 billion. Whereas, the public sector current budget (including intervention) was in deficit by £8.7 billion.

"February's UK public finance figures are rather worse than the Chancellor would have hoped for ahead of his Budget this afternoon," Says Vicky Redwood, Chief UK Economist at Capital Economics.

© Copyright IBTimes 2024. All rights reserved.