SIG Anticipates Lower Volumes in 2012

SIG, a leading distributor of specialist building products in Europe, expects to continue gaining market share from the branches opened in recent years, as well as from other growth initiatives, in spite of weak macroeconomic outlook for the UK and Mainland Europe.

The group is scheduled to report its preliminary results for the year ended 31 December, 2011 on Wednesday and expects gross margins for 2011 at a similar level recorded in 2010.

SIG holds strong positions in its core markets of insulation, energy management, interior fit out and roofing, and it is confident on the level of outperformance and market share gains achieved during 2011, while maintaining gross margins, against the continuing tough economic conditions.

The strong performance in Mainland Europe is in part attributable to the group's investment in new branches in recent years, which contribute additional sales and profit as they mature. In its December-end trading update, the group posted an 8 per cent increase in 2011 sales to £2,740 million and the board is confident of achieving a profit before tax above the upper end of the range of analysts' expectations for 2011.

While commenting on the year-end trading update, analyst Andy Brown of Panmure Gordon said: "Another solid trading update from SIG, which has indicated that FY 2011 is ahead of expectations. It retains structural growth drivers, principally through insulation, and with the strengthened balance sheet, we retain our positive stance." He assigned a "buy" rating on the stock.

SIG expects net debt to have reduced from £163 million at 30 June 2011 to £120 million at 31 December 2011, reflecting the group's continued tight management of working capital. According to the group, overall demand levels in SIG's countries of operation are likely to remain subdued in 2012. Due to lower consumer spending and the impact of government austerity measures, the group expects that the UK and Irish markets will show a modest decline next year compared with 2011.

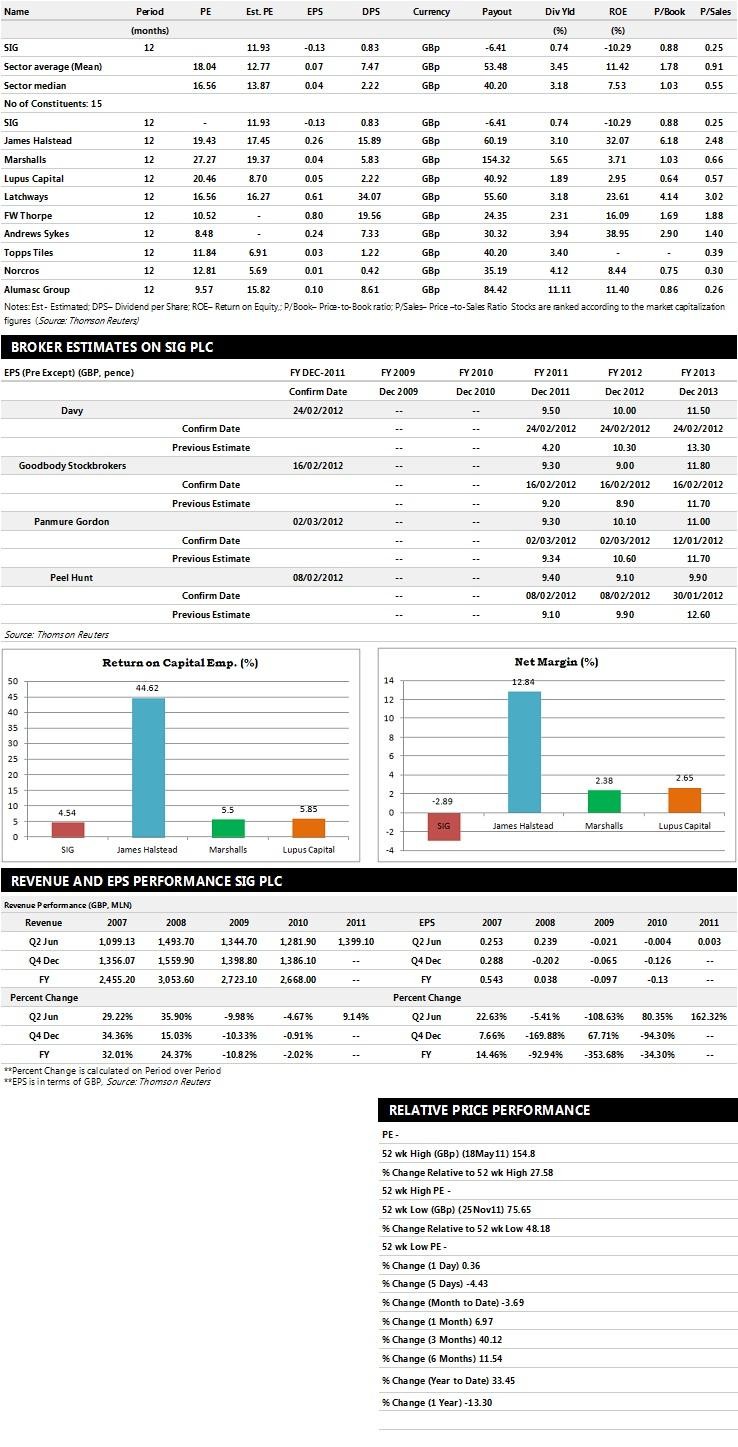

Brokers' Views:

- Panmure Gordon assigns 'Buy' rating on the stock with a target price of 165 pence per share

- Peel Hunt recommends 'Sell' rating on the stock

- Goodbody Stockbrokers assigns 'Buy' rating with a target price of 142 pence per share

- FinnCap recommends 'Buy' rating with a target price of 140 pence per share

- Jefferies & Co gives 'Buy' rating with a target price of 153 pence per share

Earnings Outlook:

- Panmure Gordon estimates the company to report revenues of £2,741 million and £2,728 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £80.50 million and £86 million. Earnings per share are projected at 9.30 pence for FY 2011 and 10.10 pence for FY 2012.

- Peel Hunt projects the company to record revenues of £2,707.70 million and £2,677.10 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £81.00 million and £78.50 million. Profit per share is estimated at 9.40 pence and 9.10 pence for the same periods.

- Goodbody Stockbrokers expects SIG to earn revenues of £2,804 million for the FY 2011 and £2,685 million for the FY 2012 respectively with pre-tax profits of £81.10 million and £79 million. EPS is projected at 9.30 pence for FY 2011 and 9 pence for FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2024. All rights reserved.