Tesco Loses More Market Share as Aldi and Lidl's Success Continues to Increase

Budget retailers Aldi and Lidl continued to snap up market share from mid-market supermarkets such as Tesco, according to data from the latest Kantar Worldpanel.

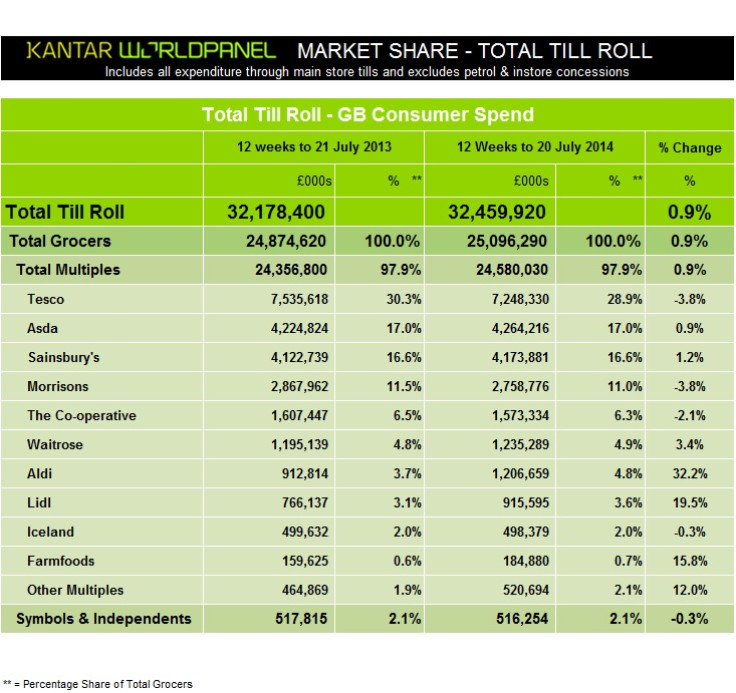

For the 12 weeks leading to 20 July, the two stores significantly increased their market share, with Aldi now holding 4.8% of it, up by 32.2% on the previous year, and Lidl gaining 19.5% more than the same quarter in 2013, as it sits pretty holding 3.6% of the market.

Aldi now sits just 0.1% behind Waitrose, which experienced much slower growth of 3.4%.

Edward Garnier, director at Kantar Worldpanel, said: "Waitrose has continued to resist pressure from the competition, testament to its policy of maximum differentiation, and has grown sales by 3.4%. This figure is well above the market average and thereby has lifted its market share."

Tesco's unrelenting descent shows no signs of coming to a halt as, although it still holds the majority of the market with 28.9%, it was down by 3.8%.

Asda took second place with 17% and Morrisons experienced the exact same decline as Tesco, as its market share dropped to 11%.

According to Kantar, grocery inflation has dropped for the 10<sup>th consecutive quarter, standing now at just 0.4%.

The market research firm states that this mirrors the competitiveness of the market, with deflation among the price of some of the most common items such as milk, bread and vegetables but also the impact of budget stores such as Aldi and Lidl that undercut the mid-market range.

© Copyright IBTimes 2024. All rights reserved.