House Price Bubbles 'in Most UK Regions'

Most UK regions are probably in a house price bubble, an academic has claimed.

A study by Professor James Mitchell, head of Warwick Business School's Economic Modelling and Forecasting Group, measured house prices against earnings.

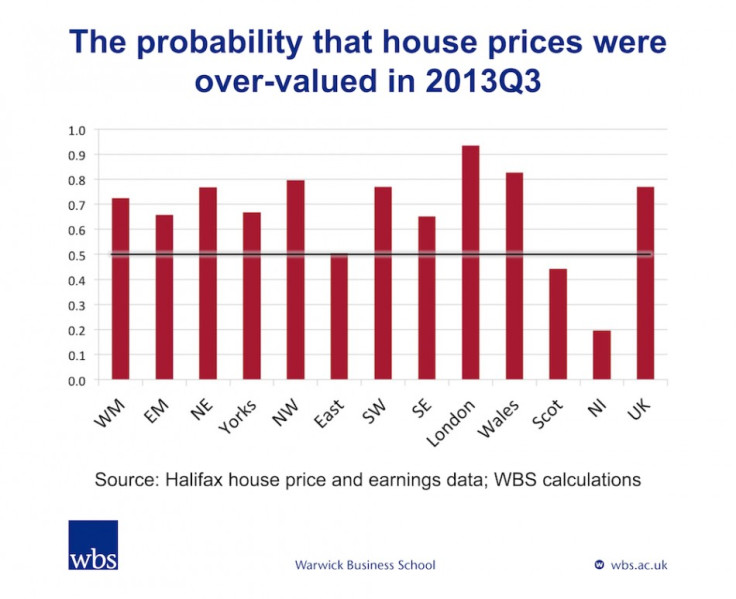

He then calculated the probability of a bubble and found that house prices in ten out of 13 regions are higher than historically affordable values.

According to the research, London is most at risk with a 93% probability it is experiencing a house price bubble. Second is Wales, at 83%. The only three regions probably not in a bubble are Northern Ireland, the East of England, and Scotland.

"The results raise the risk, although not the certainty, that house prices will fall, although predicting the timing and manner of any fall is even harder than identifying the presence of a bubble," said Professor Mitchell.

"But a bubble it appears to be and we should all - householders, business people and policymakers alike - be alert to this risk."

Mitchell's study used data from Halifax Building Society's monthly house price index reports. The latest from November revealed a 7.7% rise in the average UK house price across the year.

Rising prices come off the back of mortgage market stimulus under the Help to Buy and Funding for Lending schemes.

The Bank of England's Funding for Lending scheme offers lenders cheap loans if they lend out more to consumers and small businesses. This has incentivised greater mortgage lending by reducing interest rates.

Under Help to Buy, the government offers a package of interest free equity loans for first time buyers and a guarantee, for a small fee, which underwrites a bank's mortgage lending.

Critics say that inflating demand in the housing market through mortgage easing schemes such as these is risky because supply is so limited and prices will soar to evermore unaffordable levels.

Mark Carney, governor of the Bank of England, has said policymakers are concerned about what is happening in the UK housing market and stand ready to tighten credit conditions if needs be. He has already curtailed the Funding for Lending scheme so it no longer supports the flow of consumer credit.

As it stands, the base rate is at its record-low of 0.5%. Carney said the Bank of England will not hike interest rates until the unemployment rate falls to a 7% threshold, anticipated to happen in 2015. Even then this is only the time at which lifting rates will be considered. It is not guaranteed.

"Rising house prices are proving helpful in leading the UK out of its longest recession in living memory," said Mitchell.

"But with house prices at such historically unaffordable levels there is a risk that when interest rates start to return to more normal levels, which they will if not next year then the year after, that the finances of both households and banks are stretched to breaking point.

"This raises the spectre of falling house prices, negative equity, bad assets on banks' balance sheets and a return to the so-called Great Recession we have been so slowly emerging from."

He added: "Households are particularly vulnerable to interest rate movements in the UK; even quite modest increases in the interest rate would put significant numbers of householders into quite serious debt problems."

© Copyright IBTimes 2024. All rights reserved.