US hedge fund Elliott seeks to block Samsung C&T's treasury share sale to Cheil Industries affiliate

US hedge fund Elliott Associates is seeking to block Samsung C&T's sale of its treasury shares to an affiliate of Cheil Industries in order to smoothen the latter's proposed acquisition of the former.

"In Elliott's view the recently-disclosed proposed sale of 5.76% of Samsung C&T's issued common shares by Samsung C&T to KCC (an affiliate of Cheil Industries) is a desperate and unlawful attempt by Samsung C&T, its directors and their respective related parties to shore up voting support for the unlawful proposal for a takeover of Samsung C&T by Cheil Industries," the $26bn hedge fund said in a statement.

"Elliott has therefore been forced to apply for urgent injunctions against Samsung C&T, its directors and KCC in order to seek to prevent the treasury shares concerned from becoming shares which can be voted in respect of the proposed takeover, and thereby protect the interests of Samsung C&T's shareholders."

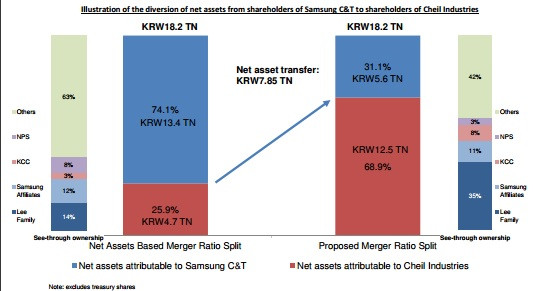

The fund added that if the takeover proposal goes ahead, more than 58% of Samsung C&T's net assets will be diverted into the hands of Cheil Industries, without any compensation.

The parties have been engaged in a row after construction company Samsung C&T agreed to be taken over by Cheil Industries, in which Samsung Electronics vice-chairman and heir apparent Lee Jae-yong is the major shareholder. As per the deal, each Samsung C&T share will be exchanged for 0.35 of a share in Cheil Industries, valuing the acquisition target at more than $8bn (£5.2bn, €7.3bn).

The merger is widely seen as the family's attempt to ensure control of the group, ahead of an expected leadership succession. The group's chairman Lee Kun-hee has been bedridden following a heart attack in May 2014.

Elliott, which recently increased its stake in Samsung C&T to 7.1%, earlier criticised the deal, saying it is not in the best interest of Samsung C&T shareholders. It also said it commenced legal proceedings for an injunction to seek to prevent the takeover.

The deal is subject to the approval of shareholders in both the companies. They will vote on the proposal on 17 July, and a two-thirds majority is required to approve the deal.

The Lee family owns just 1.4% of Samsung C&T, and the total holding will be less than 20%, if shares of affiliates and related parties are taken into account, according to brokerage CLSA.

© Copyright IBTimes 2025. All rights reserved.