What is Bitcoin and How Does it Work?

A month ago Bitcoin was a little-known digital currency whose most high-profile customer was Wikileaks, but now mainstream media reports, computer hijacks and an enormous gold rush has seen interest explode. Alistair Charlton explains what Bitcoin is and how it works.

Who created Bitcoin?

Bitcoin is an online, digital currency that was launched in January, 2009 by programmer Satoshi Nakamoto and can be exchanged through a peer-to-peer network without the need for a bank. Nakamoto - believed to be an alias - published a paper in 2008 explaining how Bitcoin works.

Nakamoto described it as "a purely peer-to-peer version of electronic cash [that] would allow online payments to be sent directly from one party to another without going through a financial institution....a system for electronic transactions without relying on trust."

The Bitcoins system is now maintained by a volunteer open-source community coordinated by four core developers. One of these developers, Jeff Garzik, said in 2011 that "Satoshi's a bit of a mysterious figure. I and other core developers have occationally corresponded with him by email, but it's always a crapshoot as to whether he responds."

Nakamoto described himself as a male in his late 30s or early 40s living in Japan, but this was met with skepticism due to his use of English and the Bitcoin software containing no Japanese.

The programmer is quoted as saying: "Governments are good at cutting off the heads of a centrally controlled networks like Napster, but pure P2P networks like Gnutella and [software to access the Dark Web] Tor seem to be holding their own."

Who issues Bitcoins?

Being decentralised, Bitcoins are not issued from a central bank in the same way dollars, pounds and euro are printed. Instead, the digital currency is created by users of Bitcoin software, known as miners.

The program presents your computer with a complex mathematical equation which takes time to solve, although a more powerful computer will work out the answer more quickly, as will networks of computers working together where mined coins are split equally between them.

That answer is a 64 digit number, and once it has been calculated the miner is rewarded with 25 Bitcoins, which are each currently worth around $150, as of 11 April. Mined Bitcoins can then be used to buy goods online, just like online banking or PayPal.

As with any currency or valuable commodity, too many Bitcoins will result in their price falling, while too few will cause their value to increase, To try and keep the Bitcoin economy stable, the complexity of the equation miners must calculate is automatically adjusted, although on average a single batch of 25 Bitcoins is mined every 10 minutes through the combined effort of every miner.

Unlike printed currencies, which can be added to as and when the economy requires it, there is a finite number of Bitcoins that can be mined, making it more like gold than cash.

How many Bitcoins are in circulation?

The maximum number of Bitcoins is 21 million with just over 11 million currently in circulation, and to combat any increases in the speed of mining, the number of coins extracted per equation solved is halved every four years. Coins per calculation will fall to 12.5 in 2016 and then to 6.25 in 2020.

At the current (but very unstable) value of around $150 per coin, the 11 million coins in circulation are worth more than $1.6bn.

In fact, the Bitcoin market is so unstable that figure increased by almost $100m in the time it took me to type that sentence, before falling by more an hour later.

Efforts to make the value of Bitcoins self-stabilising can only go so far, and in recent weeks the value has seen a rollercoaster of boom and bust caused by increased media attention, a Skype hack, cyber attacks and lag in trades taking place.

These issues are serious enough on their own, but add this to the fact that anyone can be a Bitcoin miner and trader - not just someone with an economics degree - and it's no surprise the market has been so unstable.

Where can I spend Bitcoins?

Once mined, Bitcoins can be spent as currency online through a huge and ever-increasing range of retailers, selling everything from computer components and pizzas, to custom clothing and cosmetics. Exchanges like Mt. Gox can be used to store Bitcoins and this is also where coins can be bought for dollars or other currencies.

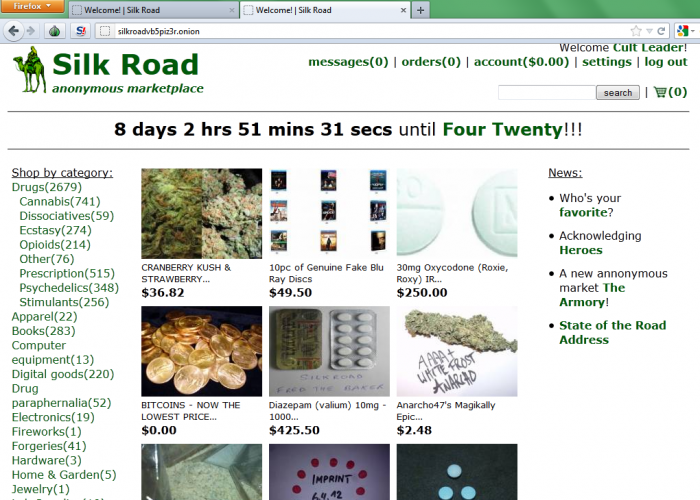

But there is a darker side to Bitcoin use. Because paying for goods with them is anonymous, users can shop on the Dark Web, a collection of websites that can only be accessed through a special computer program and includes sites like Silk Road, a marketplace for illegal drugs.

Due to reduced faith in governments and banks, who can limit the amount of cash customers have access to (as we've seen recently in Cyprus) customers could turn to Bitcoin, which is seen as an online form of gold or silver, a safe haven away from the control of banks and government, but one plagued with instability from within.

Because Mt. Gox and other exchanges hold significant amounts of Bitcoins they are a target for computer hackers, who can launch cyber attacks on them, destabilising the value of Bitcoins to make a financial gain.

Are Bitcoins safe?

Just last week, a distributed denial of service (DDoS) attack on Mt. Gox caused its trading systems to run slow. Those behind the DDoS attack would wait for the price to rise, sell their coins, execute an attack which would make the servers unstable and prompt traders to sell, thus lowering the value of Bitcoins, before buying again at the lower rate once the servers and price have stabilised.

Later in April, a computer virus was found spreading via Skype, hijacking computers and forcing them to mine for Bitcoins without the user realising.

Antivirus firm Kaspersky Labs said attackers sent messages to Skype users saying, in various languages, "this my favourite picture of you". The messages included a link that was being clicked more than 2,000 times per hour at its peak and doing so would start the covert mining, returning coins to the hackers.

Media attention and curiosity by readers lead to a huge boom and bust on 10 April, when the Bitcoin value reached a record of $266 per coin, double what it was a few days earlier and ten times its value just months ago.

Hours later, the gold rush became too much for Mt. Gox's servers to bear. The trading platform became slow and unstable, panic spread among traders who desperately tried to sell, driving the price down to just $105 before recovering to around $160 the following day.

On 11 April the price once again soared from $150 to $165 in less than an hour, pointing towards another bust, unless Mt. Gox and other exchanges can boost their servers to cope with demand.

A statement from the exchange, which handles 70 percent of all Bitcoin transactions, confirmed it is doing just that and is "working around the clock" to improve stability.

But if that happens, and trading speeds remain stable, how far will the value of Bitcoin go? How high could it have gone on 10 April, had the servers remained online and traders held their nerve?

No one really knows, but a glance at Twitter shows more spectators discussing Bitcoin each day, all waiting for the answer and an almighty crash.

© Copyright IBTimes 2025. All rights reserved.