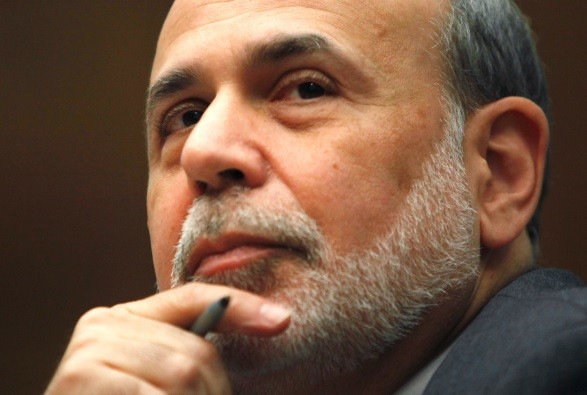

'Fed Reserve’s Ben Bernanke is the Greatest Living Expert on the Great Depression'

Religious fundamentalists are notorious for inventing authorities to support whatever argument suits them at the time but we- Economic Fundamentalists - (yes, I am one, in case you had not noticed) are a much more objective bunch, not to mention rational.

When it comes to investment, it is really quite simple: any economy able to increase GDP and employment while avoiding excessive foreign 'hot' money, credit creation and inflation will present more opportunities than one that is struggling on one or more of these fronts.

Accordingly, the first cheer is due to those of us who have argued for US equities since the start of 2012, for UK equities from last summer and for Japanese equities once the significance of the yen slide became apparent at the end of last year. It would certainly have been a mistake in 2013 to 'sell in May and go away'.

The second cheer is due to those of us who have consistently believed what the Federal Reserve's Chairman Ben Bernanke says.

It starts with accepting that he is the greatest living expert on the Great Pre-War Recession and understands why official actions and inaction went so disastrously wrong then.

Whenever he said he would prime the monetary pumps he did just that and now he is clearly intending to reduce the pace.

He has been even more explicit on interest rates set by the Fed but has not always been universally believed.

As a result, we have cautioned against buying longer-dated bonds unless held to maturity and sounded the alarm when investors, out of greed and/or fear, chased yields to unsustainably low levels in Spring/Summer last year and in April this year.

The third cheer should be withheld because most other asset classes have become subject, to an unexpected and unprecedented extent, to what can only be described as 'punting'.

It is too easy to blame it all on hedge funds, especially as many of them are reported to be desperate to generate the 20%+ returns that they need to justify themselves.

However, many conventional investors have got caught up in the excitement of emerging markets (equities, bonds and currencies), oil and gold. The huge swings in these asset classes make no sense to economic fundamentalists.

Of course, the biggest punt of them all has been on the euro.

The solid support of China and other sovereign investors has reduced the risk without eliminating it and a punt it remains, as are the sovereign bonds of many Economic and Monetary Union members and their banks.

Alastair Winter is the Chief Economist at Daniel Stewart & Co

© Copyright IBTimes 2025. All rights reserved.