Edmund Shing: Stock Markets May Be Tumbling But Do Not Join the Rush to Make a Hasty Exit

When you work in financial markets, as I do, it is easy to sense the pervading air of panic as stock markets tumble.

Newspapers and websites broadcast sensationalist headlines such as "Countdown to Panic Grips World Markets" and 24-hour news and business TV channels report on a minute-by-minute basis on the immediate loss of paper wealth that the world's investors are suffering – "£46bn lost on the FTSE 100 today".

Luckily, I have a little experience to fall back on, as I have worked in financial markets for the last 20 years now – and have the grey hairs to show for it. What this experience, and a cursory scan of financial market history, tells me is that we now seem to be heading into an overshoot mode.

Of course, there are problems...

As with pretty much all stock market sell-offs, there are good reasons for investors to be more cautious now – the Eurozone is flirting with economic recession as a result of not getting on with necessary structural reform, dragging on their economic growth prospects.

Crude oil prices have fallen over $30 per barrel from highs in June, on the back of a slowdown in demand growth coupled with a surge in current crude oil production – as you would expect, given the law of supply and demand.

But no global recession...

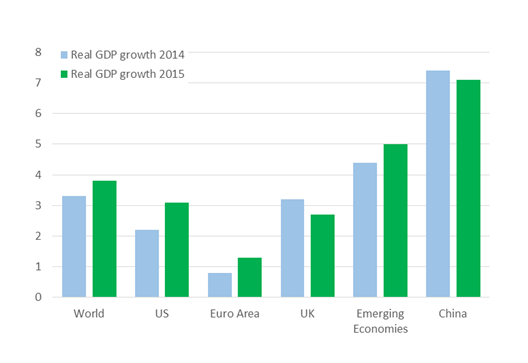

Generally speaking, stock bear markets (where stock markets fall 20% or more) tend to be triggered by economic recession. While the Eurozone may be flirting with recession right now, this is not true for the other major global economic blocs.

According to the International Monetary Fund, the US set to produce decent real growth of somewhere close to 3% next year, China still seemingly on a path to produce 7% and the UK is forecast 3.2% GDP growth this year, followed by a robust 2.7% growth rate next year (Figure 1 - The International Monetary Fund Do Not See Recession Coming, below). Hardly disastrous economic growth rates by anyone's standards.

And lower crude oil prices act like a global tax cut

An important economic fact that has been lost in this current rush for the stock market exit is the boost that lower oil prices will give to the global economy.

Remember that oil prices act like a global tax, which oil importers such as the Euro Area and Japan have to pay to oil exporters such as OPEC and Russia.

Lower oil prices mean lower costs for industry and for households, who see their purchasing power improve as motoring costs fall.

Long-term, dividends matter more than share price gains

So the global economy does not look like it is going to hell in a hand basket and lower oil prices should actually be good for most Western economies. There is a third element that someone investing for the long-term should also consider:stock market valuations look really quite decent for the long-term.

In Figure 2 - FTSE 100 Index Currently Pays a 3.7% Yield (below) I have charted the dividend yield offered by the FTSE 100 index each month since the beginning of 2000. The current dividend yield of 3.7% compares well to the long-term average yield of 3.3%; it also compares well to the 10-year UK government bond yield of only 2.0%. Indeed, if we factor in analysts' dividend forecasts for next year, the FTSE 100 dividend yield then rises to an even more attractive 4.2% going forwards.

This is important, as according to the annual Barclays Equity-Gilt Study, some two-thirds of the returns to UK stocks over the last 100 years has in fact come from the compounded effect of dividends re-invested, rather than from share price gains.

So for those of you saving for the long-term, such as for retirement, buying higher UK dividend stocks at the moment would seem to make a lot of sense, even if we cannot predict precisely when the stock market will bottom out and start to recover.

One easy way to take UK dividend stock exposure is via the iShares UK Dividend ETF (London Stock Exchange code: IUKD), which offers a 4.5% prospective yield and which invests in a diversified portfolio of higher-yielding UK stocks.

Edmund Shing is the author of The Idle Investor (Harriman House), an expert columnist and a global equity fund manager at BCS AM. He holds a PhD in Artificial Intelligence.

© Copyright IBTimes 2025. All rights reserved.