Investing in LEGO: what you might not know

Investing in LEGO is more lucrative than wine, art and gold a study suggests. So, how can you take advantage of this?

With the BRIC economies having stunned growth, Crypto markets going down and the housing markets looking set to crash let me introduce you to LEGO investing.

If you didn't know already collectable toys have been making people a lot of money for a while now. It was only last year that Logan Paul bought a Pokémon card for £3,862,424 million pounds, breaking the record for the most expensive Pokémon trading card sold at a private sale.

However, most of us don't have millions of pounds to spend on collectable toys but you don't need millions of pounds to spend on investing in Lego.

You might be asking "why LEGO?" What if I told you that LEGO holds its value better than Gold and has outperformed the FTSE 100 in returns. In a study conducted by Victoria Dobrinskaya, an associate professor at the Russian School of Economics, titled "LEGO: The Toy of Smart Investors" it explains how LEGO can be a good investment.

In the study it also says "Lego investments out perform large stocks, bonds, gold and alternative investments, yielding an average return of at least 11% in the sample period (1987-2015)."

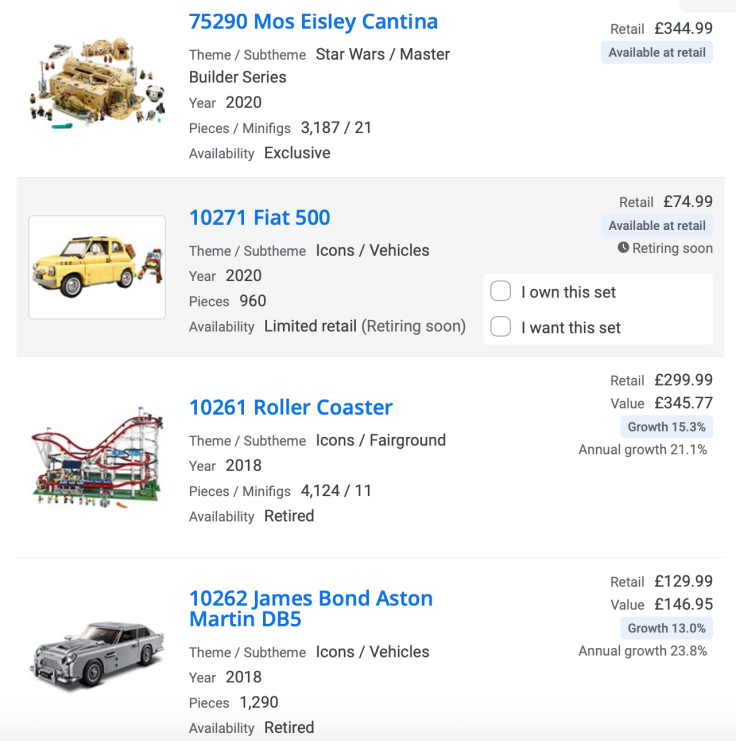

LEGO increases in value because when a set is produced they make a limited number of them over the course of 2-3 years. Then over the course of the 2-3 years when that set is being made people will build the LEGO, which decreases it's value. Some LEGO sets might be lost but some people will keep it in the box. A set has increased value if it is in the original box and sealed. In this respect it is similar to wine in that when a bottle of wine is opened it becomes less valuable.

The sets with the higher potential values tend to be the ones dedicated to films, books and historic events. The study says "eventually old, LEGO sets become rarer, collectors hunt for them, and their prices inevitably rise."

Not every LEGO set can become valuable. Brickfact is a hub of interesting information in relation to LEGO investing. On their website it says "Whether a Lego set is worth investing in can be determined on the basis of several criteria. In advance, everyone should be aware that it only makes limited sense to arbitrarily buy any set as a potential investment object. The procedure is comparable to analysing a share. Here, too, different points are considered and then an assessment is made as to whether an investment could be worthwhile."

I spoke to Justin Fitzgerald who has been investing in LEGO for seven years. He is a member of a Facebook Lego trading group. He said his "biggest profit ever was the Star Wars Cloud City set which I bought pre pandemic for £1,000, which was a lot at the time, and sold for over £2,000, a year and a half later."

He explained his strategy of LEGO investing to me. He said my "investment strategy varies between short and long term holds. I also break some newer sets into individual vehicles and mini figures depending on whether I can make a good return on them."

He also said "it can be hard work, I have to check various price sites several times a day for offer alerts, various facebook groups and web pages."

He also warned that "this is a long-term game, 12 months minimum. People get seduced into thinking it's an easy way to make a quick buck."

The study explains how the secondary market for LEGO is enormous with thousands of transactions every day. "Low exposure to standard risk factors make the LEGO toy an attractive alternative investment with a good diversification potential. Moreover, because sales of LEGO were constantly increasing in the 1990s and 2000s despite the global financial crises, we can expect 'safe-haven' properties from LEGO investments. Indeed, the LEGO secondary market delivered positive average returns in the crisis years 2002 and 2008."

The secondary markets can be found on Facebook. In these Facebook groups people come to discuss which Lego sets they think will be the next big money- making set and to seek advice on when is best to sell. A member posts: "As a 1st year investor who has just seen retirements for the first time, I'm keen for some expertise around selling. I understand that Q4 is the time to sell and have bought my picks over the last 6 months with Q4 2023 as sales time."

Another member of a LEGO investing group posted "I've been buying stock for the last two years. I work a regular job and this is in essence my deposit for a house. Considering also some reinvestment, most of my stock is sat on potential healthy returns."

So, you might be wanting some tips about getting into investing in LEGO. Justin Fitzgerald recommended that "you need some capital to start, ideally £200-£300 if you are investing in small sets and £1,000-£2,000 for large sets."

He also gave some advice on how he would invest differently to increase his profits. "Pre-Christmas retirement of that year's sets are the ones I would be buying. I would take advantage of the October half-term retailers offers and buy them in bulk. 50 small sets and 20 large sets at a discount.

"I would have only chosen three main themes to follow and researched them before investing money. I started by using a scatter bunch approach, buying things I thought would sell well, and whilst successful in some ways I got burned with a few that bombed and I only made my money back."

He also expressed how much of a logistical nightmare it can be. The cost of transporting LEGO is one that should be consider by everyone who is selling their LEGO. The cost of delivering huge sets can be astronomical given that one must package it correctly to ensure the safety of the LEGO.

It is clear that LEGO can be a good investment for some people but, like many ways of investing money, it carries risks and complications.

© Copyright IBTimes 2024. All rights reserved.