Kobo: The Ereader May Be Dying But The Ebook Will Survive

Back in December 2012, IHS issued a report proclaiming the death of the ereader:

"Current forecasts show the ebook reader market as having already reached its peak of just over 20 million units shipping in 2011, with a decline to barely 7 million in the 2015-2016 timeframe."

18 months later, another research company Forrester published a report which came to almost identical conclusions, even if it did say the decline to seven million ereaders wouldn't happen until 2017.

The figures suggest imminent doom and gloom for those few companies still challenging Amazon in the ereader market, but for the Canadian company Kobo, it has never been just about selling more ereaders:

"From an overall business model perspective this has always been about the sale of books as opposed to the sale of devices. The profitability, the margin for the company has always come from putting that next book in front of the customer," Michael Tamblyn, president and chief content officer at Kobo told IBTimes UK this week.

"From the very beginning we've created a company with the belief that people should be able to read anywhere on any device."

Upbeat

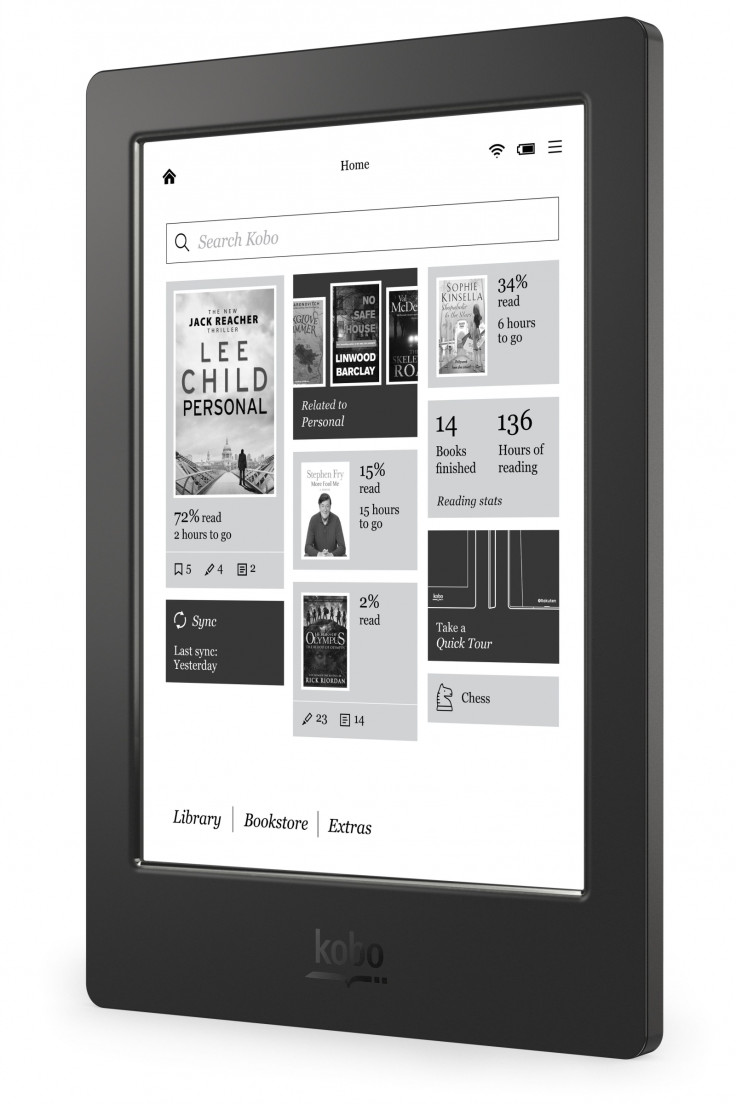

Tamblyn says that while the company continues to produce premium devices - like the Aura H20 waterproof ereader it launched this week to address demand from its more voracious readers - it also offers customer the ability to read on apps available for iOS and Android.

"[We] completely embrace the idea that people should be able to read on devices that they already own," Tamblyn says.

Despite the doom and gloom being spread about the ereader market, Kobo remains upbeat about the future of ebooks:

"We are quite happy with the way the market is developing and agree that ereading will continue to be something that is interesting for the people who read the most but at the same time we embrace those customers who really just want to have one device in their pocket all day long."

VIP customers

The company services two very distinct types of customer. One is the customer who "builds the largest libraries, is the most engaged in reading, who finishes books the fastest" and this is the type which comes from the ereader side of the business.

The other type of customer is the one who comes from using one of the companies smartphone or tablet apps, and purely in terms of numbers, there are many more of this type of customer than the ereader customer.

However, while there may be less of them, the ereader customer purchases 27% more content than app customers according to Kobo, having made the investment in a dedicated piece of hardware, and this fact makes each of these customers much more important for the company.

International phenomenon

The ereader market may be in decline, but with very few players in the market Kobo is confident its strategy of global expansion is the right one.

"I think what the last couple of years have shown is that there will really only be a few players in this market. [And] that those companies who are treating this as a global business, as a business where you have to move really quickly to establish share are the ones who are going to survive here," Tamblyn said, adding that Kobo recognised early on that ebooks were an "international phenomenon" and this has driven the company's growth.

While some of Kobo's competitors who focused solely on the US market are seeing sales stagnate or even drop, the Canadian company is now reaping the rewards with "double digit growth" across all the market it has entered.

When deciding to expand its operation beyond north America, Kobo chose its markets cleverly, going into countries where competition wasn't as fierce.

Contrarian view

In countries like France, Italy, Holland and Japan Kobo got in when the ebook market was just taking off and has established a loyal customer base.

By taking a "contrarian view" Kobo left the likes of Sony, Barnes & Noble and Amazon to fight over the "richest and only ebook market" in the US, while it "went everywhere else."

Speaking about Amazon's on-going spat with publishers, Tamblyn says that Kobo's approach is a little different:

"There is far more benefit in collaborating with publishers and going through this revolution together and that's been a very positive strategy for us."

Tamblyn adds that it is "never a good idea to penalise either consumers or authors just because you are in the middle of a renegotiation with one of your suppliers."

© Copyright IBTimes 2025. All rights reserved.