Samsung Pay partners with MasterCard ahead of European launch of Apple Pay rival

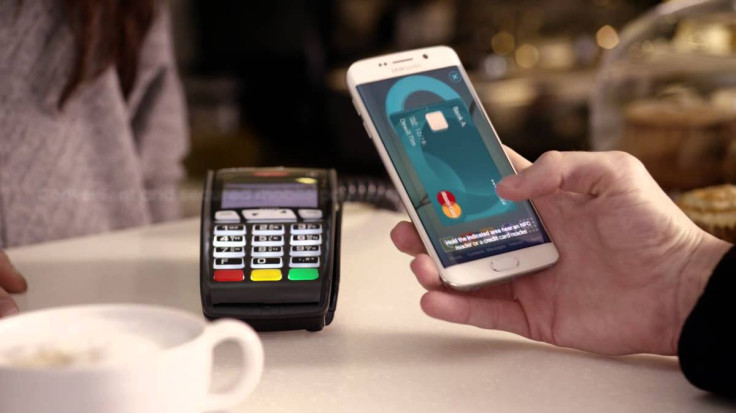

Samsung Pay, the company's imaginatively-named mobile payments system which will rival Apple Pay, has partnered with MasterCard ahead of its launch into Europe later this year. The system works just like Apple Pay, allowing users of high-end handsets to make payments by tapping their phone against a card reader at the checkout.

European card issuers will be able to connect to the MasterCard Digital Enablement Service platform and activate Samsung Pay when it launches. Cardholders can activate their credit and debit cards, as well as reloadable prepaid and small business cards from participating banks and issuers - just as they can with Apple Pay on the iPhone 6 and Apple Watch.

A key difference between the Apple and Samsung systems is that the latter will support magnetic strip technologies in older sales terminals, so retailers don't have to upgrade their hardware. This is less of an issue in the UK, where contactless card readers are becoming commonplace, but in the US, chip-&-PIN is still relatively new, while many customers still opt to swipe their card to pay for goods. Samsung says this compatibility will allow it to reach up to 30 million merchants worldwide.

In the UK, Samsung Pay will be restricted by the same £20 limit as Apple Pay, until contactless payment systems are upgraded later in the year to allow up to £30 per transaction. Customers wishing to make larger purchases will have to use their card and enter their PIN.

"Samsung Pay is pleased to join forces with MasterCard to offer a simple and safe mobile payment experience enabled for wider merchant acceptance to MasterCard cardholders and issuers in Europe," said Injong Rhee, the global head of Samsung Pay. "Both organisations are committed to groundbreaking fintech innovations that will deliver on the promise of a true mobile wallet."

Samsung Pay will launch in the US and the company's native South Korea later this summer, before arriving in Europe a few months later, once the majority of banks, card issuers and retailers are on board.

© Copyright IBTimes 2024. All rights reserved.