UK public sector borrowing falls marginally in August

ONS data shows borrowing fell by £0.9bn to £10.5bn but remained above analysts' expectations.

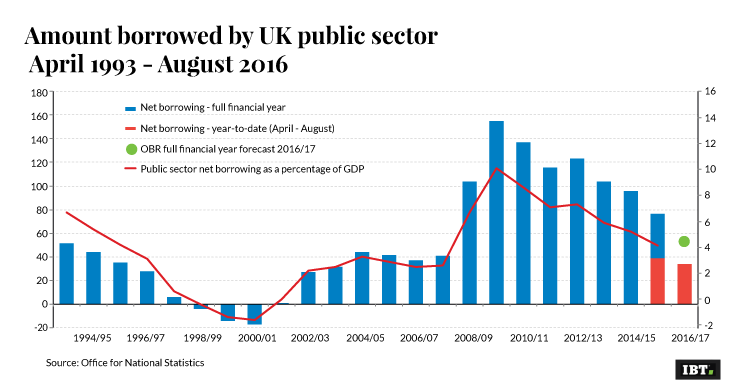

Britain's public sector borrowing fell last month but remained higher than analysts expected, according to figures released on Wednesday (21 September) by the Office for National Statistics (ONS). The data showed public sector net borrowing, excluding public sector banks, decreased by £0.9bn ($1.17bn) to £10.5 billion in August 2016 from the corresponding period in 2015, but remained marginally above the £10.2bn figure analysts had forecast.

In the financial year-to-date, public sector net borrowing, excluding public sector lenders, fell by £4.9bn to £33.8bn from the corresponding five-month period 12 months ago.

Over the same period, central government net cash requirement fell from £26.5bn last year to £19.4bn.

Meanwhile, public sector net debt, again not accounting for public sector banks, at the end of August stood at £1.62trn, equivalent to 83.6% of gross domestic product, an increase of £52bn compared with August last year.

The ONS added that, due to the volatility of the monthly data, the cumulative financial year-to-date borrowing figures provide a better indication of the progress of the public finances than the individual months.

The Office for Budget Responsibility estimated the public sector would borrow £72.2bn during the financial year ending in March 2016, meaning that, based on the latest figures, borrowing in the period is expected to be £4.3bn higher.

However, the estimates for the financial year ending March 2016 may still be subject to further revision as elements of provisional data are replaced with finalised and audited data.

© Copyright IBTimes 2024. All rights reserved.