US Federal Debt to Reach 106% of GDP in 25 Years on Growing Budget Deficits

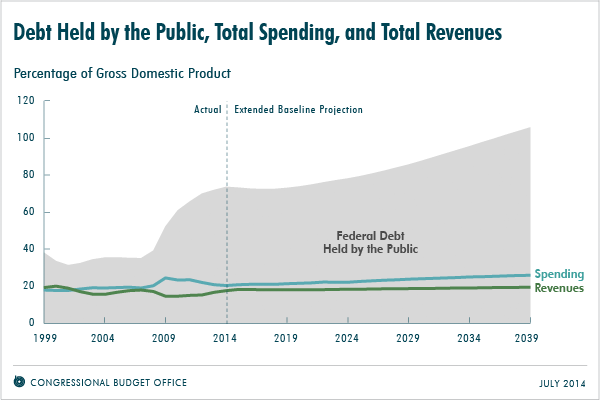

The US Congressional Budget Office (CBO) has warned that the country's public debt would rise to 106% of gross domestic product (GDP) by 2039 due to growing budget deficits.

The CBO noted that total amount of federal debt held by the public is now equivalent to about 74% of GDP at more than $17tn (£9.9tn, €12.5tn - the highest level in the US history except a short period around World War II and almost twice the level seen at the end of 2008, when the country faced a financial crisis.

The debt level would decline slightly over the next few years if current laws remain unchanged, according to the CBO.

"However, growing budget deficits would push debt back to and above its current high level. Twenty-five years from now, in 2039, federal debt held by the public would exceed 100 percent of GDP," the office said in a report.

"Moreover, debt would be on an upward path relative to the size of the economy, a trend that could not be sustained indefinitely."

The CBO noted that the country's aging population, rising health care costs, and an expansion of federal subsidies for health insurance would increase government spending. In addition, an expected rebound in interest rates from the current unusually low levels would increase government's interest payments.

These additional spending would result in larger budget deficits, rising to about $7.6tn during the 2015-2024 period. Due to the big deficits, public debt would be as high as 78% of GDP by the end of 2024.

Federal spending would increase to 26% of GDP by 2039, leading to a federal debt level seen just once in US history - just after World War II, the CBO projects.

Meanwhile, federal revenues would increase at a slower pace, equalling 19.5% of GDP by 2039, compared to 16.5% of GDP last year.

By 2039, the deficit would equal 6.5% of GDP, larger than in any year between 1947 and 2008, and federal debt held by the public would reach 106% of GDP, more than in any year except 1946 - even without factoring in the economic effects of growing debt," the CBO said.

"Beyond the next 25 years, the pressures caused by rising budget deficits and debt would become even greater unless laws governing taxes and spending were changed."

The CBO urged the government to make substantial changes to major health care programmes and Social Security to avoid the difficult situation.

"To put the federal budget on a sustainable path for the long term, lawmakers would have to make significant changes to tax and spending policies: reducing spending for large benefit programs below the projected levels, letting revenues rise more than they would under current law, or adopting some combination of those approaches," it added.

© Copyright IBTimes 2025. All rights reserved.