Asian stock markets mixed following flat to lower close on Wall Street overnight

US indices were subdued following strong gains on Wednesday amid the US Fed's rate increase decision.

Asian stock markets were trading mixed on Friday (17 March) with the Shanghai Composite down 0.54% at 3,251.15 as of 6.14 am GMT following a flat to lower close on Wall Street overnight.

On Thursday, Wall Street was quite muted following strong gains on Wednesday amid the US Fed's rate increase decision. Nasdaq was flat, while Dow Jones and the S&P 500 closed lower.

Chris Weston, chief market strategist at IG, was cited by CNBC as saying: "The story in global markets over the past 24 hours has centred on a broad-based tightening of monetary policy conditions (and the perception of future tightening), while the cost to borrow from certain financial institutions has also increased."

The subdued trend on Wall Street overnight was also attributed to losses in healthcare stocks as US President Donald Trump's budget blueprint proposes to cut the National Institutes of Health's spending by $5.8bn (£4.69bn).

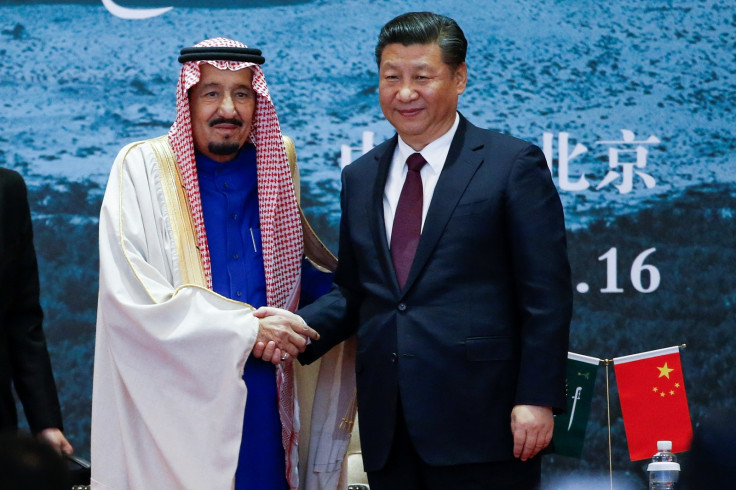

Meanwhile, China and Saudi Arabia's King Salman signed deals worth about $65m on Thursday. These included an MoU between Saudi Aramco and China North Industrial Group to build more plants in China. This, however, did not seem to have any positive effect on equities in the region.

Indices in the region were trading as follows at 6.27am GMT:

| Country | Index | Price | Up/Down | %Change |

| Hong Kong | Hang Seng Index | 24,297.51 | Up | 0.04% |

| Japan | Nikkei 225 | 19,521.59 | Down | 0.35% |

| South Korea | KOSPI | 2,162.97 | Up | 0.60% |

| India | BSE | 29,669.68 | Up | 0.28% |

| Australia | S&P/ASX 200 | 5,799.60 | Up | 0.24% |

On 16 March, the FTSE 100 closed 0.64% higher at 7,415.95 while the S&P 500 index closed 0.16% lower at 2,381.38.

Among commodities, oil prices gained amid a weaker US dollar. As of 2.19am EST, WTI crude oil was up 0.16% at $48.83 a barrel, while Brent crude was trading 0.06% higher at $51.77 a barrel.

© Copyright IBTimes 2024. All rights reserved.