Best of 2012: Business Quotes of the Year

1. "Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough." - Mario Draghi, 26 July

Easily the most influential quote of the financial year and, oddly, perhaps one of the most reluctant. Draghi's seemingly unguarded assertion during an investment conference in London set off the most significant rally in European financial markets since the credit crisis erupted five years ago. The pledge, which took several weeks to clarify and has to date failed to lead to the purchase of a single security, has nonetheless marked a definitive turning point in the region's sovereign debt crisis. The breathing space offered to Spain and Italy allowed leaders to concentrate on a viable rescue for Greece and longer-term solutions for banking supervision and fiscal consolidation.

2. "They are a tempest in a teapot as the revenues are not that big. Every company has an investment portfolio and it is our job to manage that wisely to hedge our exposures. We are a large company so the transactions will be complex and sophisticated." Jamie Dimon,13 April

Jamie Dimon's flippant reply to repeated concerns over the tactics of his colleague Bruno Iksil - the now-infamous "London Whale" - came only weeks before the bank was forced to admit "poorly monitored" credit default swap trades from its overseas "Chief Investment Office" that eventually ended up costing the bank more than $6bn, ended the careers of Iksil and his New York boss Ina Drew and raised, yet again, searching questions about the nature of ethics, leadership and oversight inside the world's biggest financial institutions.

3. "Mr Zuckerberg ... will have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of our directors, as well as the overall management and direction of our company." Facebook's "S-1" filing with the SEC, 23 April 2012

While it's hard to pinpoint any one of the myriad reasons for the spectacular collapse of the year's - indeed, the decade's - most hyped IPO, this innocuous snippet from Facebook's legal team is as good a place as any to begin. While an undoubted savant with respect to social media, Zuckerberg's prowess as a leader of publicly listed enterprises is rather suspect. Investors, already spooked at the frothy pre-IPO price tag that valued Facebook in the region of $100bn, used the "droigt du seigneur" declaration to promptly dump the stock in the opening, embarrassing moments of trading last spring. When the dust had settled (and the employee lock-up expired) Facebook went from $38 a share to just under $18 in early August.

4. "It is with great stress that I write this mail. First of all the ETF trades that you see on the ledger are not trades that I have done with a counterparty as I previously described." Kewku Adoboli, email published in September

Basically the "Houston, we have a problem" revelation that exposed a $2.3bn loss and eventually led to the seven-year prison sentence Adoboli is serving for his role in the biggest "rogue trader" scandal in British history. The staggering loss - and the simplistic way in which it was conceived and orchestrated - hastened the departure of former CEO Oswald Gruebel and stacked yet another major embarrassment on to the litany of headline failures suffered by Switzerland's biggest bank.

5. "The US, in fact, is a serial offender, an addict whose habit extends beyond weed or cocaine and who frequently pleasures itself with budgetary crystal meth. Uncle Sam's habit, say these respected agencies, will be a hard (and dangerous) one to break." Bill Gross, 1 October 2012

Co-founder of the world's biggest bond fund and monthly author of one of the few "must reads" in global finance, PIMCO's Bill Gross penned this monstering of the US political system in October as the world began to face up to risks associated with the impending - and still to be resolved - "fiscal cliff". Gross's larger point - that the West's addiction to debt will stifle global economic growth for decades to come - has so far gone unheeded but has nonetheless established the framework for what appears to be next year's most important financial market debate: are government bonds the next bubble?

6. "The point of my meeting was to say 'you really need to understand the depths of the concerns that the regulators have about the executive management, and I want you to go away and reflect on that'." Sir Mervyn King, 16 July 2012

Not exactly the "arched eyebrow" the BBC's Robert Peston ridiculously insisted was the method by which the Bank of England governor encouraged the dispatching of former Barclays CEO Bob Diamond at the peak of the Libor scandal, but effective nonetheless. Diamond, his chairman Marcus Agius and his close colleague Jerry Del Misser all fell on their swords following the humiliating admission - coupled with a $450m fine - that the bank had been conspiring to manipulate the key interbank lending rate for many years.

King's testimony to UK lawmakers regarding his role in the scandal - and that of his deputy, Paul Tucker - also caused some embarrassment on Threadneedle Street by revealing a dangerously blasé attitude towards Libor manipulation and the bank's responsibility in policing it. Tucker's "see no evil" replies to the same Treasury Select Committee likely ruined his chances to succeed King as governor.

7. "The committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labour market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. " Ben Bernanke, 13 September 2012

The preamble to the Fed's decision to launch its third programme of so-called quantitative easing in September was both a blessing and a warning to the global financial markets. The benefits of the $85bn (£52bn, €65bn) monthly intervention are easy to calculate, but the deeper concern lies in the fact that the sharpest minds in global economics are convinced that, without trillions in Fed-controlled life support, the world's biggest economy would likely sink back into recession. What the effective money-printing will do the long-term health of the markets is another question that, to date, has no consensual reply. Despite that void, the Fed's "accommodative" policy is likely to keep interest rates at near zero until at least 2015 and bond markets healthy with weekly purchases of various paper for its multi-trillion balance sheet.

8. "The board is reviewing the issue and I will provide whatever they need from me. In the meantime, I want you to know how deeply I regret how this issue has affected the company and all of you" - Scott Thompson, former Yahoo CEO, 7 May 2012

Only months into his new role as CEO of Yahoo - the web portal's third in as many years - Scott Thompson was forced to step down after discrepancies in his professional CV were made public by "activist" investor Daniel Loeb of Third Point LLC. Thompson, a former eBay executive, was said to have earned a degree in computer science at Stonehill College in Yahoo filings to the SEC in April. However, similar filings by eBay list only a degree in accounting and business administration. Third Point, which owned around 5.8 percent of Yahoo shares at the time, led the calls to sack Thompson and eventually won three seats on the board -along with around $122m in the week following Thompson's resignation - for its efforts. Thompson is now CEO of ShopRunner Inc.

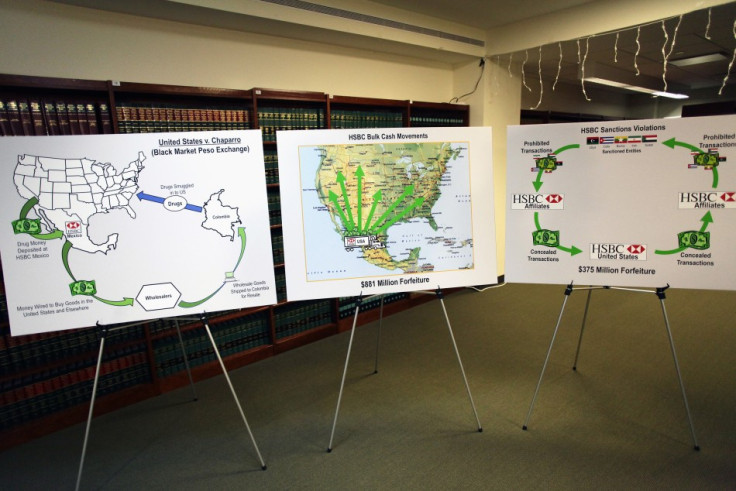

9. "The culture at HSBC was pervasively polluted for a long time. Banks that ignore anti-money-laundering rules are a big problem for our country." - US Senator Carl Levin, 16 July 2012

Mexican drug cartels, sanctions-dodging banks in Iran, Sudanese warlords, and hundreds of billions in secret cash transactions. The damning indictment of HSBC's "egregious breakdowns in anti-money laundering compliance", according to the US Treasury Department, read like the script of a Hollywood thriller. Sadly, the multiple violations of US banking secrecy laws were all too real and HSBC found itself on the wrong end of a $1.9bn fine and a tattered global reputation. Its ability to avoid criminal prosecution for the well-documented misdeeds, however, has been perhaps the most significant catalyst in the current "too big to jail" debate that raises troubling questions about the power and influence of world's biggest financial institutions.

10. "The committee awarded annual incentive compensation, in addition to salary, to Mr Pandit for the first time in four years in a manner commensurate with his responsibilities and the success of his implementation of Citi's long term strategies." Citigroup SEC filing, 8 March 2012

Few of us get to enjoy pay rises of the kind of magnitude awarded to former Citigroup CEO Vikram Pandit, who went from a nominal salary of $1 in 2010 to full compensation of around £14.9m the following year. Oddly enough, Citigroup shareholders - who saw their holdings fall 44 percent that same year - were less than thrilled at the prospect of rubber-stamping Pandit's inflation-busting 1,489,999,900 percent rise. Their displeasure sparked a series of revolts over executive pay dubbed the "Shareholder Spring" that eventually claimed the career of Avia CEO Andrew Moss and scuppered pay deals for WPP's Sir Martin Sorrell and Cairn Energy chairman Sir Bill Gammell.

Follow the links below to read the IBTimes UK picks of the year, in:-

© Copyright IBTimes 2024. All rights reserved.