Charts in Focus: European Union in Bank Branch Cull

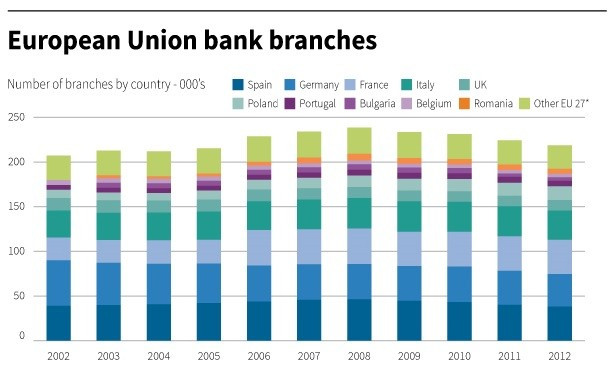

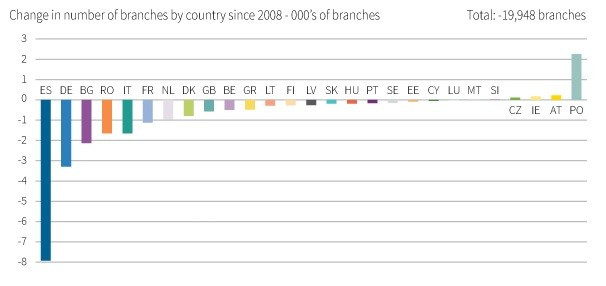

European Central Bank (ECB) statistics have revealed that banks axed 5,500 branches in 2012 in a bid to cut costs and shore up cash to tackle the sovereign debt crisis and adhere to strict capital requirements.

Naturally, the countries that were worst hit by the sovereign debt crisis culled the most physical outlets [Figure 1].

However, there were a number of bright spots, where some countries in eastern Europe actually increased the number of physical bank branches [Figure 2].

© Copyright IBTimes 2025. All rights reserved.

Request a Correction