Gold vs silver: What's in store for 2017?

Most surges in sentiment towards precious metals tends to see the Gold/Silver Ratio peak.

The first thing to say about almost every outlook article for the new year, which has discussed precious metals in recent years, is to note that from 2012 onwards each year was supposed to be the one to take us out of the dreaded bear market which had struck from 2011.

To make matters worse, many mining stocks had been falling hard for over a year – as long ago as the second half of 2009, before the underlying metals peaked. The great mining meltdown was so severe and so unexpected that for instance, even the most smart mining giants and of course their management, were left flailing.

They took too long to react in terms of cost cutting and consolidating their portfolios. By the time they did even the best such as BHP Billiton (LON:BLT) were left red-faced at best, and taken to the brink like Glencore (LON:GLEN) or Lonmin (LON:LMI) at worst.

The question that one might ask is whether there was any way of predicting the state of the metals market, from the price action of the leading contenders?

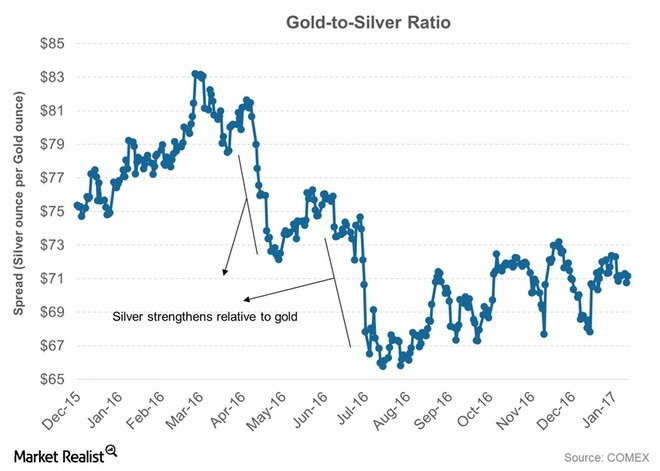

Of course, top of the list as far as the notional investigation is one of the most influential indicators in the sector – the Gold/Silver Ratio.

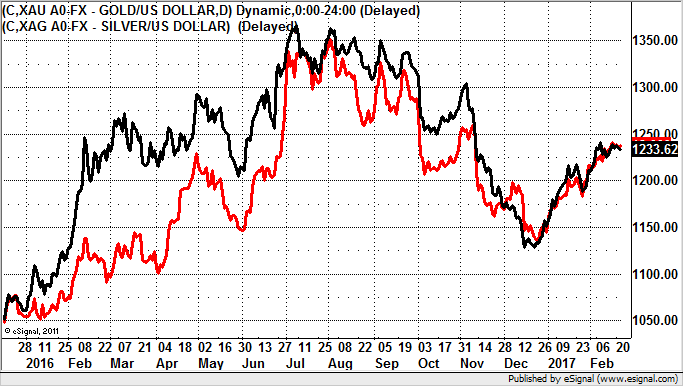

Interestingly, the normal rule of thumb here is that most surges in sentiment towards precious metals tends to see the Gold/Silver Ratio peak, with this illustrated all too well with the peak we saw almost this time last year when there was finally the great turnaround for mining stocks – after nearly five years in the wilderness.

Since then we have seen a drift in the ratio, from extreme levels over $80. This implies that investors have gold as their first port of call both on the way into mining cycle. After this there is a trickle down to other precious metals.

The view now is that the ratio will revert towards the mean over the rest of 2017. For instance, this would echo what we saw some years ago when there was a noticeable flight to safety towards precious metals in late 2008 after the fall of Lehman Brothers.

Since then we have seen what could be described as a phoney war in the mining sector, accentuated by the artificial state and attitudes towards metals in the first half of this decade.

What we can now appreciate is that courtesy of central bankers and their zero interest and quantitative easing policy we suffered a period of deflationary pressure. This was a standout in at least two respects.

The first was that the conventional wisdom in the wake of the Global Financial Crisis of 2008–09 was that low interest rates would be inflationary, and hence the inflation hedge of precious metals and associated mining stocks would thrive. The opposite proved to be the case – until the beginning of last year.

It may be argued that by the beginning of 2016 the mining sector was so bombed out, and negative yields on bonds had taken the whole monetary policy equation to a ridiculous place. Indeed, even before the Trump Bump and his promise of massive infrastructure spending and tax cuts, rising commodities prices were starting to come through.

Therefore, from where we are now it would appear that even the dove supreme, Janet Yellen, chair of the Federal Reserve will sanction a series of US interest rate hikes from as early as next month. Of course, we have been here before, and there is nothing to prevent a series of rate hikes and equally swift cuts again, but the stage appears set.

For the Gold/Silver Ratio the conclusion is that after the great peak to announce the start of precious metals and mining stocks being back in favour we should see the drift in the ratio – as the perennially less popular silver rebalances, with the ratio heading back to the historic mean towards 60.

Patrick Tsang, chairman of Hong Kong focused Tsangs & Co, explains some of the attitude amongst investors in his part of the world – traditionally where some of the largest physical gold buying takes place: "As stock prices and property prices continue to surge, Chinese speculators are hedging to commodities such as gold. Historically and culturally, the Chinese love gold which is regarded as a 'lucky' asset."

Fans of mining stocks will be hoping that their recent good fortune is similarly maintained for the rest of 2017.

Zak Mir has been involved with most areas of the City of London finance space for the best part of 30 years, as a stockbroker and derivatives dealer in the 1990s and then a financial analyst and commentator since 2000 appearing on Bloomberg, CNBC and the BBC. He is currently involved with expanding internet TV and production group TipTV. Follow Zak on Twitter.

© Copyright IBTimes 2025. All rights reserved.