Greek referendum: Five things you need to know about the 5 July bailout deal vote

Greek Prime Minister Alexis Tsipras has called for a referendum on 5 July to ask the nation if the government should accept a cash-for-reforms bailout deal put forward by the country's creditors.

Despite the Greek government's claims that the referendum is not a vote on the country's Eurozone membership, the rest of Europe sees it as just that.

We look at the various scenarios, how they might play out and what affect they could have.

No vote

This is what Alexis Tsipras' Syriza government is plumping for, but experts believe the result of a 'no' vote could be catastrophic for the economy as it would mean that the cash-for-reforms deal that would give the Greeks access to the final €7bn tranche of a €240bn bailout fund would be much further away.

A 'no' vote would send shock waves to markets outside Greece.

In turn, this would likely result in Greece defaulting on loans due on 20 July to the European Central Bank (ECB), which is currently propping up Greece's banking system.

"The risk of the ECB cutting liquidity to Greek banks will also increase," said Diego Iscaro, senior economist at IHS Global.

"Should the ECB stop providing liquidity, the Greek banking sector would collapse and the government might not have many options other than to start issuing a currency parallel to the euro. From there, a Eurozone exit would be extremely difficult to avoid.

"A 'no' vote would also send shock waves to markets outside Greece, in particular in vulnerable countries such as Portugal, Spain, and Italy."

Tsipras has said that a 'no' vote would strengthen his position at the negotiating table with the troika – the European Commission, the ECB and the International Monetary Fund (IMF) – and get a better deal.

But experts believe this is unlikely.

"He thinks that a 'no' vote will enable him to come back stronger to the negotiating table. However, this has been clearly ruled out by creditors," said Hari Tsoukas, professor at Warwick Business School.

Yes vote

This is what the markets and the European Union are plumping for. It would mean the Greek people not only accept the bailout conditions put forward by the troika, but it would almost inevitably mean the end of Tsipras' government.

Although the troika's proposal officially expired on 30 June, when Greece failed to make a €1.6bn payment to the IMF, there is a consensus that negotiations with whoever is in power could at least reopen.

However, even if there were a 'yes' vote, it wouldn't be plain sailing.

"There would still be significant uncertainty in place. Tsipras has strongly hinted that he could call a general election in the event of a 'yes' vote," Iscaro said.

"Given the urgency of the situation, it is likely that a national unity government would take temporary power in this scenario, although it is not certain whether the creditors would want to negotiate with Greece without knowing who would be in charge to implement the measures agreed in any potential deal."

Both Tsipras and his finance minister Yanis Varoufakis have said they would resign on a 'yes' vote.

Greek citizens faced with a tricky question

Tsipras has come under fire for calling the referendum in the first place and then for bamboozling voters with an overly complicated question.

As it stands, the question Greeks will be asked on Sunday is:

The Greek people are asked [to decide] with their vote whether to accept the outline of the agreement submitted by the European Commission, the ECB and the IMF [at] the Eurogroup of 25 June 2015 and consisting of two documents, which form the basis upon the referendum question [that] will be asked: the first document is entitled "Reforms for the completion of the Current Program and Beyond" and the second document is titled "Preliminary debt sustainability analysis."

Whichever citizen rejects the institutions' proposals votes NO.

Whichever citizen accepts the institutions' proposals votes YES.

Which way will it go?

The latest opinion polls suggest that the 'yes' camp is ahead, albeit marginally.

A poll by the ALCO polling institute, published on 3 June in Greek newspaper Ethnos, suggests that 44.8% of Greeks think the government should agree to the bailout terms put forward by troika creditors, with 43.4% in the 'no' camp. While 11.8% don't not know.

Experts at Rabobank are anticipating a 'yes' vote.

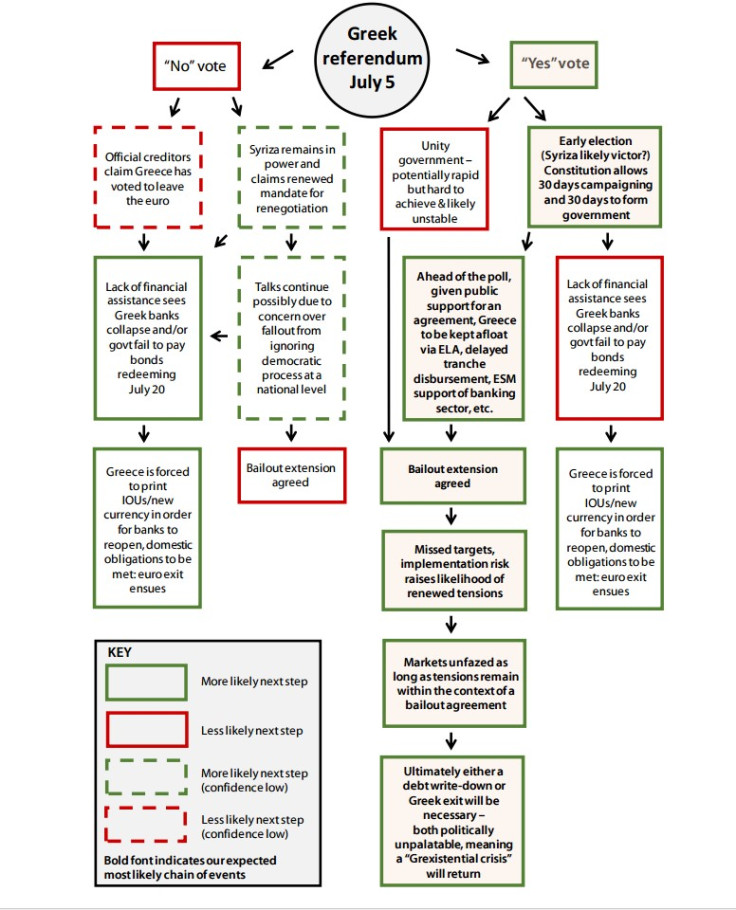

Complex scenarios of the referendum outcome

The same experts have put together a useful flow chart detailing exactly what could happen depending on the result:

© Copyright IBTimes 2024. All rights reserved.