Tesla Drivers Get 50% Insurance Cut — Insurers Are Quietly Deciding You Are the Risk

Digital insurer Lemonade bets that autonomous driving is safer than manual driving

When an insurance company commits real money to a technology's safety, it cuts through the noise. That was evident on Wednesday when New York-based digital insurer Lemonade announced it would slash per-mile rates by approximately 50% for Tesla drivers using Full Self-Driving (FSD).

The product, dubbed Lemonade Autonomous Car Insurance, is the first policy designed specifically for self-driving vehicles, according to a company press release. It will launch in Arizona on 26 January before expanding to Oregon the following month.

'A car that sees 360 degrees, never gets drowsy, and reacts in milliseconds can't be compared to a human,' said Shai Wininger, Lemonade co-founder and president, in the company's official announcement.

How the Discount Works

The rate cut applies specifically to miles driven with FSD engaged, not the total policy costs. Lemonade operates a pay-per-mile model, charging a variable per-mile fee on top of a base rate. The 50% reduction targets the variable component.

This discount far exceeds what Tesla offers through its own insurance arm. Tesla Insurance currently provides up to 10% off certain coverages for drivers who use FSD for more than half their miles, according to Tesla's support documentation. Lemonade's offer is five times more generous.

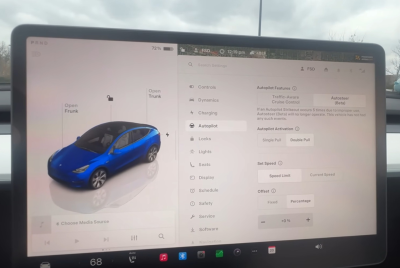

The collaboration between the two companies allows Lemonade access to vehicle telemetry data that traditional insurers cannot obtain. This enables the company to distinguish between human-driven and FSD-driven miles, while also considering the specific software version and sensor accuracy installed in each vehicle.

'By connecting to the Tesla onboard computer, our models are able to ingest incredibly nuanced sensor data that lets us price our insurance with higher precision than ever before,' Wininger stated.

What Does This Mean for Your Premium?

Lemonade's policies can cover households with a mix of Teslas and standard vehicles from other manufacturers. Customers can also unlock additional discounts for safe driving, as well as savings for bundling with homeowners, renters, and pet insurance.

The insurer has committed to further rate reductions as Tesla releases FSD software updates expected to improve safety performance. 'Beyond the product announcement today, we're also announcing our commitment to the Tesla community — the safer FSD software becomes, the more our prices will drop,' Wininger added.

Currently, Tesla's FSD costs $8,000 (£5,958) as a one-off payment or $99 (£73.74) monthly via subscription. Tesla plans to phase out the perpetual licence on 14 February, moving entirely to a subscription model, according to recent reports.

The Safety Debate Remains Unsettled

Lemonade's announcement comes amid ongoing regulatory scrutiny of FSD. The National Highway Traffic Safety Administration (NHTSA) opened an investigation in October 2025 into approximately 2.88 million Tesla vehicles after reports of traffic safety violations, according to NHTSA filings.

The investigation focuses on incidents where vehicles operating with FSD engaged allegedly ran red lights, initiated lane changes into opposing traffic, or committed other violations. NHTSA has identified at least 80 such cases, according to a December 2025 TechCrunch report.

Wininger acknowledged these concerns in comments to Reuters. 'These things are not fully autonomous yet and they require a certain intervention level, a skill level from the driver,' he said. 'So 50% off, based on the data that we have, is what we believe the improvement is of you as a driver using this technology, but not that technology driving by itself.'

Industry Implications

This move signals a potential shift in how insurers approach autonomous technology. Traditional insurers price Teslas like any other car, regardless of software capabilities. Lemonade's willingness to differentiate based on real-time driving data could pressure competitors to develop similar products.

'Is this not insanely bearish for car insurance companies?' asked one social media user in response to the announcement. 'They won't be able to monetise car insurance, assuming progress happens on self-driving.'

Another commenter, Bryant McGill, offered a different take: 'Actuaries price based on predictive power and loss data, not ideology or opinion. This is probably the most decisive and irrefutable statement to date regarding the safety issue.'

For now, the product remains limited to two US states. Whether the data supports Lemonade's confidence will become clearer as claims are filed. What is certain is that an insurer has placed a significant financial stake on the premise that allowing software to drive is safer than doing it yourself.

© Copyright IBTimes 2025. All rights reserved.