Markets react to President Trump as it happened: 'Buckle up for a bumpy ride'

Dollar and global markets expected to plunge as Donald Trump wins race to the White House.

Good morning and welcome to the IBTimes UK coverage of what will be a momentous day for global markets, as Donald Trump edges closer to being the next US President. Stock markets are expected to tumble as the shockwaves from the US election spreads across the world.

Here are the key points so far.

- Trump clinches crucial swing states and edges towards White House.

- Volatility hits stock markets across the world.

- Japan's main index sheds 5% as fears spread among investors.

- Dollar and Mexican peso sink after election.

- Gold records biggest rally since Brexit.

That concludes our live business coverage for now. We'll have more in-depth coverage of the markets reaction throughout the day and you can find all the latest developments on a momentous night here.

European markets continue to recover ground following the selloff at the opening bell, as investors across the Continent have been reassured by the tone of Donald Trump's acceptance speech.

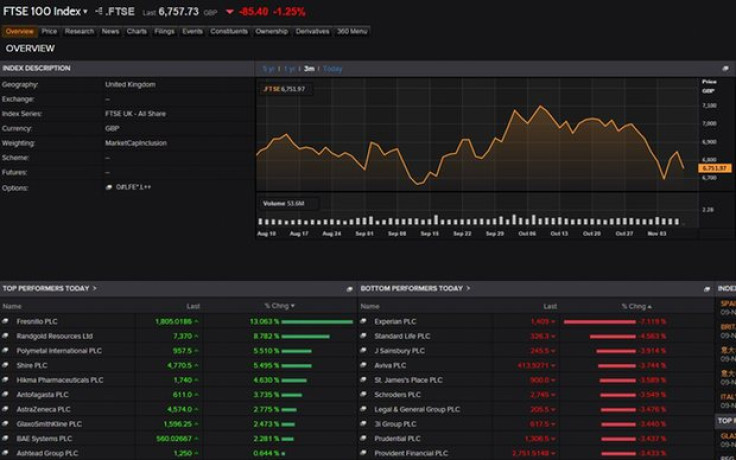

#FTSE100 flirts with a breakeven recovery. Brexit: Part deux

— Mike van Dulken (@Accendo_Mike) November 9, 2016

European markets continue to regain ground after sharp losses at the open. The FTSE 100 is almost flat, while Dax and CAC are down just 0.8%

— Sally Bundock (@SallyBundockBBC) November 9, 2016

However, US investors in particular, will want clues over the timing of the next interest rates hike from the Federal Reserve.

"The markets will need to receive more information from Donald trump on this," said Naeem Aslam, chief market analyst at Think Markets UK.

"At best, Janet Yellen can stay at her current position when her term will expire in 2018 or at worst, she will leave the office in the coming days.

"Traders will be looking for an answer from Trump on this agenda and if he is going to fire her, who will be the next person to replace her? Therefore, we consider that the Fed may not have enough time to increase the interest rate this year given the new tasks they have."

IBTimes UK – 'Buckle up for a bumpy ride' – Global markets tumble as Donald Trump wins US presidential election

Donald Trump win is set to usher in a new era of protectionist trade and enormous volatility can be expected in the markets.

Despite the fallout from the US elections, there is no respite for the pound. Having rallied against the dollar as it became clear Donald Trump would win the race, the UK currency has since relinquished its gains and is now trading only 0.35% higher against the greenback at $1.2414.

Analysts have suggested Trump's appeasing tone in his acceptance speech has definitely helped.

"It wasn't quite the reaction we were expecting, although European equity markets are all taking a hit early in trading," said Alex Edwards, currency analyst at UKForex.

"Investors and traders are still trying to get their heads around the official result, and there's a lot of trepidation out there. Spreads are wide and we still expect to see some big moves in the currency markets as the day goes on."

Shares in the UK and Germany have steadied since the initial decline, but stocks across Europe have recorded the sharpest drop since Britain's European Union referendum on 23 June.

"At the moment the losses [in Europe] aren't quite as big as there were in Asia overnight," said Spreadex analyst Connor Campbell.

"The FTSE is down just shy of 2%, with the DAX and CAC falling 2.8% and 2.5% respectively. Yet there is surely more to come, especially with a US open that could see well see the Dow Jones post its biggest ever single session slump.

Europe's shares fall by most since aftermath of Brexit vote following #Trump's win https://t.co/vrbc81o0qR pic.twitter.com/MCry6DyrHG

— Bloomberg (@business) November 9, 2016

Volatility is bound to widespread across financial markets today. Germany's DAX tumbled after the opening bell but has since recouped some of its losses and is now down by approximately 1.7%.

#Germany's Dax trims losses after first Trump shock. Now down only 1.7%. pic.twitter.com/9EIWfT34Vq

— Holger Zschaepitz (@Schuldensuehner) November 9, 2016

Oil markets, meanwhile, are enduring a tough day at the office. The West Texas Intermediate (WTI) front month futures contract was down 1.26% to $44.42 per barrel, while Brent was 1.12% lower at $45.53 per barrel.

Trump victory sends oil lower. pic.twitter.com/Qc5PbjcJhb

— Holger Zschaepitz (@Schuldensuehner) November 9, 2016

As they did with Brexit, pollsters and analysts across the world have got their forecast spectacularly wrong, said FXTM chief market strategist Hussein Sayed.

"Once again polls failed to provide a clear indication and investors were almost sure that there's no way for Trump to the White house, but he made it," he said.

"Going forward investors will no more base their decisions on polls, they would rather protect their investments through insurance policies such as protective options."

However, it is worth remembering that someone had seen this coming 16 years ago. In an episode from the Simpsons aired in 2000, Lisa is pictured sitting in the Oval Office surrounded by advisers.

"We've inherited quite a budget crunch from President Trump," she says.

A sign of things to come?

Donald Trump struck a conciliatory tone in his acceptance speech, speaking of Americans of all races and religions and building consensus in a divided country.

"It is time for us to come together as one united people. I pledge that I will be president for all of America and this is so important to me," he said.

He also pledged to double growth and get along with all other nations "willing to get along with us."

"We must reclaim our country's destiny," he said.

Trump's tone seemed to have reassured investors for the time being.

Across Europe, stocks have fallen but, at least for now, by less than expected. France's CAC 40 is down 3%, while Spain's IBEX Madrid has lost 3.8%. Over in Asia, however, markets ended firmly in the red. The Nikkei Stock Average fell 5.36%, while Australia's S&P/ASX 200 was down 1.9%, and Korea's Kospi lost 2.25. Meanwhile, the Shanghai Composite Index shed 0.62% and the Hang Seng Index in Hong Kong retreated 2.15.%.

One of the most immediate consequences of Donald Trump's victory is that the Federal Reserve will, in all likelihood, not rise interest rates next month. Economists expected the US central bank to hike interest rates in December, but the turmoil rattling the markets is likely to put that option off the table.

"The Federal Reserve is certain to tread extremely warily if market turbulence persists," said Tom Stevenson, investment director for Personal Investing at Fidelity International.

"While investors will inevitably find it hard to keep their eyes on their long-term financial goals as markets react it is essential for them to do so."

Kathleen Brooks, research director at City Index, explained market expectations for a rate hike next month fell dramatically as became evident Trump would secure the race to the White House.

"Market expectations for a rate hike from the Fed have tumbled to 50%, earlier on Tuesday expectations were more than 80%," she said.

"The Fed is unlikely to hike interest rates if we see a sharp and prolonged decline in the stock markets, on the back of Trump's win."

Paul Ashworth, chief US economist at Capital Economics, expects Trump's administration to bring momentous changes to the US central bank.

"There is a possibility that Fed Chair Janet Yellen and even some other Fed Governors will resign immediately," he said.

"Although Trump can't sack Yellen before her term ends in February 2018, his win demonstrates that many Americans share his view that she has been overtly political. Under those circumstances, she may feel duty-bound to step aside."

For the latest political developments, you can follow our coverage of the US elections here.

Tom Stevenson, investment director for Personal Investing at Fidelity International, has urged investors to keep their head, despite the market turmoil that is likely to follow Donald Trump's victory.

"The initial market reaction is certain to be messy and in the short-term risk-assets like shares, energy and industrial commodities will be hit hardest while investors seek shelter where they can find it in government bonds and precious metals," he said.

"At times like these, a balanced portfolio will provide some protection but it is unlikely to prevent some painful losses in the short term."

Here's the map with Donald Trump's 276 Electoral College votes https://t.co/raG0r7TGId #Elections2016 pic.twitter.com/biNgbgrDuP

— Bloomberg (@business) November 9, 2016

Paul Ashworth, chief US Economist at Capital Economics has warned Donald Trump's win will bring a radical change to the US policy with Mexico and China. The Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership [between the US and the EU] are 'dead', Ashworth said.

"On trade, we expect Trump to start by labelling China a currency manipulator and to bring a number of perceived disputes to the WTO," he added.

"Tariffs are possible further down the line, but won't be the first option. He will also insist on renegotiating NAFTA, but it is hard to know what he hopes to achieve."

Economists at Fidelity have warned the world is entering an era of "unprecedented political" risk following the results of the US elections.

"We are heading into a world of unprecedented political risk which calls into question the pillars of the post WWII settlement," said Dominic Rossi, Global CIO Equities at Fidelity International.

"It's unsurprising investors are heading for cover.

"The immediate sense of bewilderment at the shift rightwards in American politics will need to give way to a more sober risk assessment.

"The immediate impact will be on the Fed. The probability of a hike in interest rates in December, followed by two further hikes 2017, has fallen sharply. The dollar which has been trending higher in anticipation, has consequently reversed. Both were threats to the bull market, and these have now been postponed. Monetary policy will remain accommodative."

Donald Trump is the new US President, according to AP and Bloomberg.

BREAKING: Donald Trump is elected president of the United States. pic.twitter.com/OIJcRFNOGY

— AP Politics (@AP_Politics) November 9, 2016

© Copyright IBTimes 2024. All rights reserved.