AIIB: China takes 30% stake as 50 members sign articles of agreement

China has taken a 30% stake in the Asian Infrastructure Investment Bank (AIIB) as the country held a meeting on 29 June, for the signing of an agreement that outlines the legal framework and management structure of the institution.

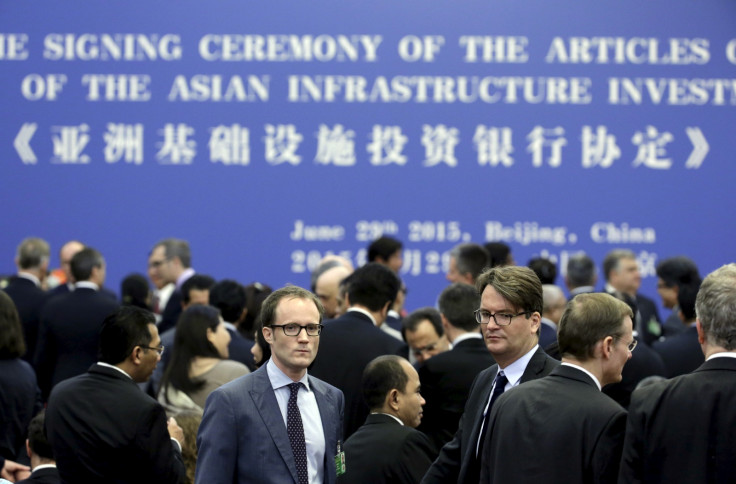

Representatives of the 50 prospective founding members of AIIB signed the bank's articles of agreement (AOA) at a ceremony held in the Great Hall of the People in Beijing. Australia was the first country to sign the document.

Seven prospective founding members, who are awaiting domestic approval for their membership, are yet to sign the agreement.

The AOA details the fundamental principles for the establishment and future operations of the AIIB.

According to the AOA, China will contribute $29.78bn (£18.92bn, €26.67bn) of the bank's $100bn capital base, becoming its largest shareholder with a 30.34% stake, the China Daily reported. The country will have 26.06% of the total votes in the institution.

India is the second-biggest shareholder at 8.4%, followed by Russia, which will have a 6.5% stake. Members from the Asian region will collectively hold 75% stake in AIIB and the rest will be distributed among members outside the region.

The bank will be headquartered in Beijing, and may have regional centres in other countries.

"The AIIB will adopt international good practices and embrace high standards, striving to build a professional, efficient and clean platform for infrastructure investment," finance minister Lou Jiwei said in an article in China Daily.

Speaking at the ceremony, Lou said he was confident that AIIB could start functioning before the end of 2015.

In October 2014, representatives of 21 Asian nations convened in Beijing to inaugurate the bank, which is focused on providing funding to infrastructure projects in Asia. The AIIB will have paid-in capital of $20bn with a total authorised capital of $100bn.

A total of 57 countries across the globe have joined AIIB as its prospective founding members.

Britain became the first major Western country to apply to become an AIIB founding member, and was followed by major European nations including France, Germany, Luxembourg, Switzerland and Austria.

The decision of the countries, most of which are close allies of the US, came despite warnings from the US over the AIIB's governance and environmental standards. The US and Japan are two major economies that have stayed out of the institution.

© Copyright IBTimes 2025. All rights reserved.