Asian stocks mixed on year-end profit taking

Stocks took their lead from a mixed finish to a quiet week on US trading floors after the Dow edged to a fresh record on Friday.

Asian markets were mixed Monday with activity thinning as investors wind down for the end of the year, with lingering optimism over easing US-China trade tensions driving some gains.

Stocks took their lead from a mixed finish to a quiet week on US trading floors after the Dow edged to a fresh record on Friday, but the Nasdaq retreated after 10 straight all-time highs.

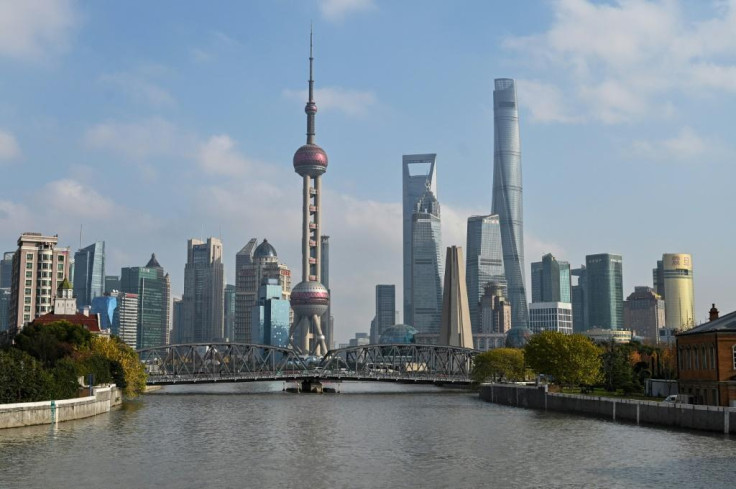

Hong Kong was up 0.40 percent and Shanghai almost one percent higher.

Tokyo's Nikkei lost 0.76 percent as investors cashed in ahead of the New Year holidays, but the final day of trading still saw the benchmark end 18.2 percent up from a year earlier.

Sydney, Jakarta and Manila were also marginally down.

"Investors appear to be growing a tad apprehensive about chasing the record setting US equity market risk-reward premise into year-end," Stephen Innes, chief Asia market strategist at AxiTrader said in a note.

Analysts have attributed the latest run of US records to upbeat investor sentiment based on a lower risk of recession in the immediate future, a mellowing of US-China trade tensions, and accommodative monetary policy.

Stocks have followed a nearly unbroken line upward since early October, drifting higher much of last week in the quiet period between the Christmas and New Year holidays.

"The overall picture is one of book squaring and profit-taking in Asia with investors preferring to wait until next week before loading up on the first trades of a new decade," Jeffrey Halley, senior Asia Pacific market analyst at OANDA said in a note.

Investors will also be watching for key policy announcements in the region this week.

North Korean leader Kim Jong Un is to give his set-piece New Year's speech on Wednesday, with all eyes on nuclear-armed Pyongyang's threat of a "new way" after its end-of-year deadline for sanctions relief from the US.

China's Xi Jinping is also scheduled to give a New Year's address, while traders will also be watching for the Tuesday release of China's official manufacturing PMI data.

Elsewhere Monday, oil prices edged higher on continued demand, mainly sidestepping comments from OPEC on Friday that the cartel would discuss ending production curbs next year.

Tokyo - Nikkei 225: DOWN 0.76 percent at 23,656.62 (close)

Hong Kong - Hang Seng: UP 0.40 percent at 28,338.72

Shanghai - Composite: UP 0.84 percent at 3,030.28

Pound/dollar: UP at $1.3106 from $1.3112

Euro/pound: DOWN at 85.39 pence from 85.40 pence

Euro/dollar: DOWN at $1.119 from $1.1202

Dollar/yen: DOWN at 109.14 from 109.13

Brent Crude: UP 0.31 percent at $68.37 per barrel

West Texas Intermediate: up 0.15 percent at $61.81 per barrel

New York - Dow: UP 0.1 percent at 28,645.26 (close)

New York - Nasdaq: DOWN 0.2 percent at 9,006.62 (close)

New York - S&P 500: S&P 500: FLAT at 3,240.02 (close)

Copyright AFP. All rights reserved.

This article is copyrighted by International Business Times, the business news leader