Walgreens Is Using Robots to Fill Prescriptions in 5,000 Stores To Fight Costs and Staffing Crisis

This automation push coincides with Walgreens' planned transition to a private company

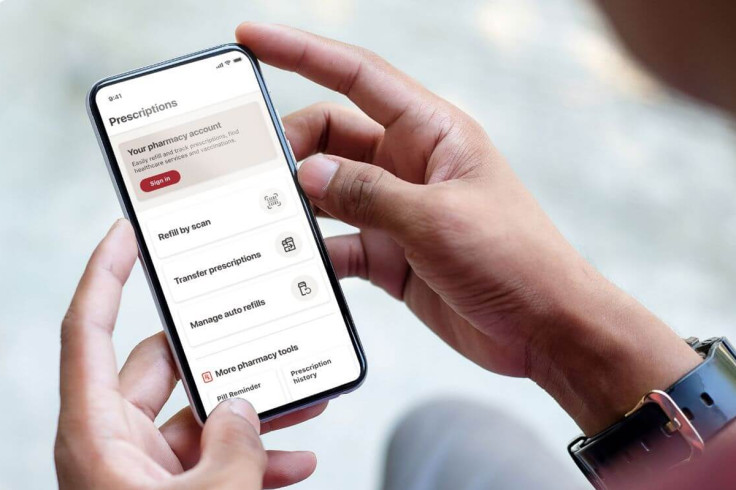

Walgreens is making a significant technological leap to tackle rising costs and a shortage of pharmacy staff. The drugstore giant is rolling out robots to automate filling prescriptions in a massive expansion across 5,000 stores.

As drugstore businesses navigate challenges to regain solid ground, Walgreens is increasing its investment in automated systems. The corporation is also expanding the number of local stores supported by its specialised fulfilment hubs.

Walgreens Bets On Automation To Tackle Pharmacy Challenges

These hubs employ robots to prepare many prescriptions for individuals who use medicine to control or manage diabetes, high blood pressure, and other health issues.

Walgreens wants to give its pharmacy staff more time by removing some of their regular duties and preventing wasted supplies. Handling fewer prescriptions would let employees connect with patients face-to-face and offer more health services like vaccinations and tests.

Walgreens initially introduced its robot-run hubs in 2021. However, they stopped further expansion in 2023 to concentrate on collecting opinions and improving the operation of their current locations.

After spending over a year making improvements, which included new internal systems, the company announced it's prepared to broaden the use of this technology once more.

How Walgreens' Robot Pharmacies Aim To Transform Operations

Walgreens informed CNBC that it aims to have its eleven micro-fulfilment centres support over 5,000 locations by the end of the year. This is an increase from the 4,800 stores they served in February and the 4,300 in October 2023.

According to Walgreens, as of February, these centres handled, on average, 40% of the prescription volume for the connected pharmacies. The company says this equates to approximately 16 million prescriptions processed monthly across all the facilities.

This renewed drive for automation coincides with Walgreens' preparations to become a private company through an approximately £7.57 billion ($9.4 billion) agreement with Sycamore Partners, which is anticipated to be finalised by the end of the year.

This potential agreement would conclude a challenging period for Walgreens as a publicly traded entity. It was characterised by a difficult shift following the pandemic, reduced pharmacy payment rates, softer consumer purchasing, and intense rivalry from CVS Health, Amazon, and other major retailers.

Walgreens' Automated Hubs Promise Faster Fills And More Patient Care

Like CVS, Walgreens has moved away from opening new establishments and is instead closing numerous poorly performing sites to strengthen its earnings. Both corporations are in a race to remain significant as online sellers attract consumers, and individuals increasingly choose quick home delivery instead of going to physical pharmacies.

These shifts also come after growing dissatisfaction among pharmacy workers. In 2023, nationwide walkouts highlighted exhaustion and persistent staff shortages, compelling drugstore chains to reevaluate their operations.

Walgreens stated that its investment in automated prescription processing is already showing positive results. So far, these specialised fulfilment hubs have produced roughly £378.54 million ($500 million) in savings by reducing unnecessary stock and improving efficiency, according to Kayla Heffington, Walgreens' vice president of pharmacy operations.

Heffington further mentioned that the stores utilising these centres are giving out 40% more vaccinations compared to those that are not. 'Right now, they're the backbone to really help us offset some of the workload in our stores, to obviously allow more time for our pharmacists and technicians to spend time with patients,' said Rick Gates, Walgreens' chief pharmacy officer.

'It gives us a lot more flexibility to bring down costs, to increase the care and increase speed to therapy — all those things,' the top executive added. Gates also noted that these hubs provide Walgreens with an advantage over smaller, independent pharmacies and some competitors that lack similar centralised support for their stores.

Cutting Costs, Easing Strain

Nevertheless, Walmart, Albertsons, and Kroger have also explored or are presently using their own micro-fulfilment centres to distribute groceries and other medications. Micro-fulfilment centres present challenges, such as a significant dependence on intricate robots that could lead to interruptions if mistakes happen.

Next in #retail? Walmart hires 50 #robots to scan shelves. #ai #robotics #bots #autonomous #automation #robotics pic.twitter.com/zsFhtky51z

— Mike Quindazzi (@MikeQuindazzi) November 6, 2017

However, these facilities are increasingly becoming a standard part of the retail landscape because of their cost benefits and capacity to simplify processes, lessen staff workload, and deliver products to consumers more quickly.

Inside Walgreens' Automated Prescription Hubs

When a Walgreens pharmacy receives a prescription, the system decides whether it will be filled in-store or at a nearby micro-fulfilment centre. Routine medications and refills are often directed to these hubs.

Each centre utilises a sophisticated automated system involving robotics, conveyor belts, and barcode scanners, overseen by pharmacists and technicians. Instead of manual in-store filling, medications travel along a computerised assembly line where technicians load canisters, pharmacists verify them, and robotic arms dispense pills into labelled vials.

Certain items, like inhalers, are handled at separate stations before all prescriptions are sorted, packaged, and sent back to stores for patient pickup. Safety measures like automated error detection are in place. Ensuring accuracy and patient safety through proper worker training is a key focus within these facilities.

© Copyright IBTimes 2025. All rights reserved.