FX Focus: Pound slips against the dollar after dire retail sales figures

Euro falls from three-week high as investors remain cautious ahead of Sunday's presidential elections in France.

The pound edged lower against the dollar on Friday (21 April), following news the UK retail sector recorded its sharpest slowdown in seven years.

Shortly after the halfway mark of the session, sterling was 0.22 % lower against the dollar, trading at $1.2778 but remained broadly flat against the euro, fetching €1.1954.

The UK currency was not helped by data released by the Office for National Statistics, which showed retail sales including auto fuel rose 1.7% on an annual basis last month, falling short of expectations for a 3.3% gain and down from the 3.7% increase recorded in the previous month.

That left the quantity bought in the three-month period down 1.4% compared with the previous quarter, marking the biggest quarterly drop since early 2010 and the third consecutive quarterly drop.

Despite a slight dip against the greenback, the pound has gained over 2% against its US counterpart this week, following Prime Minister Theresa May's decision to call a snap general election for 8 June.

However, FXTM research analyst Lukman Otunuga said the pound remained gripped by the Brexit developments and heightened political uncertainty created from the snap general election shocker, which could "extreme" upside gains.

"From a technical standpoint, although the sustainability of the sterling rebound can be questioned, the pound/dollar rate remains undeniably bullish on the daily timeframe," he added.

"The decisive breakout above $1.2775 could encourage a further incline higher towards $1.3000. On the other hand, if the bearish Brexit fundamentals inspire sellers, then repeated weakness below $1.2775 could open a path lower back towards $1.2600."

Germany the key to manufacturing and services

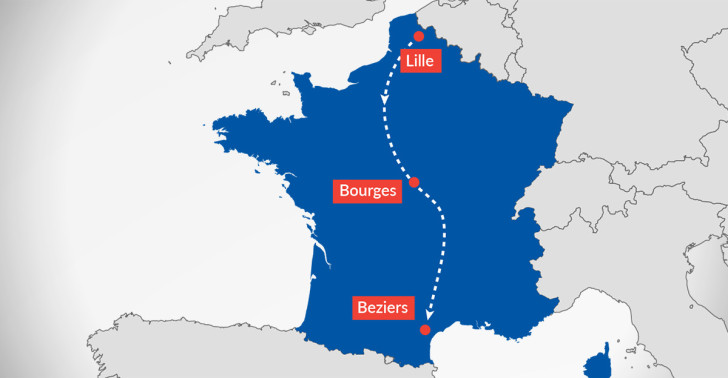

Elsewhere, the euro was on the back foot against most of its major counterparts ahead of the first round of the French Presidential elections on Sunday, despite a series of positive economic reports.

Markit's flash Eurozone PMI composite index, which takes a snapshot of the manufacturing and services indices across the region, rose to 56.7 in April from 56.4 and beat expectations of 56.3.

However, while growth in France picked up, Germany, the Eurozone's largest economy, saw the index decline to 56.3 from 57.1 last month. While growth in France accelerated, it moderated in Germany. The headline composite index for Germany fell to 56.3 in April from 57.1 in March.

Paresh Davdra of Rational FX said he expected the currency to remain under pressure until the polls open.

"The currency has been driven by recent polling predictions, with investors no longer as fearful of a shock result.

"French markets are likely to be highly sensitive to all political news over the coming days, but the positive Eurozone PMI figures may also help to work in the currency's favour."

The common currency was 0.12% and 0.31% lower against the dollar and the yen, trading at $1.0704 and ¥116.80 respectively.

"Generally speaking though, the euro/dollar rate continues to trade inside an ugly range," said Fawad Razaqzada, market analyst at Forex.com.

"The longer-term outlook on it is neutral for now but will turn decidedly bearish if and when that old support area of $1.0460-$1.0525 breaks down. Until and unless that happens, there is always the possibility for sharp short-squeeze bounces as we have seen throughout the first quarter of the year."

© Copyright IBTimes 2024. All rights reserved.