Citigroup and Northland Capital assign 'Buy' rating on Bovis Homes

Bovis Homes Group Preliminary 2011 Resutls

Bovis Homes Group, the builder of traditional homes in England and Wales, is scheduled to report its preliminary 2011 results on Monday, February 27 amid reports that Citigroup has assigned "Buy" rating on the stock, while Panmure Gordon recommends "Hold" rating with a target price of 450 pence per share.

The Group has achieved strong margin improvements in 2011 and expects, on the basis of current reservations and subject to current market conditions continuing, the full year housing gross margin will approach 20%. Additionally, for the full year 2011, overheads as a percentage of revenue are expected to reduce towards 10% from the 10.6% achieved in 2010, delivering operating margins approaching 10%. With the land investments made to date and the strength of the pipeline of further land acquisition opportunities, the Group is confident that it can achieve an average active sales outlet total of circa 85 during 2012.

The traditional homes designer opened 27 new active sales outlets in the first six months of 2011 and it further opened 33 new active sales outlets in the second half of 2011. This is expected to result in an average of 78 active sale outlets, a 15% increase on H2 2010. Subject to current market conditions continuing, this increase in outlets will support greater sales, which will lead to growth of between 5% and 10% in total legal completions for 2011 compared to 2010.

The Group expects that volumes, sales prices and gross margins will continue to increase in 2012, with an increasing proportion of legal completions expected from sites acquired since the housing market downturn and with a greater number of active sales outlets. With current market conditions continuing the Group expects to deliver an operating margin of greater than 10.0% and a return on capital employed of more than 7.0%.The Group also believes that it has the resources and opportunities to maintain its ambition of operating from an average of 100 active sales outlets during 2013.

The traditional homes builders strategise to deliver returns by increasing profitability while improving the efficiency of capital employed. Through volume growth from improved sales rates and a greater number of sales outlets, delivered through consented land acquisition, primarily in the south of England. Higher average sales prices from traditional homes in better located sales outlets, stronger profit margins from new higher margin sites, and significant build cost reductions on sites were acquired before the housing market downturn.

Brokers' Views:

- Citigroup raises to buy from neutral

- Peel Hunt gives 'Sell' rating on the stock

- Shore Capital Stockbroker recommends 'Hold' rating on the stock

- Panmure Gordon recommends 'Hold' rating on the stock with a target price of 450 pence per share

- Northland Capital Partners recommends 'Buy' rating on the stock with a target price of 550 pence per share.

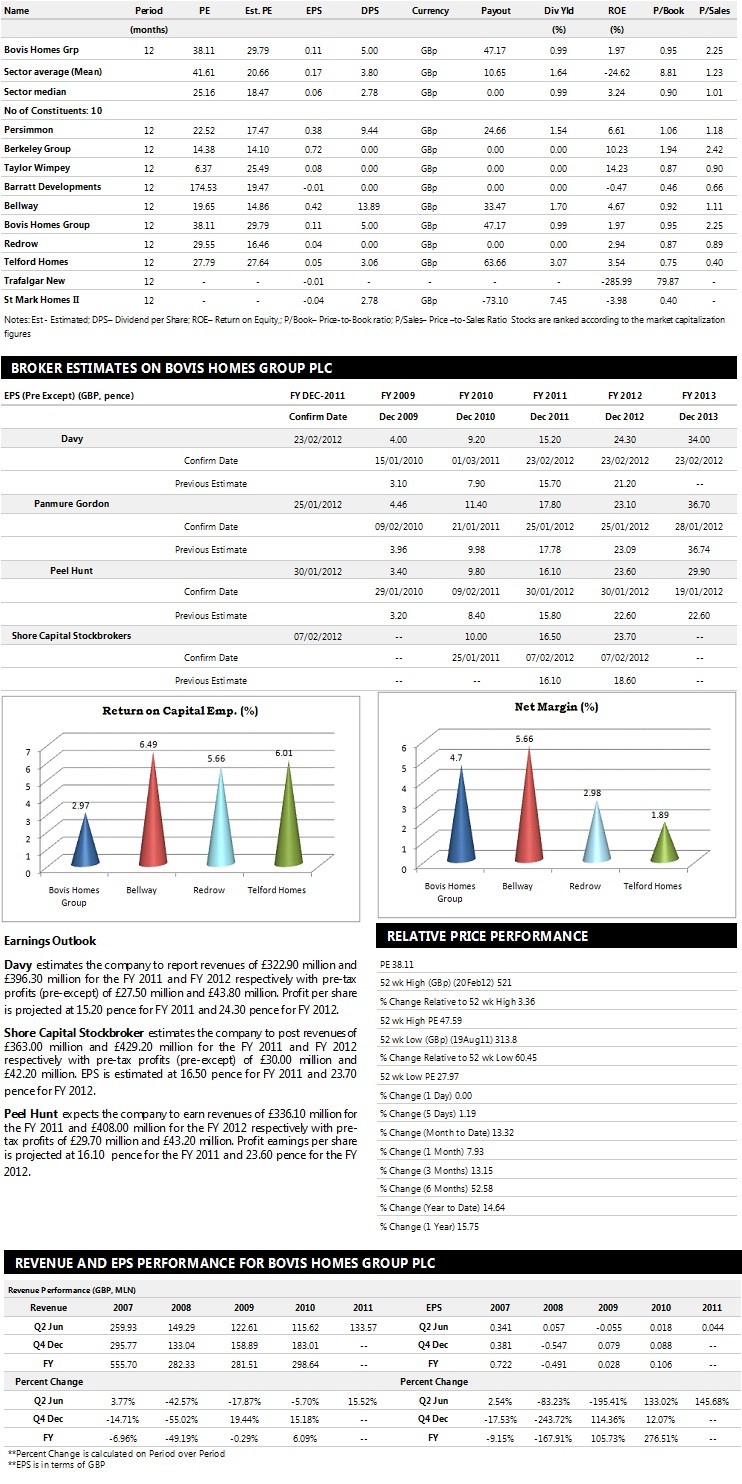

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalization.

© Copyright IBTimes 2025. All rights reserved.