Bullish or Bearish on Bitcoin? How Fluctuating Crypto Markets Influence Our Investing Decisions

Explore the impact of Bitcoin's market fluctuations on investing decisions in the dynamic world of crypto.

By: Allie Grace Garnett, a journalist who specializes in the cryptocurrency market.

- Volatile crypto markets are complex—but not as complex as how market participants react to rapidly changing token prices

- Cryptocurrency volatility can fuel emotional decision-making, intensifying market cycles through greed and fear.

- HODLers are the Zen Buddhists of crypto, reacting to market volatility by not typically reacting at all

You can read the full-length article on CasinosBlockchain.

The price of Bitcoin is up by approximately 165%, from $17,000 in January 2023 to above $46,000 in January 2024 — an impressive gain by any measure. Bitcoin holders are elated, naturally, but many O.G. crypto holders also know the pain of owning digital tokens as their values sharply decline.

What is happening when the cryptocurrency market is volatile?

Volatile crypto markets are labyrinthine, but how individuals and organizations react to crypto market volatility is even more complicated.

Keep reading to learn more about cryptocurrency market fluctuations and how they influence investors, traders, and organizations.

What can a fluctuating crypto market influence?

A cryptocurrency market with rapidly changing prices may influence user behavior and trigger specific buying and selling patterns. Let's explore this in more detail:

1. Trading and investing behavior

A volatile cryptocurrency market may cause crypto holders to react in two fundamentally different ways:

- Respond immediately: Highly reactive traders and investors, perhaps acutely sensitive to short-term price fluctuations, may respond to a significant change in cryptocurrency prices by immediately buying or selling.

- HODL: Long-term crypto investors are more likely to HODL—or "hold on for dear life"—to their digital assets regardless of market volatility.

HODLing isn't right for everyone—that's why traders may use tactical approaches to cope with crypto market volatility. Some of these tactics include:

- Portfolio diversification: Crypto holders may invest in a variety of cryptocurrencies and traditional assets to stabilize their total investment returns.

- Position sizing: Traders can limit position risk by carefully managing the size of each trade relative to their portfolio's overall value.

- Dollar-cost averaging: Investors may establish significant cryptocurrency positions over time using dollar-cost averaging, which is the practice of regularly investing a fixed amount in a cryptocurrency regardless of its current market price.

- Using stop-loss and take-profit orders: Risk management tools like stop-loss and take-profit orders are often useful to active traders wishing to minimize their transaction risks.

- Hedging: A crypto investor or trader may address market fluctuations by hedging, or investing in price-stable assets that offset the most volatile cryptocurrencies in their investment portfolios.

2. Buying and selling patterns

Crypto market fluctuations can inspire buying and selling patterns that are both rational and irrational. Let's examine some of these patterns:

- Crypto FOMO: A large influx of new crypto buyers drives cryptocurrency prices even higher, fueling even greater FOMO.

- Opportunistic buying: HODLers may be likely to engage in opportunistic buying, which means purchasing cryptocurrencies when their prices are low based on the belief that market values are likely to rebound.

- Panic selling: Panic selling exacerbates market downturns, as large volumes of sell orders drive prices even lower.

3. Crypto gambling activity

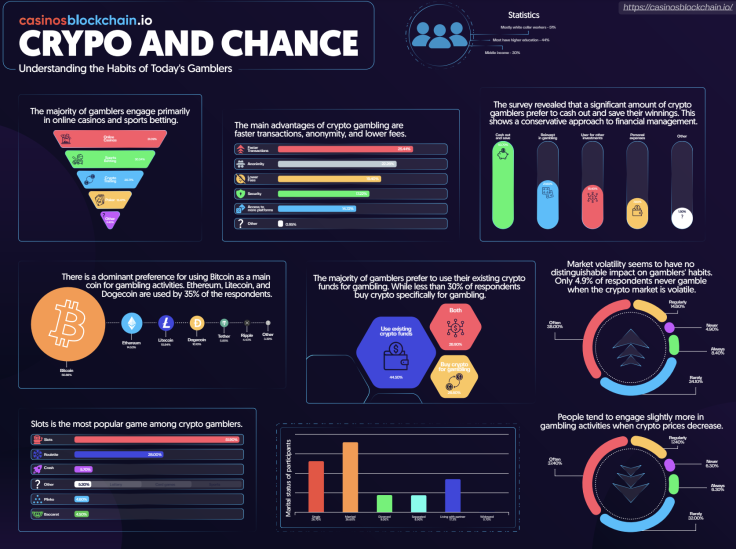

How do cryptocurrency market fluctuations influence crypto gambling activities? A 2023 gambling behavior survey by Casinos Blockchain reveals some interesting results:

- "A majority—83%—of crypto gamblers prefer to gamble with Bitcoin and 51% manage their winnings by cashing out." I'm not surprised that most crypto gamblers prefer to gamble with Bitcoin, given its widespread recognition and relative price stability.

- "A minority—31%—of crypto gamblers are less active when cryptocurrency price volatility is high, while 41% of crypto gamblers report no change in behavior." This survey result demonstrates that cryptocurrency market volatility has a limited but non-zero impact on crypto gambling activity.

- "More crypto gamblers (42.76%) prefer to gamble when crypto prices are rising rather than when crypto prices are dropping (38.82%)." More gamblers prefer to use cryptocurrency when token prices are increasing because that's when crypto holders are generally the most willing to take risks.

Is the stock market influenced by crypto volatility?

Cryptocurrencies as an asset class have long been viewed as independent of traditional financial markets, although the correlation between digital asset and traditional security prices has fluctuated over time.

The price correlation between digital assets and traditional securities may increase if many institutional investors add cryptocurrency exposure—that's because institutional investors control significant cash flows and may make policy-based investment decisions that span traditional and digital asset classes.

Macroeconomic events can also increase the price correlation between digital assets and traditional securities.

The price correlation between digital assets and traditional securities may decrease if crypto holders react to news or events that impact only the blockchain or cryptocurrency sector.

How the price of Bitcoin influences user behavior

Let's examine both the Bitcoin bull run of 2017 and the price crash of 2018 to understand how Bitcoin's price movements can influence traders, investors, and institutions.

2017 Bitcoin bull run

Picture this—one bitcoin, which sells for around $1,000 at the beginning of the year, is worth nearly $20,000 by December 2017.

This massive price increase attracts plenty of attention. Here's how individuals and organizations react:

- New investors flock to Bitcoin: The skyrocketing price of Bitcoin catches the attention of the general public, attracting a massive influx of new investors.

- Speculative trading increases: Bitcoin's bull run causes speculative trading to surge.

- Investors diversify into other cryptocurrencies: investors diversify their portfolios to include other cryptocurrencies, hoping to profit from the next big winners.

- Institutional investors show interest: institutional investors begin to seriously evaluate and invest in Bitcoin at scale.

2018 Bitcoin market crash

Now imagine this— the market value of Bitcoin is crashing. The Bitcoin price decline that begins in early 2018 swiftly brings the token's price down to below $7,000 by February of 2018.

How do you react? How do other crypto holders react? Let's take a look:

- Many Bitcoin holders choose to sell: The Bitcoin price crash triggers a widespread sell-off by investors attempting to limit their losses.

- Speculative trading declines: decline in investor enthusiasm and causes speculative trading to decrease as investors and traders become more cautious.

- Trading volumes decrease: Many investors withdraw from the market entirely or trade less speculatively or frequently, resulting in reduced trading volumes.

- Investors de-diversify their crypto portfolios: Some traders and investors rebalance their digital asset portfolios to eliminate exposure to the riskiest and most speculative cryptocurrencies.

- Risk management strategies gain popularity: Many crypto holders who continue to actively participate in the cryptocurrency markets begin using risk management strategies such as submitting stop-loss orders.

- Institutional investors show reduced buying interest: Organizations wary of high volatility and regulatory uncertainty revert to limiting their exposures to this emerging asset class.

Coping with volatility as a cryptocurrency investor

Extreme price volatility in crypto markets is often driven by investors' emotions—but that doesn't make coping with ongoing market volatility any easier.

Here's how to participate in fluctuating crypto markets without losing your cool:

- Diversify your investment portfolio to manage risk

- Develop a long-term investing strategy—and ignore short-term price fluctuations

- Use risk management tools to limit potential losses

- Avoid impulsive investment decisions that are purely emotion based

The cryptocurrency markets are likely to remain volatile as the asset class continues to evolve.

Institutional investors are increasingly entering the markets for digital assets—boosting the value and liquidity of many cryptocurrencies.

And regulatory uncertainty persists in many jurisdictions, causing the continued migration of cryptocurrency and blockchain platforms to geographic locations with clear rules for digital assets.

Widespread crypto use by both individuals and businesses, although likely to occur gradually, may significantly decrease cryptocurrency market volatility.

© Copyright IBTimes 2025. All rights reserved.