Parmesan cheese to bottle caps - alternative currencies in the age of Bitcoin and Apple Pay

From bottle tops to seashells to Parmesan cheese - there's been a plethora of cash alternatives traded and transacted over the course of history. Given the current fintech explosion, and the rise of alternative payment methods like Bitcoin, contactless credit cards and Apple Pay, comparison site Gocompare.com has put pay to study and produced a list of cash token items.

For instance, did you know the Italian bank Banco Emiliano accepts the Pamesan cheese as collateral for a personal loan, giving farmers the cash injection they need until they can sell their wares. If farmers default on the loan the bank sells the cheese, which is valued at $300 (£211) per wheel. Astonishingly, the bank's vault, containing $187m worth of cheese, has been hit by would be cheese thieves three times, most recently in 2009.

Also on the list is the hack known to many in the telco/payments space whereby people in Africa began trading mobile phone minutes. This was partly to do with hyperinflation devaluing national currency in countries like Tanzania, Nigeria and Ghana. The great thing about the trade in prepaid top-up cards and apps that send airtime is that it screamed the use case for mobile money in the Continent. The mobile money revolution in Africa, most famously characterised by Vodafone/Safaricom's Mpesa, will be remembered as one of the great technological advancements of the 21<sup>st century.

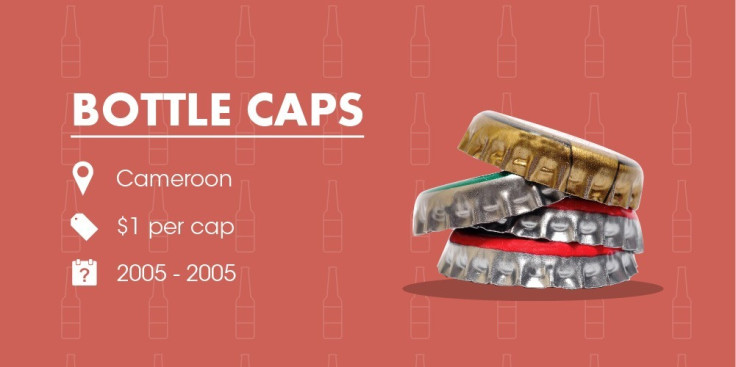

Other alternatives considered include Shire Silver, tea bricks and bottle tops. The latter came into currency back in 2005, when a brewery in Cameroon placed prizes under beer caps to boost sales. When rival companies did the same, competition escalated resulting in a prize under almost every cap. Rewards ranged from free beer to sports cars and with a winning cap being worth the equivalent of $1 – the same price as a bottle of beer – people began exchanging the caps for goods and services.

© Copyright IBTimes 2025. All rights reserved.