Edmund Shing: With the Stock Market, the Best Things Do Come in Small Packages

Big is beautiful, so the mantra goes. But not so in the stock market. The very long-term view of stock market performance by size of company, comparing small-caps to large-caps, reveals small-cap companies have in general outperformed the broad market quite substantially.

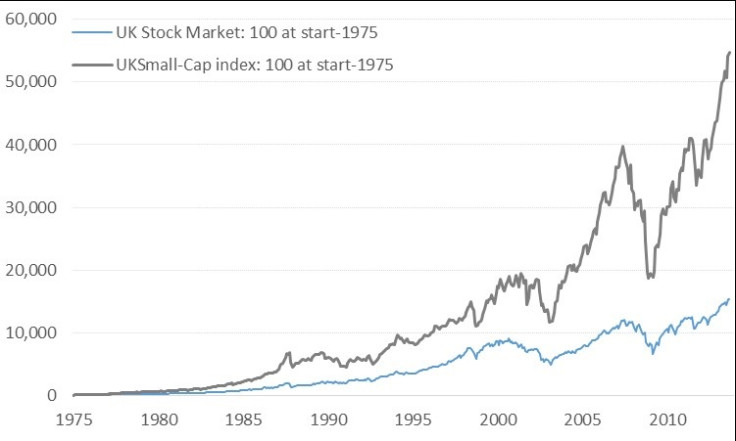

If you had invested £100 in the UK stock market back at the beginning of 1975, and had diligently re-invested all dividends (ignoring all taxes), then you would have today an investment worth well over £15,000 (Figure 1). Very impressive, you might say to yourself.

If, however, you had instead invested that £100 in an index of UK small-cap stocks in January 1975 on the same basis, you would now have an investment worth nearly £55,000.

In other words, over the very long-term (nearly 40 years) the small-cap segment of the market has delivered three-and-a-half times the performance of the overall stock market, which is dominated by very well-known stock market giants such as BP, Vodafone and HSBC.

Why would this be the case? The simple explanation is that smaller companies by and large tend to be younger companies with more innovative products or services and which can post faster growth rates, rather than massive companies that are well-established in mature markets with long-running products or services, and which therefore tend to grow at a more sedate pace.

The January small-cap effect

Not only have small-cap stocks done considerably better than large-caps over the long-term in the UK and US, a fact well-documented in the academic financial market literature, but these pint-sized gems have over time performed particularly well at the beginning of the year, the so-called January small-cap effect (Figure 2).

While this effect was originally identified in US small-cap stocks, UK small-caps exhibit exactly the same tendency to outperform in January, historically averaging over 4% gains in January since 1975.

In fact, in the UK the first four months of the year have been the best historic period of performance, delivering an average of over 13% from January to April.

Small-caps: One of the few times it is worth using an "active" fund manager

Now in general, I tend to avoid investing using actively managed unit trusts, preferring instead low-cost "passive" index funds and exchange-traded funds for the simple reason that fund managers do not tend to justify their extra cost through better net performance over time.

However, small-cap funds are an exception to this general rule. There are a number of small-cap managers who have demonstrated index-beating performance over time, even after costs.

They manage to cherry-pick a number of high-potential stocks out of a huge universe and then benefit disproportionately from strong long-term performance in these names, while also avoiding a lot of under-performing small-cap "duds".

So, in this case, I would invest in a small-cap fund using one of a small number of investment trusts, which are listed closed-end funds which are run by a stock-picking fund manager.

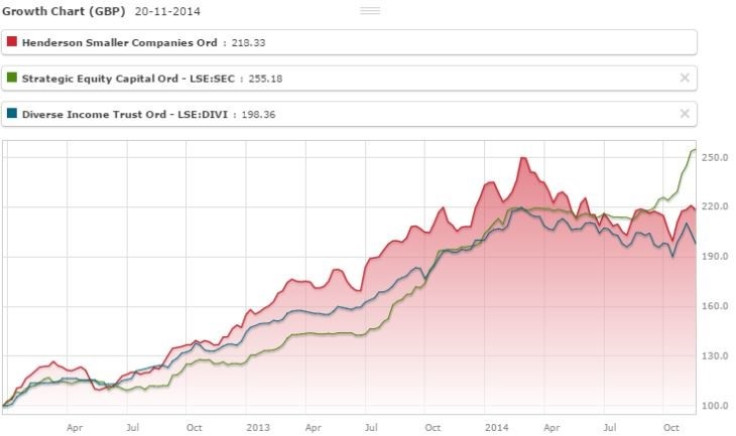

Funds run by small-cap specialists with long experience and a solid investment process, resulting in a strong performance track record (Figure 3) include:

- The Miton Income Fund (LSE code: DIVI), run by small-cap veteran Gervais Williams

- Strategic Equity Capital (LSE code: SEC), a concentrated small-cap fund run by the team at GVO Investment Management

- The Henderson Small-Cap Fund (LSE code: HSL), run by Neil Hermon at Henderson. This trust trades at a 13% discount to net asset value.

Each of these three fund managers have strong long-term track records of investing in UK small-cap stocks and outperforming the small-cap index over time. I particularly like the Miton Fund as it combines small-cap investing with income investing (a 3% dividend yield), aiming for an attractive combination of dividend income and growth from small-cap champions.

Perhaps small is sexy, at least around the new year.

© Copyright IBTimes 2024. All rights reserved.