Asian markets mixed as US-China tensions offset stimulus hope

Reports said Mitch McConnell would soon unveil a $1 trillion plan after overcoming some differences with the White House.

Asian markets were mixed Thursday as investors juggled hopes for a new stimulus deal in Washington with concerns about the virus and another flare-up between China and the United States.

Optimism over the development of a vaccine and a wall of government and central bank cash is providing much-needed support to equities as traders fret over a spike in new infections around the world and the reimposition of containment measures in the US and other key economies.

European leaders lifted sentiment this week when they finally agreed on an $860 billion rescue package for the eurozone, putting the focus on US lawmakers, with their earlier multi-trillion-dollar programme -- which gives cash to households -- about to wind down.

Republicans have been struggling to come up with a bill to counter a $3.5 trillion Democrat proposal, fanning concerns they will not come up with anything ahead of an August break.

However, reports said Mitch McConnell would soon unveil a $1 trillion plan after overcoming some differences with the White House.

Analysts said that while it may take some time, a package is expected to be ready for Donald Trump to sign off, with no-one wanting to be seen to deny money to the poorest ahead of a general election.

Indications a deal could be done helped Wall Street into positive territory, with dealers also cheered by an announcement from German firm BioNTech and Pfizer that the government had agreed to pay almost $2 billion for 100 million doses of a potential vaccine if regulatory approval is granted.

In early trade, Hong Kong rose 0.5 percent and Sydney gained 0.2 percent, a day after both fell more than two percent, while Jakarta added 0.7 percent and Singapore edged 0.3 percent higher.

But Shanghai fell nearly one percent, while Seoul, Taipei and Manila were also well down.

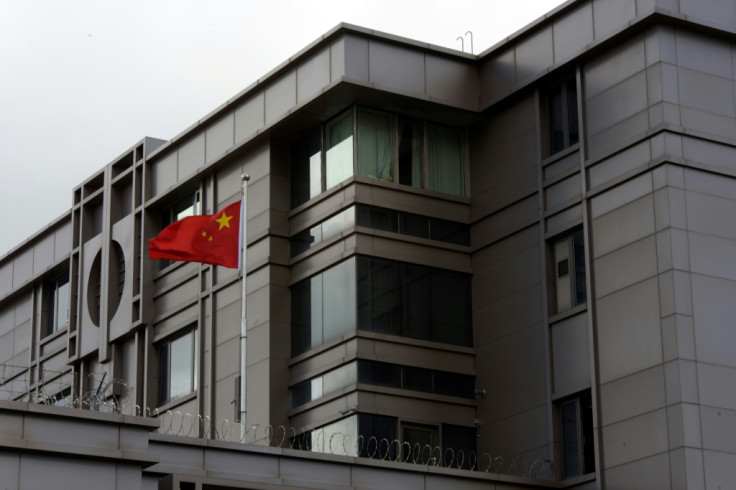

Washington and Beijing added to the long list of issues they have butted heads over when the US ordered the closure of the Chinese consulate in Houston within 72 hours.

That came a day after two Chinese nationals were indicted for allegedly hacking hundreds of companies worldwide seeking to steal vaccine research.

China slammed the US move, and threatened retaliation, while Trump said "it's always possible" more consulates could be closed.

"The escalation in US-China tensions is a reminder of the headline risk faced by investors during the upcoming US election campaign," said AxiCorp's Stephen Innes.

"The US and China have become increasingly combative in their views this year. The markets better get used to it because there is more of that to come and even without Trump in the White House."

However, he added: "So long as the deteriorating political scrim does not drive economic fragmentation between the world's largest economies, the political bruhaha remains a tempest in a teapot."

Hong Kong - Hang Seng: UP 0.5 percent at 25,181.86

Shanghai - Composite: DOWN 0.9 percent at 3,302.29

West Texas Intermediate: UP 0.1 at $41.94 per barrel

Brent North Sea crude: UP 0.1 at $44.34 per barrel

Euro/dollar: UP at $1.1576 from $1.1572 at 2030 GMT

Dollar/yen: DOWN at 107.12 yen from 107.16 yen

Pound/dollar: DOWN at $1.2735 from $1.2740

Euro/pound: UP at 90.90 pence from 90.83 pence

New York - Dow: UP 0.6 percent at 27,005.84 (close)

London - FTSE 100: DOWN 1.0 percent at 6,207.10 (close)

Tokyo - Nikkei 225: Closed for a holiday

Copyright AFP. All rights reserved.

This article is copyrighted by International Business Times, the business news leader