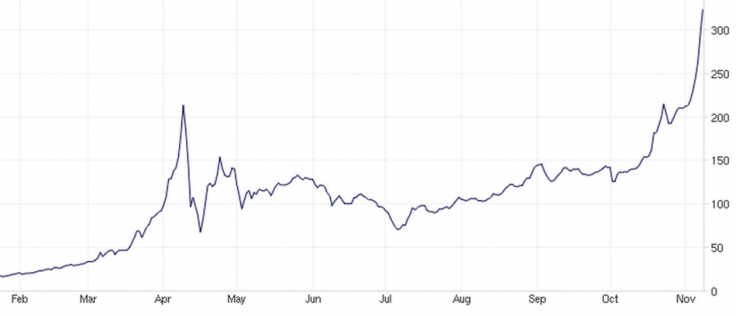

Is Another Bitcoin Bubble About to Burst as Value Soars Past $300?

Bitcoin has reached an all-time record valuation of more than $310 (£192) per coin as a repeat of April's boom and bust looks set to rock the currency once more.

The decentralised digital currency has almost doubled in value in the last month alone, rallying from around $125 at the start of October to $312 at the time of publication, prompting investors and bystanders alike to ask why; after a similar spike to $266 in April was followed by a crash to just $75.

- Read More: What is Bitcoin and how does it work?

Last time around, it was easy to blame huge media attention luring in inexperienced traders, and DDoS attacks for the dramatic rise and fall, but this time Bitcoin finds itself in a different environment.

Silk Road

Bitcoin dipped briefly at the beginning of Ocboter when online illegal drug marketplace Silk Road - which dealt exclusively in the digital coins - was shut down by the FBI, but its value soon recovered, proving it can survive without being associated with the darker corners of the web.

Indeed, Bitcoin has spent much of the last six months edging closer to being recognised as a real currency, like pounds, dollars and the euro. Germany now classes Bitcoin as a 'unit of account', the US Senate is keen to learn more about it and other digital currencies to be used safely; Vancouver has the world's first Bitcoin cash machine.

Cashing in on the stratospheric price rise, a Norwegian man recently bought an apartment with part of his £552,000 wealth acquired from holding £15 worth of Bitcoins since 2009.

Why has Bitcoin risen so much?

Some believe the shuttering of Silk Road has benefited the currency, adding to its perceived legitimacy among users - and if the FBI is successful in detaining more than 600,000 coins from the encrypted wallet of alleged Silk Road owner Ross Ulbricht, the US government will have taken 5% of all Bitcoins out of circulation, driving demand and prices up.

Another theory is China's growing interest in the currency. Not only are Chinese transactions increasing among regular web users, but the web giant Baidu - which offers search and other web services similar to Google - now accepts Bitcoin as payment for Jiasule, its online security and firewall service.

Jiasule was only acquired by Baidu in August, so it's difficult to claim these transactions are solely responsible for Bitcoin's current boom, but growing popularity among the world's largest internet population should only send its value one way.

Not out of the woods yet

However if Bitcoin wants to become a legitimate, stable and trusted currency, it isn't out of the woods yet. A new version of the Silk Road website has emerged, complete with a front page mocking the FBI's closure of the old site and listings of illegal drugs to be purchased with Bitcoin.

Meanwhile, an Australian man has claimed the theft of his Bitcoin wallet, reportedly containing 4,100 coins worth around £780,000. Because it is almost impossible to trace or revert Bitcoin transactions, the man, known only as TradeFortress and claimed to be "not much over" 18, says he sees no point in reporting the theft to the police.

"The police don't have access to any more information than any user does when it comes to Bitcoin. Some say it gives them control of their money," he said.

Plainly, Bitcoins can still be used openly for illegal transactions, and their anonymous nature makes the theft of them as tempting for hackers as it is impossible to trace.

Will Bitcoin's value crash again?

Economic theorist Konrad S. Graf suggests that, while the currency will experience growth "mania" and decline, these fluctuations - no matter how dramatic when compared to relatively stable pounds and dollars - are to be expected from a currency that is just four years old.

Additionally, Graf suspects the overall price rise can be explained thus: "The more people begin using or expanding their use of a particular medium of exchange, the more its actual utility rises, the more valuable it actually is in this function from the point of view of its users.

"The exchange value of a medium of exchange unit is related to, among other things, each holder's expectations of being able to use the unit in future exchanges. How many people will accept the unit, how readily, and for what?"

Graf concludes: "At least when it comes to the aspect of monetary network-effect growth in any season, 'tis the more the merrier."

Shredded to bits

But investors should exercise caution. Currencies Direct senior analyst Alistair Cotton warns Bitcoin is "a currency that is substantially more volatile than any other traditional peer on the market. This is a currency that rose by 14% in one day recently and fell by 40% in a matter of hours...This remains an extremely speculative bet and any individual investors would do well to steer clear if they want don't want their investment portfolio shredded to bits."

The more businesses and services offering to accept Bitcoin, the more its value in a practical sense grows, along with its financial value. However, this makes it more appealing to hackers looking to make a quick buck, either by stealing a user's wallet, or by attacking Bitcoin exchanges to bring the value down, knowing it will later recover to earn them a profit.

Until these Wild West scenarios can be eradicated, Bitcoin will struggle to establish itself as a safe, reliable means of investment.

© Copyright IBTimes 2025. All rights reserved.