Indian Rupee Gains on Foreign Flows But Likely to Skid on Budget and Weak Monsoon

Despite the greenback's broad strength, the Indian rupee has appreciated against the US dollar over the last few days, helped by foreign inflows and budget-related optimism, but the local unit is likely to weaken again as the budget may not meet the high expectations of markets.

Weak monsoon so far this year and forecasts for below average output for the rest of the year have increased inflation and growth concerns in Asia's third largest economy, analysts said.

The USD/INR fell to a 20-day low of 59.49 on 3 July, from the previous close of 59.71, marking the sixth straight session of losses. It is down 1.7% from the near two-month high of 60.53 touched on 19 June.

At the same time, the USD index, the gauge that measures the strength of the dollar against the currencies of the six largest trading partners of the US, has risen to a three-day high of 80.0 from a two-month low of 79.75 touched on 1 July.

"Some inflows have helped the rupee recently, in addition to the feel good factor in play since the election of Modi's government," K Chandrangathen, chief of forex trading at South Indian Bank, Mumbai, told IBTimes UK.

Prime Minister Narendra Modi is considered powerful as his party BJP has won a majority on its own in this year's election, thereby eliminating the likelihood of hard bargains by coalition partners when it comes to implementing politically tough measures.

"But I don't think Modi will be able to meet the very big expectations already priced in by the market this soon, and therefore, rupee has more downside risks in the near term," he added.

The rupee has advanced about 19% from the record low of 69.20 per dollar touched in August 2013 to the near one-year high of 58.23 on 22 May. However, the Indian unit is still in the correction mode considering the 60% decline from around 43.0 in August 2011 to the record low last year, traders said.

They mostly expect the rupee to weaken near 62.0 after the budget on 10 July, and beyond that, they see the optimism about strong governance supporting the currency again.

Monsoon Challenge

One of the most unpredictable factors that impacts Indian businesses year after year is the amount and distribution of rainfall as the country's agriculture heavily depends upon the monsoon rains for water rather than underground sources or dams.

Starting June, farmers as well as businessmen will begin looking out for monsoon forecasts and development reports by the government's meteorological department for output cues.

And this year, forecasts so far have been for lower rainfall and less effective distribution, and therefore, expectations are for a faster pace of inflation and increased growth challenges - dampening prospects of a stronger rebound in the rupee.

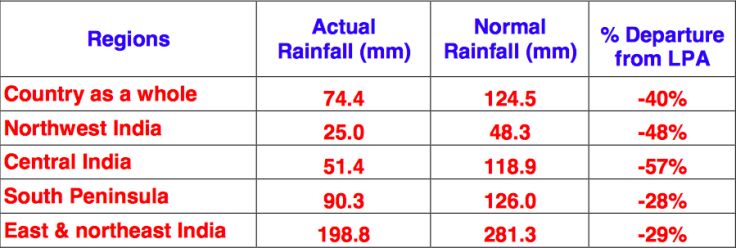

"For the country as a whole, cumulative rainfall during this year's monsoon has so far up to 25 June been 40% below the long period average," the latest weekly report from the government says.

The Other Side

Some market participants say that a softer MSP (minimum support price) hike for agricultural products by the new government, compared to that of last year's hike, will help offset the impact of a weak monsoon.

"With forecast probability for an El Niño increasing, there are concerns about its impact on monsoons, thereby on agricultural output and food inflation. However, historical data doesn't imply that poor monsoons necessarily aggravate food inflation," said Gautam Chhaochharia, one of the Mumbai-based India analysts of UBS.

"Food inflation spiked up historically if it coincided with high MSP increases announced by the government, as seen in 2009 and 2012. In periods before 2009, MSP increases were generally muted and coincidentally, food inflation spikes in periods of weak rainfall in that era (2002, 2004) were also relatively muted," Chhaochharia said.

Sonal Varma, Mumbai-based economist of Nomura, also expects to see factors easing inflation concerns.

"Fears of a bad monsoon have led to concerns of rising vegetable prices. However, we have not seen evidence to cause major concern so far," she wrote in a note.

Technical Outlook for Rupee

The USD/INR has fallen below the 50-period moving average on the daily chart and with MACD having triggered a bearish signal, the pair is likely to break through 59.45 to 58.88 ahead of the 22 May low of 58.23.

On the higher side, the levels to watch are 60.0 and 60.53 ahead of the more important 61.20-61.30 region. The pair will then target 61.77-62.0 in the near term.

On the weekly chart, the MACD signal is bullish and the main target seen is the 61.20-62.0 region, which coincides with the 50-period moving average. Further north, the level to watch is 63.51, the 23.6% Fibonacci retracement of the two-year uptrend since August 2011.

The main big picture downside level is the 57.50-56.50, a break of which will turn the correction mode to appreciation mode with regard to the rupee. The next big support is 53.65.

© Copyright IBTimes 2025. All rights reserved.