Top 19 Lucrative Side Hustles To Boost Your Income And Smart Money Management Apps To Maximize Your Profits

This article provides insights on profitable side hustles that can help individuals increase their income and improve their finances. It discusses various side hustle ideas, including freelancing, selling products online, renting out properties, and providing services, such as pet care or house cleaning.

The article also covers important aspects of personal finance, such as budgeting, saving, and investing, and offers tips on managing money effectively while pursuing a side hustle.

Overall, this aims to provide practical advice and inspiration for anyone looking to boost their income and achieve financial stability through a side hustle.

1.

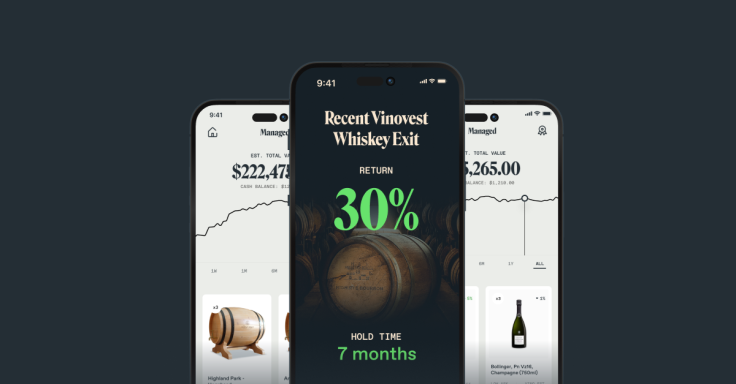

Vinovest - Wine and Whiskey Investment

Vinovest is not just revolutionizing investment, they are democratizing it. It leverages technology to provide access, liquidity, and transparency to all investors.

These assets showcase a remarkable resistance to market volatility, offering a protective shield against the erosive effects of inflation and recessions. Unlike stocks and bonds, you can savor true ownership of your wine and whiskey investments, with the added convenience of doorstep delivery.

Fine wine consistently delivers impressive annualized returns of 10.6 per cent, outshining global equities, while whiskey proudly claims the title of "the best-performing collectible of the decade." Rest easy with Vinovest, where your investments are stored securely, insured, and authenticated in bonded warehouses.

Additionally, with Vinovest, your investment portfolio is curated to match your unique goals, ensuring a perfect alignment between your financial aspirations and your assets. Join the world of wine and whiskey investing and experience stability, security, and growth like never before.

2.

Starling Bank - Award-winning Mobile Banking

Starling wants to fix what is broken in banking – by building Britain's first digital bank. With all the convenience it offers, it was recognized as the Best British Bank for 2018 to 2021, voted the Best Current Account Provider five years in a row, and declared the winner of The Which? Banking Brand of the Year for 2021 and 2022. All these accolades build the reputation of this app to be one of the best user-friendly financial management tools to help track your finances.

The Starling Bank app provides instant notifications to help you track every incoming and outgoing transaction. This makes it easy to track payments received and money spent, allowing users to be familiar with their spending habits. The app also has no fees for overseas transactions and provides 24/7 support.

3.

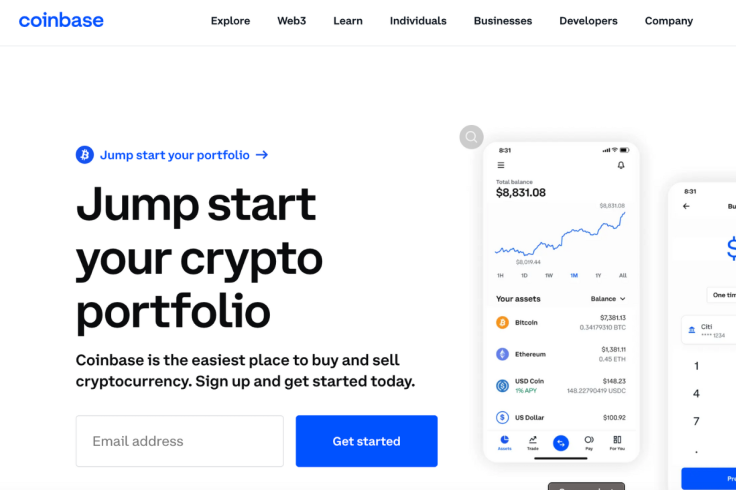

Coinbase - Buy/Sell Cryptocurrency & Bitcoin Wallet

Coinbase is a popular cryptocurrency exchange platform that allows users to buy, sell and store various cryptocurrencies, such as Bitcoin, Ethereum, Litecoin and more. The platform was founded in 2012 and is headquartered in San Francisco, California.

Coinbase provides a user-friendly interface and a mobile app for both iOS and Android devices. Users can easily buy and sell cryptocurrencies using their bank accounts, credit/debit cards, or wire transfers. The platform also offers a secure wallet for users to store their digital assets.

Coinbase is known for its high levels of security and compliance, which has made it a trusted platform for cryptocurrency trading. The company is regulated by several financial authorities, including the U.S. Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN).

In addition to its exchange platform, Coinbase also offers various other products and services, such as Coinbase Pro (a more advanced trading platform), Coinbase Wallet (a decentralized cryptocurrency wallet) and Coinbase Commerce (a platform for merchants to accept cryptocurrency payments).

4.

BlackBull Markets - Online Forex And CFD Broker

BlackBull Markets is a Forex and CFD broker that provides online trading services to individual and institutional clients worldwide. The company offers access to a wide range of financial instruments, including currency pairs, commodities, indices and cryptocurrencies.

BlackBull Markets aims to provide a seamless trading experience to its clients by offering various trading platforms, including MetaTrader 4 and 5, cTrader, and BlackBull Markets WebTrader, which are available on desktop and mobile devices.

The company also offers competitive trading conditions, such as low spreads, fast execution speeds and high leverage of up to 500:1. Clients can also benefit from free educational resources, market analysis and 24/5 customer support in multiple languages.

BlackBull Markets is regulated by the Financial Markets Authority (FMA) in New Zealand, ensuring that the company adheres to strict regulatory standards and maintains the highest levels of security for its clients' funds.

5.

Honey - Automatic Coupons, Promo Codes, And Deals

Honey is a free browser extension that automatically finds and applies coupon codes at checkout for over 30,000 shopping sites. With Honey installed on your browser, you don't have to search for coupon codes or deals manually anymore. It scans the web for the best deals and applies them to your cart, helping you save money and time.

Aside from finding coupon codes, Honey also has a rewards program where you can earn Honey Gold points on qualifying purchases, which can be redeemed for gift cards from popular retailers like Amazon, Walmart and Target.

Honey also offers a feature called "Droplist," where you can track the price of items you're interested in and get notified when the price drops. This can be especially helpful when shopping for big-ticket items like electronics or furniture.

Honey is a useful tool for online shoppers who want to save money and time while shopping online.

6.

The Hard Assets Alliance - Buy And Store Gold, Silver, Platinum And Palladium

Hard Assets Alliance is a platform that enables individuals to invest in physical precious metals, such as gold, silver, platinum and palladium, through a simple and secure online interface. The platform connects users with a network of trusted precious metals dealers and custodians to ensure the authenticity and safety of their investments.

Users can purchase precious metals in a variety of forms, including coins, bars and rounds. They can choose to store their holdings in secured vaults in various locations around the world. Hard Assets Alliance also offers the option for users to take physical possession of their precious metals if they prefer.

In addition to precious metals investments, the platform provides educational resources and market insights to help users make informed investment decisions. The company's mission is to provide a convenient and accessible way for individuals to protect and grow their wealth through tangible assets.

7.

Coinrule - Smart Trading Bot For Crypto Traders

Coinrule is a user-friendly cryptocurrency trading platform that enables users to create automated trading strategies without the need for programming skills. The platform allows users to set up trading rules using a simple drag-and-drop interface, which can be customized to fit their trading strategies and risk management preferences.

Coinrule integrates with major cryptocurrency exchanges, including Binance, Kraken and Coinbase, and supports a wide range of trading pairs. Users can monitor their trading strategies in real-time and receive alerts when their trades are executed or when certain market conditions are met.

Coinrule also offers a range of educational resources and community support to help users learn more about cryptocurrency trading and make informed investment decisions. The platform is designed for both beginner and advanced traders and offers a free trial period for new users to test its features.

8.

YouHodler - Crypto-Backed Loans, Stablecoin Conversions And Crypto Wallet

YouHodler is a financial technology platform that provides cryptocurrency-backed lending, borrowing and exchange services to users worldwide. With YouHodler, users can take out loans in USD, EUR, GBP, or stablecoins like USDT, USDC, or TUSD using their crypto assets as collateral.

Users can also earn interest on their crypto holdings by depositing them in YouHodler's interest-bearing wallets. Additionally, YouHodler offers a unique "Multi HODL" feature that allows users to diversify their crypto portfolio by investing in a basket of top cryptocurrencies.

YouHodler also provides a user-friendly cryptocurrency exchange that supports a variety of cryptocurrencies, including Bitcoin, Ethereum, Litecoin and more. Users can quickly and easily exchange one crypto for another without having to go through a cumbersome process.

The platform boasts advanced security features, such as two-factor authentication, SSL encryption and cold storage for crypto assets. YouHodler is available to users worldwide, except for residents of the United States, China and several other countries where cryptocurrency-related activities are restricted.

9.

Pleo - The Business Spending Solution That Makes Life Easier

Pleo is a smart company spending platform designed to simplify how businesses manage their expenses. It offers a range of features to help teams track, manage and automate their company expenses, including virtual and physical cards for employees, automated expense reporting, receipt capture and expense categorization.

With Pleo, businesses can easily set spending limits and track expenses in real time. The platform also integrates with accounting software to streamline the expense management process and reduce manual data entry.

Pleo aims to make company expenses transparent and easy to manage, giving businesses more control over their spending and enabling them to make better financial decisions. It also helps reduce the administrative burden on finance teams, freeing them to focus on more strategic initiatives.

Pleo offers a modern, flexible and user-friendly solution for businesses looking to improve their expense management processes.

10.

HighLevel: Your Ultimate Affiliate Marketing Solution

Are you looking for an all-in-one platform to supercharge your affiliate marketing efforts? Look no further! HighLevel is here to revolutionize the way you manage, track, and optimize your affiliate campaigns. With its comprehensive suite of tools and features, HighLevel empowers marketers like you to take your affiliate marketing game to new heights.

HighLevel provides a user-friendly interface that simplifies the entire affiliate marketing process. Whether you're a seasoned affiliate marketer or just starting out, HighLevel has got you covered. It offers a range of intuitive features that make it easy to create, manage, and track your affiliate campaigns, all in one place.

One of the standout features of HighLevel is its powerful campaign management system. With just a few clicks, you can create eye-catching landing pages, set up email sequences, and track the performance of your campaigns in real time. HighLevel's drag-and-drop builder allows you to customize your pages without any coding knowledge, giving you complete control over your marketing funnel.

Whether you're an affiliate marketer, an agency, or a business owner, HighLevel has the tools and features you need to succeed in the competitive world of affiliate marketing.

11.

Corporate Finance Institute - Your Ultimate Resource For Finance Training And Education

Corporate Finance Institute (CFI) is a leading provider of online financial education and training for professionals and aspiring financial analysts. The organization offers a wide range of courses and resources designed to help individuals develop the skills and knowledge needed to succeed in the world of finance.

CFI's courses cover a variety of topics, including financial modeling, valuation, budgeting and forecasting, accounting and Excel skills. The organization's courses are taught by experienced instructors and industry experts and are designed to be practical and hands-on, with a focus on real-world applications.

In addition to its online courses, CFI also provides a variety of resources, including financial modeling templates, Excel tutorials and articles on various finance topics.

The organization's mission is to empower individuals and organizations to make better financial decisions and achieve their goals through high-quality education and training.

12.

Earn Rewards With Swagbucks - The Ultimate Online Reward Program

Swagbucks is a rewards and loyalty program website that allows users to earn virtual currency called "Swag Bucks" by completing various online activities such as taking surveys, watching videos, playing games, shopping online and searching the web. Swag Bucks can then be redeemed for a variety of rewards, including gift cards, merchandise and cash through PayPal.

Swagbucks was launched in 2008 and has since grown to become one of the largest online rewards programs, with millions of users worldwide. The website is free to join and offers a wide range of activities and rewards that cater to different interests and preferences.

In addition to earning Swag Bucks, users can participate in daily polls, refer friends to the platform, and take advantage of various promotions and discounts to increase their earnings. Swagbucks also has a mobile app that allows users to earn rewards on the go.

Swagbucks offers a fun and easy way for users to earn rewards while engaging in everyday activities online.

13.

Gohenry - A Digital Banking Solution For Kids And Teens

Gohenry is a financial technology company that offers a mobile banking app and debit card designed specifically for children and teenagers. The app and card are intended to help young people learn about money management and financial responsibility in a safe and controlled environment.

Parents can use the gohenry app to set up a monthly allowance for their children, as well as monitor and control spending on the card. Children can use the app to track their spending and savings, set savings goals and learn about budgeting.

The gohenry app and card also come with a range of security features, including parental controls and spending limits, to ensure that children can only spend what they have available and can't overspend or get into debt.

The app provides a fun and engaging way for children to learn about money and financial responsibility. It also gives parents peace of mind and control over their children's spending.

14.

Penfold - Pension For Freelancers And Self-Employed

Penfold is a U.K.-based digital pension provider that helps self-employed individuals and small business owners save for their retirement. Their online platform enables users to open and manage a pension account quickly and easily, without the need for financial advisors or lengthy paperwork.

Penfold offers a variety of pension plans, including a self-invested personal pension (SIPP) and a pension for those who have been automatically enrolled by their employer. They also provide a range of investment options, including socially responsible funds and funds focused on specific industries or regions.

Users can track the performance of their investments through the Penfold platform and make changes to their plans or investment choices at any time. Penfold also offers tools to help users estimate their retirement income and plan for future financial needs.

Penfold basically simplifies the pension process and makes it more accessible for self-employed individuals and small business owners, so they can feel more secure and prepared for their retirement.

15.

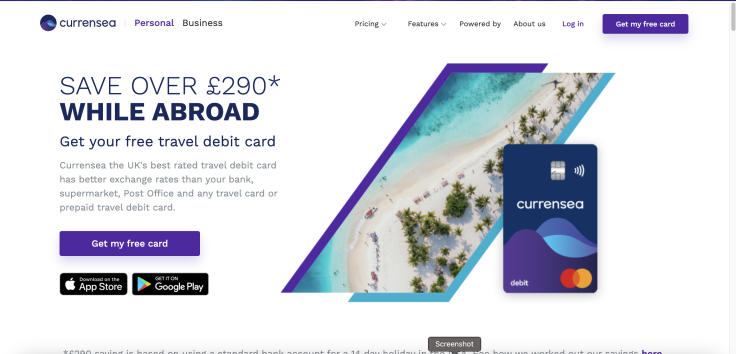

Currensea - Multi-currency Debit Card For Travelers

Currensea is a U.K.-based financial technology company that offers a travel card, which allows users to save money on foreign currency transactions. The company's mission is to provide a transparent and affordable way for travelers to spend money abroad without incurring excessive fees or hidden charges.

The Currensea travel card can be used anywhere in the world where Mastercard is accepted, and it is linked directly to the user's bank account. This means that users can avoid expensive foreign exchange fees and enjoy competitive exchange rates when they use the card to make purchases or withdraw cash.

The Currensea travel card also comes with a range of other benefits, including real-time notifications of all transactions, 24/7 customer support and the ability to freeze and unfreeze the card instantly if it is lost or stolen.

To use the Currensea travel card, users must sign up for an account on the company's website and link their existing bank account. They can then load funds onto the card and use it to make purchases and withdrawals abroad.

Overall, Currensea offers a simple and convenient solution for travelers who want to save money on foreign currency transactions and avoid the hidden fees and charges often associated with using traditional bank cards abroad.

16.

RoosterMoney - Personal Finance App For Kids

RoosterMoney is an app and website designed to help parents teach their children about money management. Children can also use the app to learn how to manage money, earn rewards and build good habits around saving and spending.

It offers a digital platform for parents to set up allowances, track spending and saving, and teach children about budgeting, saving and earning.

The app also includes educational resources, such as games and quizzes, to help children learn about money. The platform aims to empower children to develop positive financial habits early on and to help parents facilitate that process in a fun and engaging way.

17.

Snoop - Personal Finance Management App

Snoop is a personal finance app that helps users take control of their finances and make better financial decisions. The app connects to the user's bank accounts and credit cards to provide personalized insights and advice on their spending, bills and savings.

With Snoop, users can see all their accounts in one place, including current and savings accounts, credit cards and mortgages. The app analyzes the user's spending patterns to identify areas where they can save money, such as by switching to a cheaper energy supplier or canceling unused subscriptions.

Snoop also sends notifications when bills are due, so users can avoid late fees and keep track of their expenses. The app also provides personalized insights and advice on how to improve their credit score, manage debt and save for their financial goals.

Snoop is designed to be easy to use, with a simple and intuitive interface that makes it easy to see where the user's money is going and how they can make it go further. The app is available for iOS and Android devices, and it is free to download and use.

18.

Moneyfarm - Investment Management And Advisory Services

Moneyfarm is a digital wealth management platform that offers personalized investment advice and portfolio management services to individuals and businesses.

The platform uses a combination of technology and human expertise to help its clients build and manage investment portfolios tailored to their unique goals and risk tolerance.

Moneyfarm offers a range of investment products, including stocks and shares ISAs, pensions and general investment accounts. Its services are available to clients in several countries across Europe.

© Copyright IBTimes 2025. All rights reserved.