Premier Cru CEO Stacey Golding Q&A: Investing in Fine Wine [VIDEO]

The fine wines market has evolved into an established alternative investment sector where total returns have vastly exceeded those in traditional assets, such as equities and bonds, even during unprecedented market collapses.

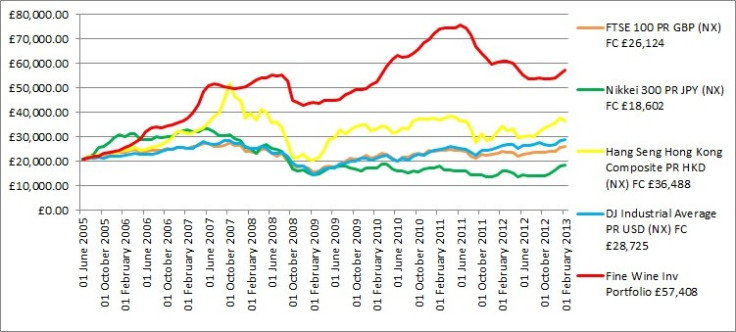

From 2005 to present day, the Fine Wine Investment Portfolio return has beaten equity indexes' performances around the globe [Fig 1.]

Speaking with IBTimes UK in a televised interview, Premier Cru (Fine Wine Investments Limited) co-founder and CEO Stacey Golding says investing is wine "is evolution, revolution and war proof."

"Investing in fine wine is not only inflationary proof but it is also low risk. The market has posted significant returns to investors, even after unprecedented financial crises and volatility. On top of that there is no taxation around wine investments, making the sector even more desirable," says Golding.

For the full interview, check out IBTimes TV or the video at the top of this page.

© Copyright IBTimes 2025. All rights reserved.